December Payrolls Preview: Strong Enough For A March Rate Hike?

We are officially in the “good news is bad news” quarter of the artificial business cycle, and as such a strong payrolls number on Friday (especially after last month’s major headline payrolls disappointment when only 210K jobs were added) will only raise expectations of an even stronger hawkish response by the Fed, and an appropriate market reaction. And, naturally, vice versa especially since it appears that the Fed is hiking into a major economic slowdown.

With that in mind, here is what Wall Street expects tomorrow, courtesy of Newsquawk:

- Analysts look for a 447k rise in December payrolls, up from 210K with a range in analyst forecasts between 150k and 1.1 million.

- Manufacturing payrolls are expected at 35k vs the prior 31k, while private payrolls are expected to rise 365k vs the prior 235k.

- The unemployment rate is expected to drop from 4.2% to 4.1%, with analyst forecasts ranging between 4.0% and 4.4%.

- Wages are seen rising 0.4% M/M, up from 0.3% in November, while the Y/Y metric is seen slowing to 4.2% from 4.8% growth.

- The average work week hours are expected to remain unchanged at 34.8hrs.

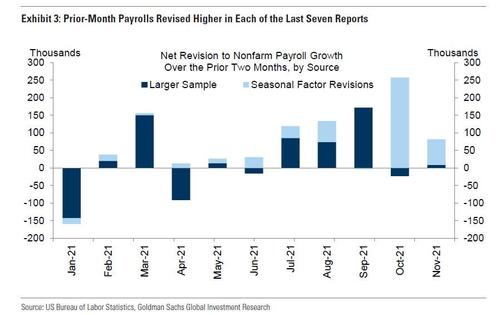

Significant upward revisions to prior-month payrolls are fairly likely, following large upward revisions over the previous seven reports and a view that the depressed November response rate may have weighed on reported job growth in the advance release.

In a late Thursday report, Goldman raised its nonfarm payrolls estimate from 450K to 500k, above the consensus of +447k, after the strong ADP print, with the bank noting that the pre-Omicron payroll trend was much firmer than the 210k pace reported for November – perhaps as high as +600k – and most of the virus-related slowdown in dining activity occurred after the December survey week. Big Data labor market indicators were generally solid in the month, and the number of year-end layoffs was well below normal. By industry, Goldman looks for a weather-related boost in the construction industry and a ~50k rebound in education employment (public and private) — the latter reflecting fewer janitors and support staff departing for the holidays. However, the bank also expects another modest decline in retail jobs due to labor supply constraints, and we are assuming only a modest pickup in leisure-sector job growth.

Slack measures will also be eyed, with the November report showing an improvement in the participation rate, employment-population ratio and U6 underemployment, although none have managed to return to pre-pandemic levels. While Powell has acknowledged the “rapid” progress the labor market is making, he has highlighted the pick-up in participation was subdued and disappointing, with Powell suggesting that it was now likely that higher participation will take longer than previously anticipated. Powell explained the subdued participation may be a result of people not wanting to go back into the labor force while COVID is still prevalent, a lack of availability of childcare, and higher savings. Other measures of slack also saw improvement in November, the employment to population ratio rose to 59.2%, compared to the 61.1% pre-pandemic print, while U6 underemployment fell to 7.8%, edging closer to the pre-pandemic level of 7.0%.

The December NFP report will be framed in context of Fed lift-off, especially after the latest minutes leaned hawkish with some policymakers suggesting a hike could come before maximum employment is met, but several said that this had already been achieved and most judged it could be achieved relatively soon if job growth continues at the current pace. Fed pricing moved hawkish following the minutes, to see an 80% chance of a March hike, therefore a strong report will be viewed as a tiebreaker whether March will see the first lift-off.

That said, employment gauges for December are mixed, the jobless claims week that coincided with the usual NFP survey period was in-line with expectations and unchanged from the prior week at 205k, while continued claims fell by more than expected. However, some analysts question the accuracy of the jobless claims data over the holiday period. The ADP report, although having a weak correlation with the official release, saw a very strong print which doubled analyst expectations, and led some banks to slightly revise higher their forecasts for the NFP print. The business surveys point to further growth in the manufacturing sector, while the services sector shows a slowdown, but still in expansionary territory. Job cuts however were disappointing, rising to 19k from 14.9k.

