Markets Turmoil As FOMC Minutes Spark Surge In Rate-Hike-Odds

Well that escalated quickly…

What we would like to know is – if the market is a “forward-looking” whatever… what exactly was it looking forward to by ignoring the fact that STIRs have been pricing a dramatically more hawkish Fed for weeks?

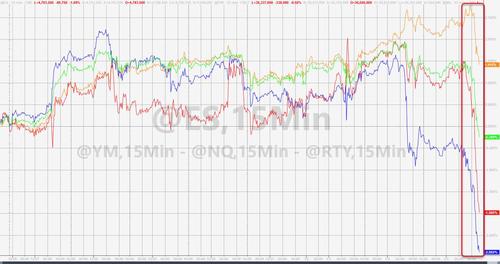

The S&P and Small Caps joined Nasdaq in the red for 2022 today, puking lower after FOMC Minutes offered no dovish relief at all on a Fed that is looking increasingly like it wants to surprise markets… to the downside. The Dow is clinging to gains for 2022 while Nasdaq is down over 3% followed by Small Caps down over 2% and the S&P down around 1.5%…

The Nasdaq is down 6 of the last 7 days.

Small Caps crashed back below their 200DMA and Nasdaq broke below its 50- and 100-DMA…

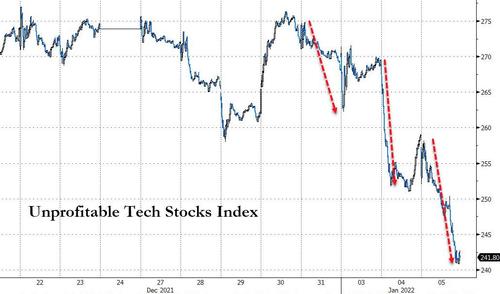

Cathie Wood’s ship is sinking…

Source: Bloomberg

Unprofitable tech stocks continued to plunge, now at their lowest since Nov 2020…

Source: Bloomberg

VIX surged back above 19.5 – 2-week highs…

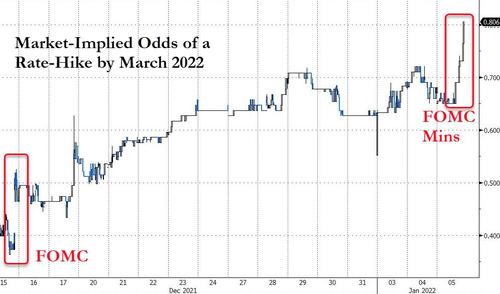

The hawkish comments sent rate-hike-odds soaring, with a March liftoff now more than 80% priced-in…

Source: Bloomberg

And it was the short-end of the yield curve that underperformed today (2Y-5Y +7bps, 30Y +3bps)…

Source: Bloomberg

For context, 30Y tagged 2.10%, 10Y 1.70%, 2Y above 80bps…

Source: Bloomberg

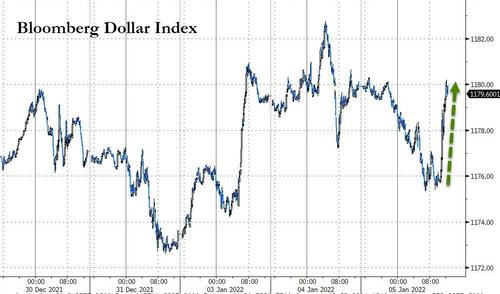

The Dollar was weaker overnight but surged back to unchanged on the Fed Minutes…

Source: Bloomberg

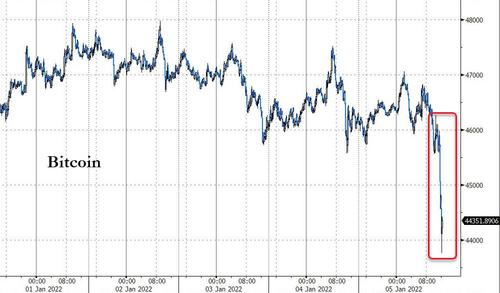

Bitcoin barfed back to a $43k handle today…

Source: Bloomberg

This is the lowest close for bitcoin since Sept 2020 and notably below its 200DMA…

Source: Bloomberg

Gold puked along with everything else, but for now is holding above $1800…

WTI managed to hold on to gains for the day after rollercoastering on a big drop in gasoline demand and The Fed minutes…

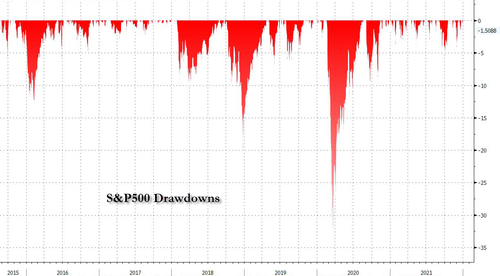

Finally, the entire Santa Claus Rally has been erased…

Source: Bloomberg

And the Nasdaq has a long way to go (relative to Small Caps) to catch down to real-yields (inverted) as the latter reached its highest since June 2021…

Source: Bloomberg

The question is – would that size drop be enough to trigger Powell’s Put?

Because for now… the S&P is only 1.5% from its all-time-high!!!

So don’t start panicking yet?

Tyler Durden

Wed, 01/05/2022 – 16:00

via ZeroHedge News https://ift.tt/3FZeetT Tyler Durden