What Spooked Markets So Badly In Today’s Fed Minutes? JPMorgan, Goldman Explain

Considering that today’s minutes covered a FOMC meeting that took place some three weeks ago, with numerous Fed speakers having ample opportunity to set the stage for what was to come (talk about those famous Fed “communication” skills), it is rather shocking how powerful and violent today’s stock tantrum was.

But what exactly spooked traders so badly?

Well, as JPM Michael Feroli writes in his FOMC post-mortem, the minutes portray “a Committee on the march toward removing policy accommodation” which is not a surprise to anyone except perhaps the biggest cubic zirconium hands out in Seoul. Regarding the expected path of policy rates the minutes note that meeting participants generally see rate hikes “sooner or at a faster pace” than previously expected. Of course, this too had already been hinted at by the dots released after the meeting.

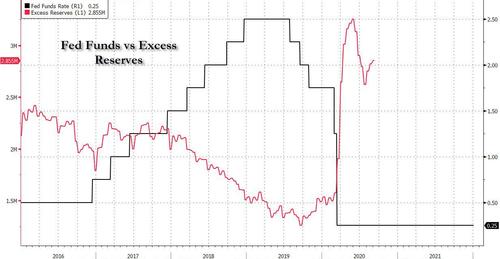

What was new in these minutes, and was also unexpectedly hawkish, were the clues given to how balance sheet normalization would play out. While most favored allowing assets to run off after the first rate hike, it was generally thought that this runoff would occur sooner after liftoff relative to the 2014-17 episode. Moreover, it was generally felt that the pace of runoff would be faster than the last experience: as a reminder, last time it took two years between the first rate hike and the beginning of balance-sheet contraction (see excerpt below) so the Fed is now hinting that it could shorten this to less than nine months so that runoff begins in 2022… or at least that’s how the market reads it.

And the other big surprise is that some on the Committee felt that tightening financial conditions by relying more on balance sheet runoff and less on rate hikes would help steepen the curve, a desirable outcome in their opinion, though it’s not clear this was a widely-shared view, especially considering the catastrophic conclusion to the Fed’s tapering in Sept 2019 when JPMorgan had to crash to repo market to force the Fed to launch Not QE (narrator: it was QE) when the financial system promptly ran out of reserves. Here is the section in question:

Some participants commented that removing policy accommodation by relying more on balance sheet reduction and less on increases in the policy rate could help limit yield curve flattening during policy normalization. A few of these participants raised concerns that a relatively flat yield curve could adversely affect interest margins for some financial intermediaries, which may raise financial stability risks. However, a couple of other participants referenced staff analysis and previous experience in noting that many factors can affect longer-dated yields, making it difficult to judge how a different policy mix would affect the shape of the yield curve.

Many participants judged that the appropriate pace of balance sheet runoff would likely be faster than it was during the previous normalization episode. Many participants also judged that monthly caps on the runoff of securities could help ensure that the pace of runoff would be measured and predictable, particularly given the shorter weighted average maturity of the Federal Reserve’s Treasury security holdings.

Separately, Feroli also notes that “many” also felt the recently-authorized standing repo facility should support faster and smoother balance sheet normalization, and as has been the case recently, “some” participants favored a quicker runoff pace for agency MBS relative to US Treasuries.

There were fewer surprises regarding the Fed’s views on the economy where the staff revised up their inflation forecast for coming years, noting the “salience” of ’21 inflation outcomes. On the labor market, some on the Committee noted that the recovery was already “more inclusive.” In the discussion of the labor force participation rate, the Committee sounded more pessimistic that participation would soon recover, if ever. More generally, “several” thought the labor market was already at maximum employment, and many others thought it would “fast approach” that criterion. It was also noted by “some” participants that liftoff could happen before maximum employment had been reached if inflation expectations appeared to become unanchored.

Commenting on the maximum employment assessment, Bloomberg economist Yelene Shulyatyeba said that “the FOMC participants’ labor-market assessment suggests they see the economy at or very close to full employment. Apart from ‘a number of signs that the U.S. labor market was very tight,’ policy makers also saw little potential for a significant short-term improvement in participation. Therefore, the economy may have achieved full employment earlier and with a smaller labor force than previously foreseen, which implies the need for tighter policy sooner than anticipated.”

We disagree with this for reasons we explained in “A March Rate Hike? Not So Fast“

Finally, while virus variant risks were noted several times, the overall tone of the minutes suggests this was not expected to be a major headwind to the growth outlook.

Shifting from JPM to Goldman’s post-mortem, the bank’s Jan Hatzius cut to the chase and titled his note with the big punchline. namely that “Fed Balance Sheet Runoff Could Start “Relatively Soon” After Liftoff.” Similar to Feroli, this is how he explains it:

The December FOMC minutes indicated that participants continued to view mid-March as an appropriate end date for net asset purchases. The minutes also noted that “some” participants said that it could be appropriate to start runoff “relatively soon after beginning to raise the federal funds rate” and “many” participants judged that the appropriate pace of balance sheet runoff would likely be faster than last cycle.

In our view, today’s minutes increase the chances that the FOMC might be ready to reach a decision on the runoff process and issue new normalization principles in the second quarter, which could mean that runoff begins somewhat earlier than our standing assumption of Q4. We still expect that the start of runoff will substitute for a quarterly hike, so that the FOMC would still hike 3 times total in 2022 if runoff begins in Q3, but an earlier announcement of the start of runoff would be somewhat less likely to substitute for a hike than one that comes toward the end of the year.

This is all fine and good, and it is certainly far more hawkish than the market expected, but it does raise several questions, as today’s market action indicated.

First, and foremost, back in 2018 when r-star was far higher than it is today, the Fed managed to get away with 8 rate hikes before a 20% drop in stocks forced Powell into a premature easing cycle in the summer of 2019, right around the time the repo crisis emerged and the Fed realized it needs to add far more reserves (and lo and behold 7 months later, we got just the perfect Made in China excuse to inject trillions into the financial system). So the first question is how many rate hikes can the Fed get away with now that global debt is orders of magnitude higher than it was just 4 years ago. 3 hikes? 4 hikes and a run off, before the next big crash forces the Fed into early easing.

Keep a close eye on fwd OIS swaps markets for the tell on when the next rate cut cycle/QE will start.

And tied to that are two more question: while it is clear that Biden is freaking out about inflation far more than he is about the prospect of a market crash, is the president even remotely aware of what a 20%, 30% (or more) crash in the market will do to Democrats in the polls, and midterms, not to mention 2024? Something tells us the answer is no.

Last but not least is the question everyone would like answered: just how is the Fed tightening financial conditions going to ease a historic supply chain collapse which is driven by countless other factors than just excess demand sparked by Biden’s stimmies.

We doubt we will find out the answer, but we also doubt that the market’s latest freak out about much tighter financial conditions – including 3 rate hikes and balance sheet run off starting in 2022 – will ever come to pass. Because if it does, the only question then is how long before the Fed starts monetizing ETFs, cryptos and NFTs to preserve the $145 trillion or so in US net worth parked squarely in the hands of the 1%, the only legacy the US central bank will leave on this earth.

Tyler Durden

Wed, 01/05/2022 – 20:00

via ZeroHedge News https://ift.tt/3qSlqBF Tyler Durden