FED POLICY OUTLOOK: The Friday NFP report will help shape expectations for lift off from the Fed. The December meeting minutes on Wednesday revealed that participants generally noted it may become warranted to increase the FFR sooner or at a faster pace than was earlier anticipated, while some members of the FOMC said there could be circumstances whereby the Fed raises rates before maximum employment had been fully achieved. Meanwhile, several participants viewed labor market conditions as already largely consistent with maximum employment, while most judged it could be met relatively soon if the recent pace of the labor market continues. The prior jobs report (which the Fed saw going into the December meeting) disappointed on the headline, seeing 210k jobs created in November, although measures of slack (participation rate, employment to population ratio, and U6 underemployment) all improved from the prior, but remained beneath pre-pandemic levels. After the release of the hawkish December minutes, interest rate futures started to price in a c.80% chance of a Fed hike at the March meeting, something Governor Waller has previously alluded too. As the Fed is now in data-dependent mode, and given the remarks around the labor market from the Fed minutes, providing job growth continues at the current pace, the case for a March lift-off will strengthen, although doves on the FOMC, including Kashkari, suggested to wait before the April data has been seen – note, Kashkari is a non-voter this year. Given the Fed are looking for the current pace to continue, a beat or miss on the headline may not be too important, just providing the jobs market is still increasing at a decent pace, while the Fed will also be cognizant of the slack metrics.

JOBLESS CLAIMS: For the week coinciding with December’s NFP, initial jobless claims printed in-line with expectations at 205k, and unchanged from the prior week. Pantheon Macroeconomics note, “the apparent stalling in the downshift jobless claims in the past couple weeks is no big deal; the seasonals now are less friendly over the next few weeks than in October and November, and the data are always noisy over the holidays”. Moreover, PM added “the core story is unchanged; the trend in claims is very low and still falling, because rising demand is easing the pressure on businesses. Moreover, firms are reluctant to let staff go in such a tight labor market, unless they have no other choice”. The continued claims that coincide with the NFP survey week fell to 1.716mln from 1.856mln, better than the expected rise to 1.868mln.

ADP: The ADP report was strong, although the consistency with the official NFP report has not been strong. The ADP report added 807k jobs in December, seeing the largest increase since May 2021, rising from the prior 505k (revised lower from 534k) despite expectations for job growth to slow to 400k in December. Analysts at Pantheon Macroeconomics highlight the ADP data is slightly lower than the over 1mln rise in private payrolls signalled by the Homebase small business employment data, but although neither are consistently accurate in terms of the official NFP report, it is still consistent with their view that the NFP expectation of c. 400k is too low and thus are maintaining their 1mln forecast. Note, following the ADP report, analysts at Goldman Sachs boosted their NFP forecast for Friday to +500k from +450k. Pantheon points out that the rise in payrolls could be due to the fading of some of the forces holding back labor supply, such as enhanced unemployment benefits and school closures, combined with strong labor demand. However, the consultancy does note this could be interrupted by the rise in Omicron cases, although this may not be seen until the January data is released. Pantheon writes “it looks as though December survey week fell in something of a sweet spot, after the Delta wave faded, but before the Omicron surge began.”

BUSINESS SURVEYS: The December ISM Manufacturing PMI report saw an uptick in employment, suggesting faster growth than the prior month. The employment index rose 0.9pts to 54.2 from 53.3 to show the fourth consecutive month of expansion. The report also notes that “an Employment Index above 50.6 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment”. ISM note that the survey panelists’ companies are still struggling to meet labor-management plans, but there were modest signs of progress where 7% of comments noted greater hiring ease, the same as November. Meanwhile an overwhelming majority (85%) indicated their companies are hiring or attempting to hire, but 37% of those expressed difficulty in filling positions, but that is lower than the November report. The December services report was more downbeat, employment fell to 54.9 from 56.5 in December, albeit remained in expansionary territory. Commentary noted respondents are struggling to backfill positions in a timely manner noting “The Great Resignation” is hitting them. Respondents are having to relook at their policies and incentive programs as fast-food restaurants are offering higher pay for lower level jobs as well as sign-on bonuses.

ARGUING FOR A BETTER-THAN-EXPECTED REPORT:

- Education seasonality. Education weighed on job growth during the fall, likely because some janitors and support staff declined to return for the new school year. Many of these individuals typically stop working for the December survey period, implying a seasonally adjusted gain in education payrolls in tomorrow’s report.

