Blain: Inflation Will “Change The Way We Think About Markets”

Authored by Bill Blain via MorningPorridge.com,

“A multiplicity of options does not lead to better choices…”

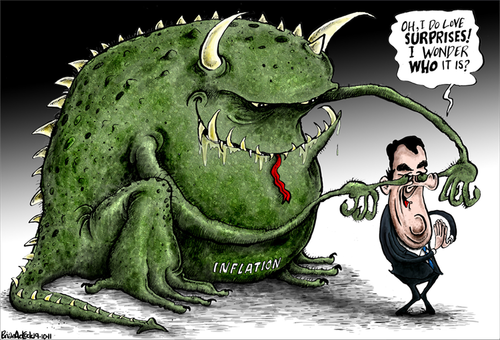

Inflation is the market’s theme today. Markets expect it, but are they prepared? Inflation doesn’t necessarily spell disaster, but it will force change in the way we think about markets – and Tech will likely be the sector that feels it most!

Neither the market nor the world’s central bankers will be much surprised by 6% inflation prints in coming months. Tomorrow we get US Dec CPI numbers – which will raise sighs (headline expected over 7%). Markets expect inflation – but are they prepared? The big uncertainty in economic/trading circles is just how significant the inflation threat could prove – will it be short or long-term, and how deep will the consequences go?

It’s a fascinating debate – split between pragmatists and economists.

-

The pragmatists – who can be characterised as traders – look at markets, inflation, activity and make plans like; “this is a mess, it’s going to take time to fix. We can profit by adapting as inflation impacts expectations and markets, and how the unravelling consequences of price volatility determine the investments most likely to prove the best inflation hedges to add value.”

-

The economists want to understand. They model the global economy across a disconnected multiverse of separate worlds called short-term, medium-term and long-term. They look at snap-shots of each, consider how they are changing and consult their arcane models to sagely conclude the innovation of new technology is mid-term deflationary, that long-term demographic changes will also prove deflationary, and that short-term inflation is simply a temporary imbalance between supply and demand. Snap shots give fascinating insights, but don’t really show how the machine actually works – or how unimagined consequences will trip their predictions.

I find it all terribly fascinating. Somewhere in the middle is truth. Being adaptable as the picture changes is critical, but understanding what that picture is also counts. Which is why we need to understand what CPI tells us.

I wish I was clever enough to be both a great trader and a great economist – but sadly I suspect they are mutually exclusive. So, I’ve spent a career trying to do both and become a middling investor and a dumb economist dispensing advice gleaned from both sides – a professional position known as an “Investment Banker”.

I am trying to better myself.

Over the past few weeks the Tech sector has become a bellweather for inflation fears. It has proved increasingly wobbly to the threat of rising bond yields (a result of inflation and normalisation). It increasingly feels like a tech “moment” or “shakeout” is coming. Will rising inflation and higher bond yields crush the speculative forces that have driven tech stocks to their current ultra-fantabulous valuations? And could a correction/collapse in tech trigger a possible contagious collapse across markets?

The inflation/markets relationship is much deeper and more complex than just the prospects for over-priced quasi-gambling stocks. Working out how and where to hedge against the escalating inflation bogey is complex on so many levels.

First there is the big inflation picture – when it comes to understanding how inflation is going to hit markets, I’ve taken a pragmatic cause-effect-consequences view on how the trend is going to travel. For instance: the supply chain bottlenecks caused as the pandemic economy imperfectly reopened were in themselves transitory issues, but have triggered consequences that will create longer-term structural inflation – most visibly in labour shortages and nascent wage inflation.

As the pandemic has stretched on into Delta and Omicron the destabilisation caused by pandemic supply chains has become magnified and stretched – to the extent it’s no longer just a short-term effect. The global economy is swiftly evolving around the bottlenecks. What does that mean for commodities and products? The economy isn’t following a predicted path – but kind of snakes its way to whatever unimagined place it’s going to. In trader speak – that’s called opportunity!

