Watch Live: Powell Positions Himself As Populist Crusader In Senate Confirmation Hearing

Jay Powell’s big day has finally arrived.

After being officially nominated for a second term at the Fed just before Thanksgiving, Fed Chairman Jerome Powell will appear before the Senate Banking Committee on Tuesday for his nomination hearing before the committee, then the entire Senate, vote on whether to officially confirm him to serve another 4 years at the central bank’s helm, a decision that most see as preordained (since the Senate wouldn’t dare defy markets, and risk tanking their own portfolios, by siding with Sen. Elizabeth Warren and voting against him).

In his prepared testimony, Powell once again tried to position himself as a populist by addressing the inflationary pressures that have arisen from the combination of Fed stimulus and the supernova of federal spending, and insisting that the Fed is running the economy for the benefit of all, rather than embracing policies that stoke asset inflation, further widening economic equality.

The Federal Reserve works for all Americans. We know our decisions matter to every person, family, business, and community across the country. I am committed to making those decisions with objectivity, integrity, and impartiality, based on the best available evidence, and in the long-standing tradition of monetary policy independence. That pledge lies at the heart of the Fed’s mission and is one we all make when we answer the call to public service. I make it here again, with force and without reservation.

Nowhere in his remarks does Powell touch upon his own responsibility for helping to create the inflationary supernova that’s currently squeezing working and middle-class Americans – though he claims to be the man to fix it.

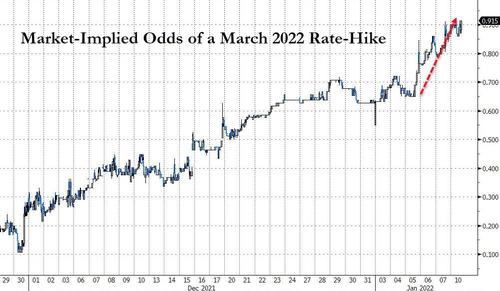

As for what we might hear from Powell on the subject of monetary policy, Ransquawk believes he might share an update on the Fed’s thinking about the labor market following the disappointing headline number for December released on Friday. The chair will likely also be asked about the prospects for a March rate hike, which markets have already started to aggressively price in.

Powell also might be asked about the latest ethics scandal at the Fed, which resulted in (former) Vice Chair Richard Clarida resigning two weeks shy of his retirement date after the press discovered in an amended ethics filing that Clarida had lied about buying stocks – via ETFs – just days before the Fed unveiled its stimulus measures in response to the March 2020 COVID-inspired market rout.

Readers can find Ransquawk’s preview of Tuesday’s hearing below:

The hearing will take place at 15:00GMT/10:00EST on Tuesday 11th January 2022. President Biden renominated Powell for the Fed Chair Position in November 2021. In the follow up remarks, Powell noted strong policy actions and vaccines have set the stage for a strong recovery, but he knows high inflation takes its toll on families and the economy. Powell also promised the return of maximum employment. In his prepared remarks for the hearing, he noted the economy is growing at its fastest pace in many years and the labour market is strong, highlighting the rapid strengthening of the economy despite the pandemic, resulting in elevated inflation. Powell will likely get quizzed about hot inflation (note, US CPI is on Wednesday, after the hearing), but given the hawkish pivot in December (acceleration of asset purchases, discussion around the balance sheet, and hawkish dot plots), he will likely say the Fed is pivoting to address high inflation and will reiterate that maximum employment could be achieved relatively soon, providing job growth continues at the current pace.

Given the December meeting and press conference were so recent, and the Fed has only really had the latest jobs report to digest since then, we may see updated commentary on the labour market, although other remarks are likely to be a reiteration. However, given the recent increased attention around a March lift-off, remarks on this will be key, as will any further details on the balance sheet. In the Minutes, on lift off, some suggested there could be circumstances in which it would be appropriate for the Committee to raise rates before maximum employment had been fully achieved, several participants viewed labour market conditions as already largely consistent with maximum employment while most judged it could be met relatively soon if the recent pace of the labour market continues. The latest jobs report saw an even further hawkish shift in market pricing for the March meeting given a strong improvement in the unemployment rate and decent improvement in slack measures, while the miss on the headline NFP perhaps shows that there are less jobs to add in the COVID labour market, suggesting full employment is either here, or at least near, for the short-to-medium term. Nonetheless, Powell’s views on this will be in focus. For reference, the Fed currently forecasts three hikes in 2022; however, the likes of Goldman Sachs call for four and JP Morgan’s CEO Dimon said more than four hikes in 2022 were a possibility. On the matter, Bostic (2024 voter, hawk) sees three 2022 hikes with the risk of a fourth on the possibility of higher inflation.

The Fed officially dropped the term “transitory” from its December meeting, therefore this may be a topic of question at the hearing. However, Powell did note he still expects price pressures to ease in the second half of this year, along with supply chain issues, although there was still great uncertainty. The FOMC’s SEPs in December saw the median view of PCE easing from current levels to 2.6% in 2022 with the core at 2.7%, albeit both estimates are above the Fed’s prior estimate back in September. Looking ahead, both the headline and core PCE metrics are expected to slow further to 2.3% in 2023 and 2.1% in 2024, so the Fed still thinks the recent elevated inflation prints are temporary. On wages, Powell will likely reiterate there is no evidence of wage growth spiralling into inflation, but given the political nature of the hearing, and given inflation is one of congress’ largest concerns, he will have to convince the Senate Banking committee he will be acting to bring inflation down.

Fed-Vice Chair nominee Brainard will have her hearing at the Senate Banking Committee on Thursday January 13th at 15:00GMT/10:00EST, she tends to lean more dovish, but she hasn’t spoken much recently, therefore her comments will likely reiterate Powell today, but it will be interesting to see her views on the balance sheet and lift-off timings.

And here’s Powell’s full prepared testimony:

Tyler Durden

Tue, 01/11/2022 – 09:55

via ZeroHedge News https://ift.tt/3tphuem Tyler Durden