Here’s What The Fed’s Quantitative Tightening Will Look Like

As we noted last night, the December FOMC meeting minutes included a lengthy discussion of the timing and speed of Fed balance sheet shrinkage (quantitative tightening or “QT”), an unexpected twist which sent risk assets and Treasurys tumbling. The broad message appears to be that QT will start sooner than it did in the previous tightening cycle, and proceed at a faster pace although as the Fed’s Bullard (who is a voting member this year) observed, the runoff could be passive, i.e., not involve actual selling but merely be the result of maturing securities held by the Fed.

In any case, in a note from BofA economist Aditya Bhave, he argues that the Fed’s balance sheet policy will remain accommodative for the next several quarters for several reasons:

- The Fed has more than doubled its balance sheet during the pandemic.

- Therefore it will have to reinvest a larger quantity of maturing Treasuries even while it is shrinking its balance sheet.

- BofA expects QT to start in 4Q 2022, but the stance of Fed balance sheet policy will remain more accommodative than it was before the pandemic through end-2023.

With regard to point two, a frustrated Steve Liesman pointed out yesterday that what the Fed is doing is a “historic absurdity” and noted that “the fed is talking about aggressively reducing its balance sheet while at the same time adding assets to that balance sheet. I think that’s the monetary policy equivalent of a dog chasing its tail.”

I can’t let the historic absurdity of current monetary policy pass w/out remark: the fed is talking about aggressively reducing its balance sheet while at the same time adding assets to that balance sheet. I think that’s the monetary policy equivalent of a dog chasing its tail.

— Steve Liesman (@steveliesman) January 5, 2022

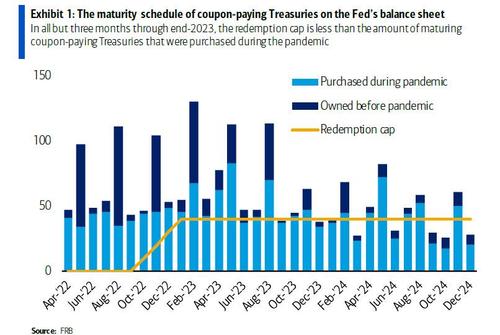

Fed’s (now constant) absurdity aside, what markets want to know is what the Fed’s QT will look like, and for the answer we again turn to BofA, whose strategists think the Fed will allow $10BN of maturing coupon-paying Treasuries to run off its balance sheet in the first month of QT (which they expect will start in October 2022). This “redemption cap” – shown in yellow on the chart below – should rise to $40bn by January 2023 and then remain at that level. They also assume a $30bn redemption cap for Agency MBS.

In total, this would allow the Fed’s balance sheet to shrink by $1.2tn through end-2024. They think the balance sheet could be cut further in future years, all the way down to $4.7tn, i.e. about 15% larger than its pre-pandemic level (spoiler alert: there is no way the market will allow this type of balance sheet shrinkage without a historic tantrum first).

Here BofA takes a quick detour to note that there is considerable debate about the exact mechanism through which balance sheet policy affects markets, with three pathways generally viewed as important. Some investors think it is the size of the Fed’s balance sheet that matters. In that case Fed balance sheet policy is clearly easier than it was pre-Covid. Others – such as this website – think that flow matters, i.e., the change in the balance sheet, or said otherwise, the size of asset purchases net of maturities, is the key variable. Then balance sheet shrinkage – QT – would certainly imply a tighter policy stance than the flat balance sheet policy of early 2020.

A third view is that gross asset purchases are what matter. This is the view that BofA sympathizes with. In the “gross” world, the Fed replaces maturing assets via “add-ons” in Treasury auctions, or as Liesman put it, the Fed is adding to its balance sheet at the same time as it is shrinking it all the while it’s chasing its tail. For example, if the Fed plans to re-invest $10bn in an auction, the Treasury would reduce the size of its auction by this amount and then allocate $10bn worth of securities to the Fed at the market-clearing price. Markets price in this mechanism: the larger the add-on, the less is the supply that markets have to absorb, and the higher would be the market-clearing price.

Theory aside, let’s look at some numbers: since the Fed’s balance sheet has more than doubled during the pandemic, keeping it steady would require significantly more reinvestment than would have been the case before the pandemic. Specifically, to keep its balance sheet steady as a result if upcoming maturities, the Fed would have to purchase (i.e., reinvest) nearly $400bn worth of coupon-paying Treasuries in 2Q and 3Q 2022, of which 59% were bought during the pandemic. This, according to BofA and it is correct here, would buffer the impact of rate hikes. Recall that most banks are now forecasting three to four hikes this year, as the Fed responds to sticky high inflation.

What about QT?

The chart below compares BofA’s QT forecast to the maturity schedule of coupon-paying Treasuries on the Fed’s balance sheet. The light blue bars represent Treasuries that were purchased in pandemic-era QE and the dark blue bars show those that were on the balance sheet pre-Covid. Quantities below the QT redemption cap (the yellow line) would run off the balance sheet while those above the cap would be reinvested (i.e., re-purchased)

Notice that in all but three months through end-2023, the redemption cap is less than the amount of maturing coupon-paying Treasuries that were purchased during the pandemic. Therefore in 2022 and 2023, reinvestments will generally exceed the amount of maturing assets that the Fed owned before Covid.

In other words, the likely path of reinvestment under QT would have amounted to QE relative to the pre-pandemic Fed balance sheet.

The bottom line is despite impending QT, the stance of the Fed’s balance sheet policy for the next couple of years should be more accommodative that it was pre-pandemic (as it continues to buy tens of billions in Treasuries just to keep its balance sheet from shrinking too fast), and as a final note, the above analysis excludes the additional liquidity support of roughly $1.5 trillion currently parked in the Reverse Repo facility which will slowly be drained in the coming quarters to make the impact of QT easier.

Tyler Durden

Thu, 01/06/2022 – 20:40

via ZeroHedge News https://ift.tt/31DEn2w Tyler Durden