US Services PMI Dips In December As Input Prices Hit Record High

After Markit’s Manufacturing survey for December dropped to 12-month lows, the Service Sector survey also faded modestly

Source: Bloomberg

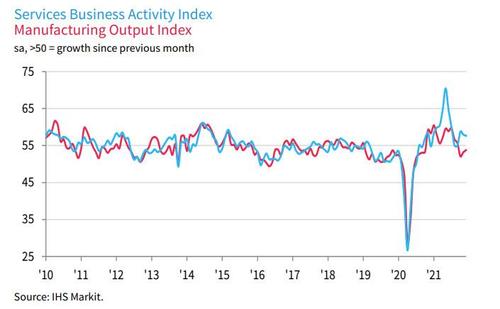

The IHS Markit US Composite PMI Output Index posted 57.0 in December, down slightly from 57.2 in November.

The latest data signalled a steep increase in private sector business activity, albeit largely driven by the service sector as manufacturing production rose at a relatively muted pace.

Input shortages, transportation delays and upticks in labor costs drove the rate of private sector input price inflation to a fresh series high in December.

Commenting on the latest survey results, Siân Jones, Senior Economist at IHS Markit, said:

“Service sector business activity growth remained strong in December, supporting indications of a solid uptick in economic growth at the end of 2021. Although the expansion in output softened slightly, the flow of new orders picked up, with buoyant client demand rising at the fastest pace for five months.

“The service sector continued to aid overall growth, as the manufacturing sector saw output hampered again by material and labor shortages. The impact of the latter, however, had a burgeoning effect on service providers as job creation rose at only a marginal pace amid challenges keeping hold of staff and enticing new starters. “Subsequently, soaring wage bills and increased transportation fees drove the rate of cost inflation up to a fresh series high.

“Business confidence strengthened at the end of the year to the highest since November 2020, as firms were hopeful of more favorable labor market and supply-chain conditions going into 2022. The swift spread of the Omicron variant does lace new downside risks into the economic outlook heading into 2022, however. Any additional headwinds or disruption faced by firms are likely to temper sentiment.”

Does this feel like a good time to be tightening monetary policy?

Tyler Durden

Wed, 01/05/2022 – 09:53

via ZeroHedge News https://ift.tt/3nkuuhV Tyler Durden