Globalisation of supply chains is being more swiftly undone and replaced by regional solutions than we imagined possible – the results could be very significant. As China navel-gazes inwards, its’ overseas markets refocus. Again – what does that mean in terms of repatriating domestic jobs elsewhere, and how much will new tech ease the costs of doing so? Again – opportunity! You should even factor in the geopolitical consequences for China as its’ economy is morphed by the pandemic.

Even as “transitory” supply chains alter the shape of global trade, soaring energy costs are a very real, long-term inflationary wrench thrown between the cogs of the global economy. Energy has been distorted by climate change transition – basically a consequence of no one planning just how important and for how long gas will remain critical as we move to a decarbonised economy.

But it’s not just the global economy that’s changing. Markets are also undergoing fundamental seismic shifts as well – and they are also all about inflation, or more correctly; hidden inflation.

Since the Global Financial Crisis that began in 2007 (and is set to continue, in my mind, for at least another 10-years), we have seen ultra-low-rates, quantitative easing “QE” (soon to be QT) and other forms of extraordinary monetary experimentation to stabilise markets and kickstart recovery growth. The effect on markets has been huge. Smart traders very quickly understood how these distortions inflated all financial asset prices, and the market followed.

Effectively, easy money underlies the bull market of the last 12 years. Inflation has been hidden in financial assets as equity and bond prices went stratospheric. That inflation has begun to leak into the real world – the more expensive a financial asset becomes the less it yields, hence investors are always looking for better yielding cheaper assets. Real assets in the real economy; from trade finance, aviation, property, private debt and private equity have become increasingly “financialised” – bought for the returns they generate. (I think I just invented a new word! Yay!)

That process of “financialisation” is increasingly unstable – built on easy money, cheap capital and bountiful liquidity. What would happen if it dried up, or was withdrawn? As interest rates normalise, what could happen if investors conclude the low returns on “risk-free” bonds are actually preferrable and a better risk-return than high-risk other assets?

There is a balance: one of the best reasons not to buy bonds is inflation. If you pay the UK Debt Management Office £100 for a 10-year bond today, what you get back in 2032 will buy far fewer cups of coffee than today. Which means investors will favour financial assets most likely to prove resilient to inflation.

The obvious ones are banks and financials. The commonly held wisdom is that banks will be able to increase their profits during periods of inflation by raising fees. Except, that only works if everyone’s wages are rising to pay these fees. At present – around the globe incomes are not rising, but standing still. That leaves consumers with rising energy, food and essentials bills to cover, and reducing discretionary spending… the most likely result of tumbling spending in an inflationary world being stagflation.

Maybe defense stocks would be a better idea? In an unstable world, governments perceive rising threats, and would spend accordingly… if they we’re already up to their necks paying for the pandemic!

For Tech stocks, the argument on inflation is most interesting. Think of the current market uncertainty on inflation and demand as a moment of reality. There are really two factors to consider: which Tech stocks are fundamental game changers, and which are distractions.

- What we’ve seen during the easy capital cheap money era since 2007 has been a feeding frenzy in any and all Tech stocks. In a low interest rate, cheap capital environment it didn’t really matter if companies are unprofitable: size = returns.

That relationship is about to change.

- When rates rise and money is diminished by inflation, profits start to matter as returns become ultra-important as an inflation counter.

That does not mean all Tech is bad. Identify now the long-term Tech stocks likely to become the next Amazon, Apple, Microsoft or Meta. They are going to be the ones that show profits, returns and a grasp of reality.

Yesterday, in the office we were talking about streaming and which firms can continue to grow subscriptions by providing the best content. Where does the line get drawn between Netflix and Disney or how much Apple can pump at the opportunity? What does the future of gaming via streaming mean. The office was split on Netflix.

At that point I was struck by something we learnt prior to the great financial crisis… Back in 2002 my bank was acquiring a US sub-prime lender and we wanted to know just how likely their borrowers were to repay their mortgages. We commissioned some research and discovered that among sub-prime borrowers, the last thing a broke borrower stopped paying wasn’t his mortgage or car, but his subscription to the Sports Channel.

Somewhere there is a lesson in that..

Tyler Durden

Tue, 01/11/2022 – 10:44

via ZeroHedge News https://ift.tt/3qeFv5Y Tyler Durden