FOMC Minutes Shows Hawkish Fed Hiking “Faster Than Anticipated”, Warn Of Omicron Risks

Since December 15th’s FOMC statement, bonds have been battered, the dollar is down modestly while stocks and gold are up strongly….

Source: Bloomberg

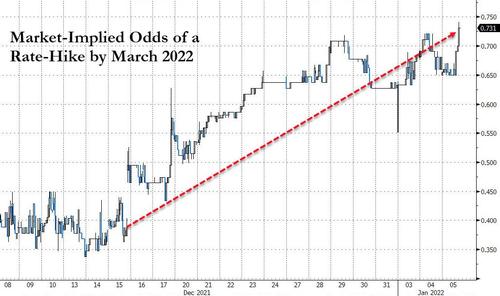

The short-end of the yield curve has risen dramatically, pricing in the new hawkish dot-plot offered by The Fed (for 2022) with a 73% chance of Fed hikes by March 2022 now ((from 40% pre-FOMC)…

Source: Bloomberg

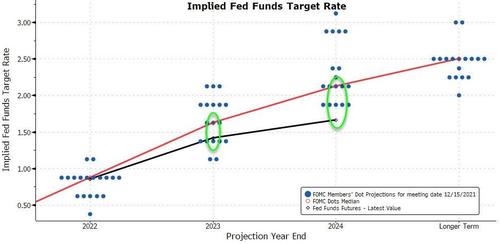

Interestingly though, the market has rejected The Fed’s longer-term dots, presumably pricing in a policy-error/reversal…

Source: Bloomberg

All of which leaves the market desperately seeking clues today on the accelerated taper and timing of lift-off and trajectory of rate-hikes among the Minutes.

On the liftoff timing and pace of rate-hikes:

“Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated. Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate. Some participants judged that a less accommodative future stance of policy would likely be warranted and that the Committee should convey a strong commitment to address elevated inflation pressures.”

On Omicron’s impact:

“In particular, the possibility that COVID-19 cases could continue to rise steeply, especially if the Omicron variant proves to be vaccine resistant, was seen as an important source of downside risk to activity, while the possibility of more severe and persistent supply issues was viewed as an additional downside risk to activity and as an upside risk to inflation.”

“Members also agreed that, with the emergence of the Omicron variant, it was appropriate to note the risk of new variants of the virus in their assessment of risks to the economic outlook.”

Additionally, a key thing to understand from the Minutes is that there was a wide variety of views on when to start shrinking the balance sheet.

“almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate.”

* * *

Read the full Minutes below:

Tyler Durden

Wed, 01/05/2022 – 14:08

via ZeroHedge News https://ift.tt/3q5Uak9 Tyler Durden