JPM Trading Desk: Odds Not Looking Good For A Continued Bounce Today

While we’ve done our best to capture the sheer insanity of yesterday’s market action, perhaps the most eloquent summary belongs to DB’s Jim Reid who this morning writes that “at one point yesterday it felt like we were in a full blown crisis let alone a recession. At Europe closed their laptops down the S&P was as much as -3.98% lower, which would have been the worst daily return since June 2020. The NASDAQ was -4.90% lower, the worst potential close since September 2020. However at that point Manic Monday turned and remarkably the S&P 500 (+0.28%) and NASDAQ (+0.63%) closed higher. The volatility continues this morning though with S&P 500 futures down -1.1% and Nasdaq futures -1.4%. Note that earning season starts to get going with some momentum today. The highlights of those reporting are in the day ahead at the end but Microsoft is probably the biggest and most important.”

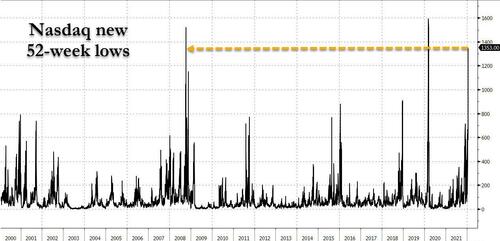

Of course, sometimes a picture has more impact than one thousand poetic words, and we believe that the following chart of Nasdaq new 52 week lows may it: it shows that on Monday, there were 1,353 new 52-week lows in the Nasdaq. This was the third highest on record, only surpassed by the March 2020 implosion and the global financial crisis.

So no matter how one describes it, yesterday’s market even was truly historic.

But what traders want to know is whether the crash is over or will today see more pain? Unfortunately, for those who care about the opinions of the trading desk at the world’s largest commercial bank, we have some bad news. According to JPM’s Andrew Tyler who does the bank’s daily trading desk recap (where unlike JPM’s permabullish Marko Kolanovic, people actually put their money where their mouth is), it’s not looking too good because when looking at history, after a furious reversal such as yesterday, “the following day, markets were down 4 of the previous 6 times, with an average return of -1.6%.” Of course, what really matters for stocks is not what they will do today, but what the Fed will say tomorrow, so we reserve judgment for the next 24 hours.

In any case, here is JPM’s take.

Yesterday, we saw significant reversals in the 3 major indices. Focusing on the NDX, a 5% reversal is an uncommon occurrence. If you exclude March 2020, yesterday was the 7th 5%+ NDX reversal since GFC. The following day, markets were down 4 of the previous 6 times, with an average return of -1.6%. In 2000 – 2002 and in 2008, there are many more observations of 5% reversals, occurring 194 times during those time periods.

Overall, intraday reversals of this magnitude seems to suggest more volatility rather than a directional change. This hypothesis appears to be playing out in futures this morning.

Finally, answering the all important question, “how much more downside exists?”, Tyler writes that the answer to that depends on the combination of MSFT earnings today, the Fed tomorrow, and AAPL on Thursday. “The Fed is most important for market direction while the Tech behemoths could allow the NDX to rally alongside the other major indices.” And speaking of the Fed, here is what JPM thinks will happen during tomorrow’s meeting “which should be a non-event”:

With the Fed meeting tomorrow, what should be a non-event now has investors questioning (i) will the Fed end QE next week; (ii) is next week a live meeting or does liftoff begin in March; and, (iii) is the first rate hike 25bps, 50bps, or more.

The US Market Intelligence view is:

(i) No – while the economy does not really need additional stimulus there is noticeable impact from Omicron without a clear answer as to when Omicron fully dissipates.

(ii )The JPM view is that liftoff begins in March. With a 6- 9 month lag between Fed action and economic impact, pulling forward liftoff to January does not have a material impact on the economy and the bond market, and thus financial conditions, reaction would potentially be negative enough to derail the Fed’s attempt at a soft landing.

(iii) 25bps. While we have seen the Fed cut 50bps or more, we have not seen the Fed hike inthose increments. While Powell seems the most likely Fed chair to attempt this, it seems unlikely. That said, we could see the Fed accelerate their hike schedule form an assumed once per quarter to once per meeting. Even that aggressive of an approach is not being price into markets and would seemingly violate Powell’s preferred data-driven approach.

The silver lining: Monday’s near crash showed the Fed just how bad things will get for him and for his boss, if the Fed continues to push with a blind, and very hawkish narrative.

Tyler Durden

Tue, 01/25/2022 – 08:51

via ZeroHedge News https://ift.tt/3Iz4GGO Tyler Durden