Not Looking Good: Goldman Warns Earnings Guidance Is “Disappointing” With 5 of 6 Companies Lowering Expectations

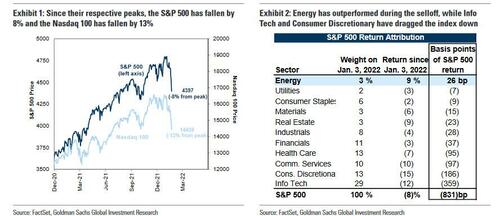

Late on Sunday, Goldman’s chief equity strategist David Kostin published a note titled “Anatomy of the S&P 500 sell-off and Nasdaq correction: Valuation compression and the re-pricing of equity risk” (available for professional subs) highlighting how the 8% drop in the S&P500 since Jan 3 (as of mid-Monday, the drop is now 10%, with the S&P officially in correction) and the Nasdaq’s 16% drop – matching the drop in December 2018 when Powell was forced to end the Fed’s tightening, has been driven by both increased concerns about future growth and a sharp rise in the equity risk premium (ERP).

As Kostin notes, the speed and breadth of the S&P 500 index decline has made it particularly challenging for fund managers to navigate. While the Energy sector surged by 12% since the index peaked the ten other sectors all declined. The 11% drop in Information Technology accounted for nearly half the index decline during the past 13 trading sessions.

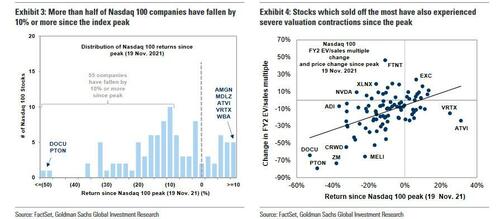

And with the Nasdaq 100 looking at a bear market at some point this week – with less than 4% to go until it is down 20% from its ATH – Kosting notes that share prices for more than half of the index constituents (55 companies) have dropped by 10% or more during the past two months. The NDX carries high concentration and some of the largest constituents corrected dramatically. For example, NVDA (-29%) and AMZN (-22%) were hit particularly hard during the correction while GOOGL (-12%) and MSFT (-14%) fell less sharply.

Goldman’s market crash post-mortem aside (which Kostin failed to predict in his barrage of bullish notes even as Goldman was selling billions in stocks), what we found most interesting in Goldman’s note is that five out of the 6 companies providing 1Q22 guidance so far this earnings season have lowered expectations, and alongside the broader market rout, the forward P/E multiple for the S&P500 index has fallen by 2 points to 19.6X from 21.5X. But even after the multiple contraction, equity valuations remain high on a historical basis, (~94th percentile vs. the last 40 years).

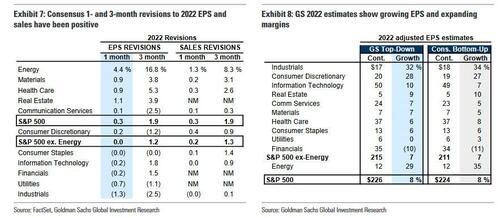

Before we look at the guidance, Goldman notes that earnings season has been so far characterized by positive sales and EPS revisions but falling share prices, with Kostin adding that “sharp declines in stock prices can reflect a jump in the cost of equity or reduced growth expectations. S&P 500 aggregate sales and EPS estimate revisions for 2022 have been positive during the past 1-month and 3-month periods. However, recent market rotations and investor conversations indicate concern about the growth outlook.”

With that in mind, here is a look at what even Kostin admits is “Disappointing guidance. Investors are most interested in forward-looking guidance from managements, and recent information on that front has been concerning. Five of the six S&P 500 firms that provided formal 1Q 2022 guidance following 4Q results lowered expectations.”

Drilling into that critical point, the GS strategist notes that following the release of 4Q results, only six companies in the S&P 500 provided formal near-term guidance for 1Q 2022. Unfortunately, five of the six firms guided below consensus for next quarter, including three of the stocks that actually beat expectations in 4Q. Only Micron Technology (MU) “beat-and-raised.”

Here Kostin reminds us that the most notable firm to provide updated guidance was Netflix which “stunned investors by dramatically lowering its expected rate of net subscriber growth in 2022. The shares plummeted by 22% the following day and $50 billion of equity cap was erased on Friday. The stock price has plunged by 33% since the S&P 500 peaked in early January and by 41% since NDX hit its all-time high in November.”

