Stellar 3Y Auction Shows Bond Market Not Worried Fed May Unleash Barrage Of Rate Hikes

It appears that for all the huffing and puffing about surging rates, Fed rate hikes, and bond market turmoil, today’s 3Y auction was actually quite stellar, and if anything validated our personal view that there is no way that the Fed will be able to pull off 4 (or even 3) rate hikes in 2022 while starting QT.

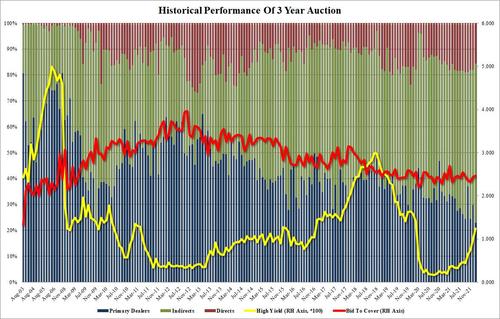

Moments ago the US Treasury sold the first coupon issuance of 2022 when it auctioned off $52BN in 3Y paper in an auction that went phenomenally well.

The high yield of 1.237% was higher than last month’s 1.000% and the highest since Feb 2020, which was to be expected in light of the recent rate hike freakout, but it also stopped through by 0.4bps, the most since March 2021. In other words, there was significant demand for today’s paper despite a consensus of many more rate hikes which would have impaired buyers in today’s auction should they materialize. Or perhaps the bond market knows, like we do, that 4 rates hikes in 2022 – as Goldman predicts – and many more in 2023 and so forth, is just a pipe dream.

Demand was also stellar as gauged by the bid to cover which jumped from 2.432 to 2.469, the highest since August 2021 and well above the 2.419 recent average.

Finally, the internals were absolutely stellar with Indirects taking down a whopping 61.6%, up dramatically from 52.2% and not only high above the 53.2% recent average but also the highest since Aug 2017. And with Directs taking down just 15.5%, the lowest since Jan 2021, Dealers were left holding to 22.8%, the lowest on record!

The 10Y dipped slightly on news of the phenomenal demand for today’s auction, and was last seen at 1.755%, down 1 bp from pre-auction levels and down from a session high of 1.78%.

Tyler Durden

Tue, 01/11/2022 – 13:24

via ZeroHedge News https://ift.tt/3tk4eb4 Tyler Durden