Here’s The One Thing Traders Want To Know After Biggest “Rate Shock” Selloff Since 2016

Just how bad was yesterday’s market rout? According to quants at Morgan Stanley, it was worse than every selloff in the past 5 years, including the March 2020 crash.

As Morgan Stanley’s QDS team notes, flows were aggressively for sale post 2pm when the FOMC Minutes hit, with signs of selling from both institutions and retail: as shown in the chart below, S&P 500 futures Trade Pressure hit negative $13 billion, the most for sale since at least 2016…

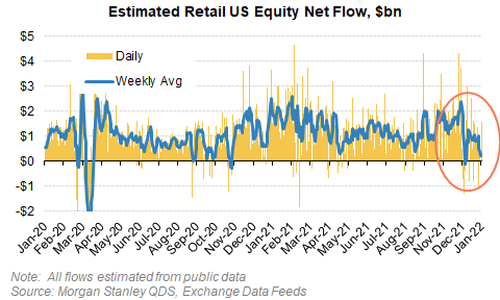

… and QDS also estimates retail supply post 2pm was the 4th largest for that time frame in the last two years, with most of the retail selling in Tech, where daily supply was the biggest of the last year, perpetuating the painful rotations even as the stress spilled into the S&P 500.

So while yesterday’s selling was clearly panicked, furious and indiscriminate, the question on all traders’ minds is simple: is the rout finally over?

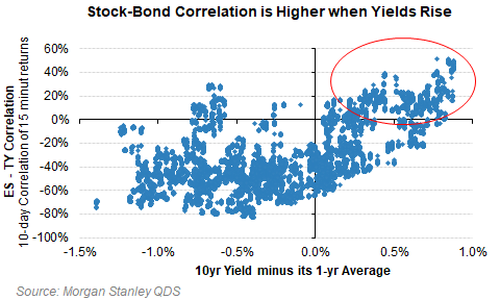

In response, Morgan Stanley’s quants write that whether investors overreacted today or there is more to come will depend on whether yields continue to rise… and if rates do move higher, the drawdowns in equity indices could only be 40 to 50% done if history is a guide.

QDS calculates that in five prior “rate shocks” over the last five years, the S&P 500 typically moved down ~5%, while right now SPX is only 2% off the highs.

That said, some corners of the market may be reaching selling exhaustion, notably baskets like MSXXCRWD (crowded longs) and MSXXEVSA (expensive Tech) which are currently down 80 to 85% as much as in prior rate shocks – and that is only accounting for the moves since yields started to rise since mid-December (when MSXXCRWD was already down 18% and MSXXEVSA was already down 24% from the highs), supporting a view that broader indices could have more downside than the underperformers of the last few months (alternatively, the trade here is to short the S&P or Nasdaq while going long the most beaten down stocks).

A detailed breakdown of trough-to-peak increases in yields and corresponding drawdowns is shown below.

While history suggests more pain at the index level, a similar picture emerges when looking at flows and positioning where there is a risk of further supply from both institutions and retail from here, according to Morgan Stanley’s quants.

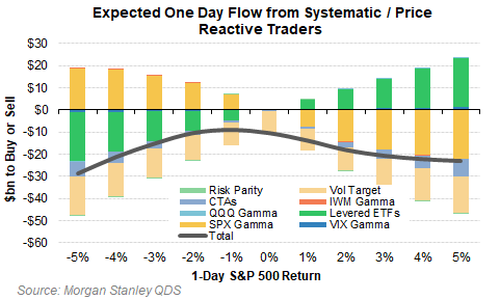

For institutions, QDS estimates systematic strategies will have $15 to $20bn for sale over the next week on the back of yesterday’s gap lower – not a particularly significant amount, but this can build if realized vol rises further (see slide below). And the continued weakness in crowded longs and long duration Tech (MSXXCRWD -6% YTD, MSXXUPT -11%, MSXXEVSA -12%) is a drag on HF P/L, where according to Goldman, hedge funds had already undergone some of the biggest selling (and degrossing) in the past decade ahead of the FOMC minutes.

This matters because as QDS notes, the early year hits to P/L are having a big impact on sentiment and investors’ likelihood of adding or even holding risk, particularly coming off the poor alpha of 2021. This leaves Morgan Stanley concerned about overall equity exposures having to come down, particularly given that US L/S nets came into today in the 70th %ile per the MS PB Content Team even while grosses are at a relatively light 36th 5-year percentile.

