Who’s Hiring And Who’s Firing In December

As discussed extensively earlier, there were some pretty striking disconnects in today’s jobs report: while the headline payrolls number was a huge miss and printed the lowest monthly gain of 2021 (as it did in November), the unemployment rate tumbled (also as it did in November), and the number of employed workers actually surged by 651k according to Household survey, while wages came in red hot, rising at 4.7% Y/Y, half a percent higher than expected. In short, the establishment survey was a disaster for the second month in a row, while the household survey was stellar (also for the second time in a row).

To be sure, Wall Street’s commentariat, which was very wrong for the second month in a row about the payrolls number, glossed over the disappointing establishment survey number and instead focused on the sold wage growth and the drop in the unemployment rate, concluding that both greenlight the Fed’s March rate hike. As Michael Pierce, economist at Capital Economics said “the key takeaway for the Fed is that, with few signs of a recovery in labor supply, the continued decline in the unemployment rate and surge in wage growth looks set to be sustained over 2022.”

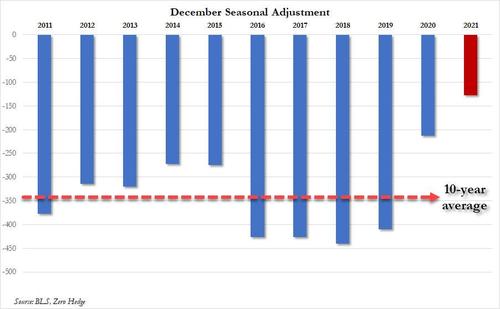

As for the actual payrolls miss, as we also showed earlier, a big reason for the confusion was yet another month of a highly aggressive seasonal adjustment factor used by the BLS to “normalize” the December number. Had it used the 10 year average December adjustment factor, payrolls would have increased by 220K, resulting in a payrolls number of 420K, in line with expectations.

In keeping with the history of recent upward revisions, one month from today we expect the BLS to revise today’s 199K print aggressively higher.

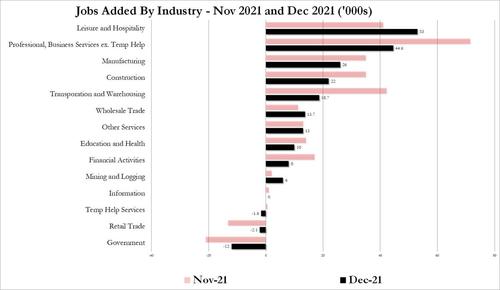

And while we wait, here is our traditional breakdown of the components of the establishment survey, looking at which jobs increased and which dropped, with the knowledge that all of these will change dramatically next month.

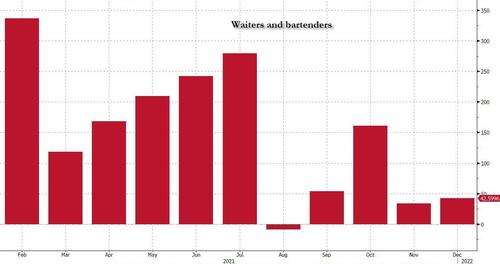

- Employment in leisure and hospitality continued to trend up in December (+53,000). Leisure and hospitality has added 2.6 million jobs in 2021, but employment in the industry is down by 1.2 million, or 7.2 percent, since February 2020. Employment in food services and drinking places rose by 43,000 in December but is down by 653,000 since February 2020.

- Employment in professional and business services continued its upward trend in December (+43,000). Over the month, job gains occurred in computer systems design and related services (+10,000), in architectural and engineering services (+9,000), and in scientific

- research and development services (+6,000). Employment in professional and business services overall is slightly below (-35,000) its level in February 2020.

- Manufacturing added 26,000 jobs in December, primarily in durable goods industries. A job gain in machinery (+8,000) reflected the return of workers from a strike. Manufacturing employment is down by 219,000 since February 2020.

- Construction employment rose by 22,000 in December, following monthly gains averaging 38,000 over the prior 3 months. In December, job gains occurred in nonresidential specialty trade contractors (+13,000) and in heavy and civil engineering construction (+10,000). Construction employment is 88,000 below its February 2020 level.

- Employment in transportation and warehousing increased by 19,000 in December. Job gains occurred in support activities for transportation (+7,000), in air transportation (+6,000), and in warehousing and storage (+5,000). Employment in couriers and messengers was essentially unchanged. Since February 2020, employment in transportation and warehousing is up by 218,000, reflecting job growth in couriers and messengers (+202,000) and in warehousing and storage (+181,000).

- Employment in wholesale trade increased by 14,000 in December but is 129,000 lower than in February 2020.

- Mining employment rose by 7,000 in December. Employment in the industry is down by 81,000 from a peak in January 2019.

And visually:

While the overall picture was clearly mixed, not to mention the weakest since 2020, the one job sector which has kept on giving since Lehman, namely employees in food services and drinking places (or waiters and bartenders), was back in form adding 42K jobs in December.

Separately, here are the industries with the highest and lowest rates of employment growth for the most recent month.

Finally, one curious point: as we first noted last month, tthe jobs deficit relative to February 2020, which currently stands at 3.6 million jobs, is entirely comprised of workers who lack a college degree. College-educated workers are now about 2% above their February 2020 employment levels and continue to see the strongest job growth, with high-school-educated workers still about 5% below pre-pandemic levels. Employment among workers with less than a high-school diploma actually declined over the last three months.

The good news: all those who spent over $100,000 to major in feminist studies, can take comfort that they will always have a minimum wage job waiting for them in America’s food service industry.

Tyler Durden

Fri, 01/07/2022 – 11:25

via ZeroHedge News https://ift.tt/34jfjyz Tyler Durden