Why are investors obsessed with guidance? Because while cynical investors often quip, “Managements are the last to know” Goldman notes that “executives also have line-of-sight on their supply chains, customer orders, and other operating trends.” Multiple headwinds exist that make providing forward guidance challenging for executives, including labor (costs, recruitment, and retention), public health (the Omicron variant and shifting local government regulations, and travel restrictions), supply chains (cost and space availability on ships, railroads, and trucks), and monetary policy (pace of Fed hikes and the path of long-term interest rates).

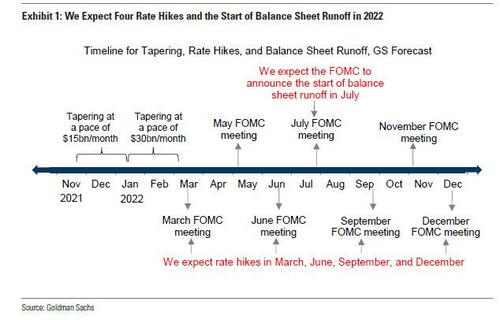

And then there is the Fed, whose increasingly hawkish shift has alarmed equity investors. According to Goldman calculations, two months ago, when the NDX traded at a record high, interest rate futures implied two hikes during 2022. Today it stands at four 25 bp hikes (one per quarter) that would leave the funds rate at 1.0%-1.25% by year-end. Although their baseline forecast is also four hikes, Goldman’s US Economists have raised the prospect that the Fed could hike five times (with a hike in May) and perhaps even tighten at every meeting this year starting in March.

Needless to say, elevated core PCE and labor inflation are the proximate causes for the expected tightening. The uncertain path of future inflation explains the range of forecasts around the pace and duration of tightening following liftoff.

And despite the compression in PE multiples, valuation metrics remain sky high: while the forward P/E multiple for the S&P500 index has fallen by 2 points or 9% since the start of the year (from 22x to 20x) in absolute terms, equity valuations remain at near record levels, in the 94th percentile vs. the last 40 years.

One final highlighted observation from Kostin (there is much more in the full report) and it has to do with investor positioning.

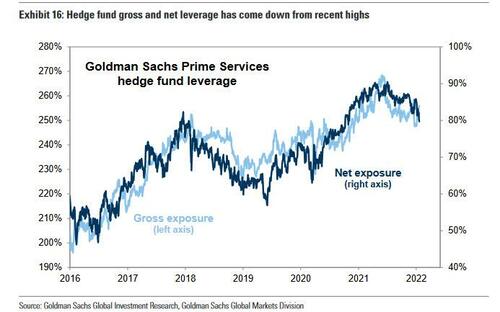

Although equity investor length has declined in recent weeks, it still remains elevated versus history. High frequency hedge fund leverage data from Goldman’s Prime Services desk shows that hedge funds have cut net leverage from 86% on December 30th to 80% today. This de-risking has brought net leverage to the lowest level in the past year. However, relative to the last 3 years, net leverage ranks in the 57th percentile. As Kostin warns, “above-average positioning suggests that investors will require a catalyst in the near-term to add length, but few obvious catalysts are evident in the near-term.“

One potential catalyst would be a slowdown in inflation, but Goldman economists – who were dead wrong in 2021 on inflation, expecting it to be transitory only to be proven laughably incorrect when even Powell said it is time to retire the word “transitory” – do not expect that will occur until 2Q (of course, once the current market crash translate in inflation terms, expect a major drop in inflationary pressures). That said, and quite obviously, “dovish commentary from the Fed or an extremely strong earnings season could potentially lead investors to increase equity allocations in coming weeks.”

* * *

So how to position in light of all this? Given the prospect of tightening financial conditions, Goldman recommends investors own stocks with ‘quality’ attributes (such as strong balance sheets) at moderate valuations. Meanwhile, economically-sensitive small-cap and value stocks tend to suffer amid tightening financial conditions. However, many strong balance sheet stocks today are fast growing and trade at elevated valuations, explaining why weak balance sheet stocks have outperformed YTD. And with uncertainty around margins, Goldman also recommends investors own stocks with strong pricing power.

Tyler Durden

Mon, 01/24/2022 – 12:20

via ZeroHedge News https://ift.tt/3H0AZhr Tyler Durden