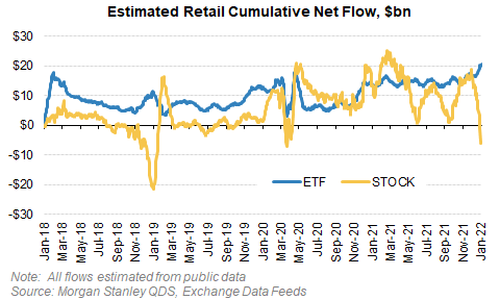

What about retail traders? Here, flows have been choppy: Tuesday was a strong buy day but retail was light both today and Monday. This comes on the back of the lightest buying in December since March 2020 (and all of the buying was in ETFs while stocks have been for sale), plus negative P/L in many names retail is active in.

And while retail flows can be volatile and could quickly turn positive again – after all JPM’s Marko Kolanovic has often turned bullish expecting strong retail inflows – so far retail flows are not following the normal strong January seasonality, which to MS suggests retail will be slower to buy this dip than they have been historically.

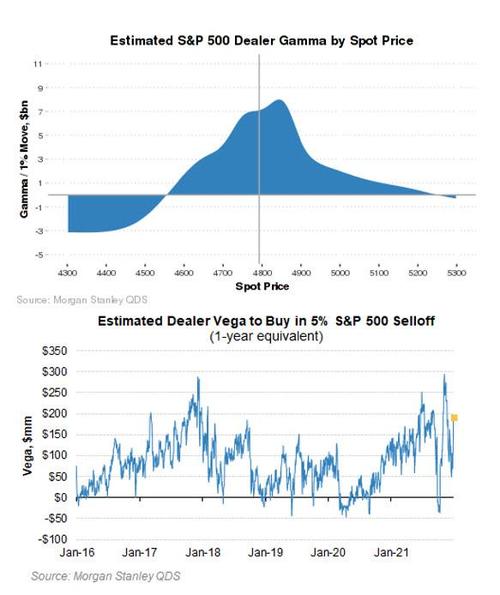

One place where there was a surprisingly calm response was in vol: despite the sharp spot moves lower after the Minutes, implied volatility was relatively well behaved, and VIX rose just 2.82 points, relatively in-line with the normal 1.5x ratio of VIX moves vs SPX returns. One reason for this is that market makers remain short downside vega, a byproduct of cliquet flows, but end user demand for volatility was relatively light so those short vega positions weren’t squeezed. According to QDS, for vol to gap higher the market will likely need sharper moves lower to force a scramble from investors to buy hedges. For now dealer long gamma balances which remain > $5bn / 1% help cushion against sharper moves, but as seen several times last year, that gamma can evaporate quickly in a down market.

Putting it all together, Morgan Stanley’s QDS says that much will depend on what yields do going forward but at this stage its base case is for modest further downside in SPX and NDX over the next ~2 weeks, and believes that rallies should be sold: “The Fed is steadfast in telegraphing a hawkish tone which is unlikely to change in the very near-term, while there is little in terms of positive catalysts for investors to latch on to” according to the MS quants, which also note that “earnings may provide some respite if growth proves strong enough to pair off against the Fed’s hawkishness (but isn’t too strong…), but again that is still several weeks away.”

That leaves technical and positioning to play a larger role near-term, and given the negative P/L to start the year, it may be easier for investors (both institutional and retail) to sell rather than buy.

Finally, the QDS desk notes that while near-term technicals are worrisome, returning to the impact of prior rate spikes on equities, the bank notes that all of those events were relatively brief, and also had relatively modest impact on stocks (with the exception of 4Q18, which also coincided with slowing growth expectations and was followed by rate cuts).

So unless growth quickly slows at the same time, QDS expects similar modest drawdowns as equities absorb this rate shock as well, and hence continues to favor put spreads in SPX or NDX to hedge downside over the next few weeks. On the other hand, a slowdown now appears increasingly likely since the US consumer is once again largely tapped out (most if not all excess savings for the middle class have been spent) and we expect this to materialize in economic data, forcing the Fed to comprehensively rethink its tightening bias.

Tyler Durden

Thu, 01/06/2022 – 15:21

via ZeroHedge News https://ift.tt/33bFc2E Tyler Durden