Shift To Quality Intensifies Thanks To Hawkish Fed

By Ishika Mookerjee, Bloomberg Markets Live commentator and analyst

Demand for quality stocks is strengthening in Asia as the Federal Reserve dials up its hawkish commentary, making riskier firms look more vulnerable with borrowing costs expected to rise.

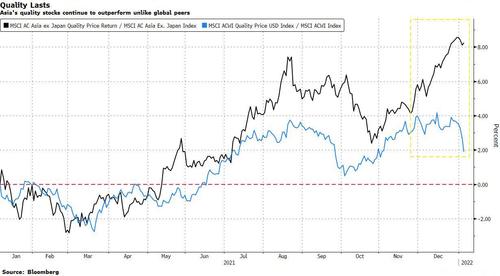

The MSCI AC Asia ex-Japan Quality Index has climbed about 1% since the end of October as the Fed announced its plan to taper asset purchases, while the MSCI AC Asia ex Japan Index has slumped 4%. The gauge of stocks with a high return on equity, stable earnings growth and low leverage trounced the broader benchmark by about nine percentage points last year, a better relative performance than that seen in its global peer.

“Asian quality stocks tend to outperform during global slowdown, inflationary regime in Asia and in the following 12 months post China slowdown,” Sanford C. Bernstein analysts Rupal Agarwal and Anusha Madireddy wrote in a note on Wednesday. There’s also support from positive earnings revisions and a historical discount to low-quality stocks, they added.

Investors are dumping riskier companies, yet the outperformance of the quality gauge suggests they are still comfortable betting on the more mature tech companies in the region. The sector had the biggest weighting in the gauge as of November with software firms Infosys and Tata Consultancy Services as well as chip giant Taiwan Semiconductor Manufacturing among the largest constituents. Their shares are up 9%, 12% and 9% respectively since the end of October, despite pressure on the global tech sector

While the jury’s still out on China’s internet behemoths, semiconductor stocks are expected to fare better in Asia amid an ongoing chip shortage. The 12-month forward earnings estimates for Samsung Electronics and TSMC have risen more than 20% in the past year and over 50% for SK Hynix. That’s while the MSCI Asia Pacific Communication Services Index — which includes Tencent — saw a drop of 13% in its earnings estimates.

Given inflationary pressures, high-yielding quality stocks in Taiwan and China are preferred by Bernstein. “We are most bullish on staples, tech and energy while being most negative towards discretionary and industrials,” the analysts wrote.

The median forecast in Bloomberg’s survey of analysts anticipates the FOMC will raise its policy rate twice this year and three times next.

Tyler Durden

Thu, 01/06/2022 – 22:21

via ZeroHedge News https://ift.tt/3zylXN2 Tyler Durden