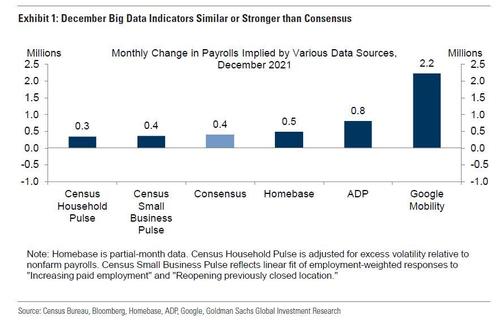

- Big Data. High-frequency data on the labor market generally point to in-line or above-consensus job gains, as shown in Exhibit 1. That being said, the Google series continues to be biased upward by return-to-office (RTO) initiatives (office workers commuting instead of working from home)

- ADP. Private sector employment in the ADP report increased by 807k in December, nearly double consensus expectations and consistent with strong growth in the ADP panel.

- Jobless claims. Initial jobless claims fell during the December payroll month, averaging 204k per week vs. 277k in November. Continuing claims in regular state programs decreased 337k from survey week to survey week.

- End of federal enhanced unemployment benefits. The expiration of federal benefits in some states boosted job-finding rates over the summer, and all remaining such programs expired in early September. With 4.6mn fewer individuals receiving benefits versus in early September, the gradual return of these workers is expected to boost job growth in tomorrow’s report and beyond.

- Weather. Unseasonably warm weather during and leading up to the survey week argues for a solid rise in industries like construction. National temperatures averaged 40 degrees during the December survey week, compared to 35 degrees on average in those of the previous three years.

- Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—decreased by 2.1pt to 42.6, but remained near record highs. JOLTS job openings decreased by 529k in November to 10.6mn but remained significantly higher than the pre-pandemic peak.

ARGUING FOR A WEAKER-THEN-EXPECTED REPORT:

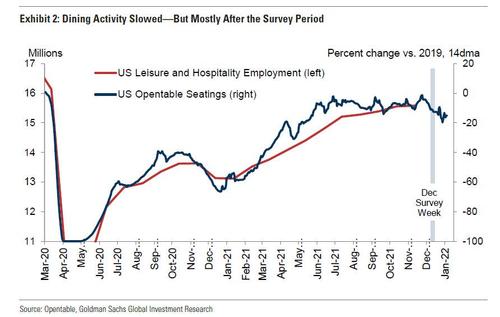

- Public health. Covid infections rose sharply in late December, but the survey period ended on December 18th, and as shown below the decline in dining activity versus the November survey week—eventually to 20pp below pre-crisis levels—mostly occurred after the December survey period. Coupled with the 246krise in ADP’s estimate of leisure and hospitality jobs, we expect continued job gains in the leisure sector in tomorrow’s report (our estimates embed a rise of nearly+100k, compared to +23k in November).

- Supply constraints in retail. Labor supply constraints likely weighed on pre-holiday hiring in the retail industry in November (-20k mom sa). The BLS seasonal factors anticipate 100k net hires in December, and we do not expect all of these positions to be filled. If so, retail payroll could again fall on a seasonally adjusted basis.

- Vaccine mandates. The vaccine mandates announced by the Biden administration in September apply to roughly 25mn unvaccinated workers, and may have weighed on December job growth in healthcare and government. While the federal deadline for compliance is generally not until early January and faces an uncertain future in the court system, early adoption in some states may have reduced job growth at the margin in tomorrow’s report.

- Employer surveys. The employment components of business surveys generally decreased in December. Goldman’s services survey employment tracker decreased 2.3pts to 54.1 and the manufacturing survey employment tracker decreased 1.7pt to 57.9.The Goldman Sachs Analyst Index (GSAI) edged down by 0.3pt to 76.9 in December, but the employment component rose 6.8pt to a record-high of 82.4.

NEUTRAL FACTORS:

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas increased by 24% month-over-month in December after decreasing by 11% in November, but remain near their three-decade low.

As noted above, upward revisions to prior-month non farm payrolls are likely in tomorrow’s report, which reflects the trend of large upward revisions over the course of the year.

There are two potential explanations, both of which could produce upward revisions in tomorrow’s report as well. First, some reopening establishments may respond to the BLS survey with a lag (e.g. 1-2 months after reopening). This would result in positive revisions to the not-seasonally-adjusted data (dark blue bars above). Relatedly, the depressed response rate in last month’s report (lowest for November in 13 years) may have in part reflected this issue, with the busiest human resource managers least likely to respond to the survey during the Thanksgiving holiday.

A second possible explanation is that the seasonal factors may be overfitting to the advance releases, mistaking some of the strong job creation in 2021 as an evolution of seasonality (light blue bars). Given this and given consensus expectation of strong gains in the December panel, upward revisions are fairly likely.

Tyler Durden

Thu, 01/06/2022 – 20:07

via ZeroHedge News https://ift.tt/3JNj8wa Tyler Durden