IMF Slashes Global GDP Growth To 4.4% In 2022, Warns On Aggressive Fed Tightening

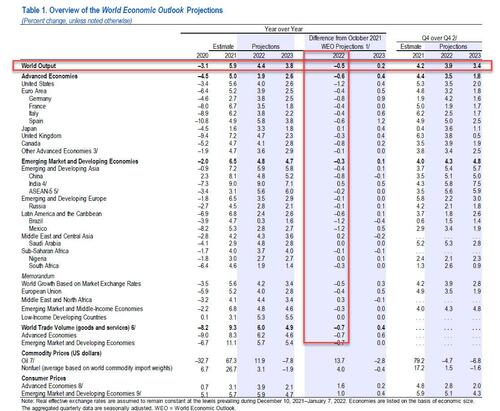

Looking for more proof that the global economy is slowing fast? Then look no further than today’s latest quarterly World Economic Outlook publication from the IMF, which slashed its global economic growth forecast for 2022 from 4.9% to 4.4%, as the Covid-19 pandemic enters its third year, citing weaker prospects for the U.S. and China along with persistent inflation. The downgrade was across the board, with the monetary fund slashing its GDP forecast for the US, Eurozone, UK, Japan, China and emerging markets. The IMF also downgraded its view on global trade from 6.7% to 6.0%.

The U.S. saw its forecast cut on the imploding outlook for President Joe Biden’s spending agenda and China, the second-biggest, on challenges in real estate. Some more details:

- The fund slashed its forecast for growth in the U.S. by 1.2 percentage points to 4%. The revision reflects removal of assumptions for a positive impact from Biden’s Build Back Better social-spending plan, which died in Congress; earlier withdrawal of Federal Reserve support; and continued supply-chain bottlenecks

- The IMF trimmed China’s growth forecast by 0.8 point to 4.8%, citing disruptions caused by the pandemic, the nation’s zero-tolerance policy for Covid-19 and disruption in the housing sector.

- The IMF cut its growth forecasts for Brazil and Mexico by 1.2 percentage points to 0.3% and 2.8%, respectively, with the fight against inflation already prompting tighter monetary policy that will weigh on domestic demand

- India will see the fastest growth among major economies at 9% from 8.5%, due to credit-growth improvements

Looking even forward, which is a silly exercise as nobody can anticipate what happens between now and year-end 2023, IMF sees more slowdown, with global growth dropping to 3.8%, which however was a 0.2% increase from its previous forecast, but the cumulative expansion for the two years will still be 0.3% less than previously forecast.

According to the IMF, the world economy expanded 5.9% last year the most in four decades of detailed data. That followed a 3.1% contraction in 2020 that was the worst peacetime decline in broader figures since the Great Depression.

“The last two years reaffirm that this crisis and the ongoing recovery is like no other,” Gita Gopinath, who became the fund’s No. 2 official this month after three years as its chief economist, wrote in a blog accompanying the report.

“Policy makers must vigilantly monitor a broad swath of incoming economic data, prepare for contingencies, and be ready to communicate and execute policy changes at short notice,” Gopinath said. “In parallel, bold, and effective international cooperation should ensure that this is the year the world escapes the grip of the pandemic.”

According to Bloomberg, while the IMF sees the omicron variant weighing on growth in the first quarter, it expects the negative impact to fade starting in the second quarter, assuming that the global surge in infections abates and the virus doesn’t mutate into new variants that require more restrictions on mobility.

Supply-chain disruptions – which like inflation is proving to be anything but transitory – are spurring more broad-based inflation than anticipated, with the annual rate projected to average 3.9% in advanced economies this year, up from a prior 2.3% estimate, and 5.9% in emerging and developing nations.

The good news is that the IMF sees surging inflation easing gradually later this year, assuming price expectations remain well anchored, as shipping bottlenecks ease and major economies respond with interest-rate increases.

Advanced economies raising interest rates may create risks for financial stability and emerging-market and developing economies’ capital flows, currencies and fiscal positions after debt levels increased, the IMF said. International cooperation will be needed to preserve nations’ access to cash and facilitate orderly debt restructuring where needed, the fund said.

The projections assume that bad health outcomes from Covid-19 recede to low levels in most countries by the end of this year, vaccination rates improve and treatments become more available. Risks are tilted to the downside, with new variants threatening to extend the pandemic.

Bringing the pandemic to an end depends on ending vaccine inequality, the IMF said. The fully vaccinated share of the population is about 70% for high-income countries but less than 4% for low-income nations. Eighty-six nations, accounting for 27% of the world’s population, fell short of the 40% vaccination level for the end of last year that the IMF estimates is needed to curb the pandemic.

Perhaps the most interesting comment came from Gopinath who said that any miscommunication fof the Fed policy changes may provoke flight to safety and trigger capital outflow from Emerging Markets.

How will less accommodative monetary policy in the United States affect global financial conditions? With inflation on the rise and still large pent-up demand in the system in part due to the pandemic recovery program, US monetary policy will have to tighten. But how far and fast is not yet clear. The WEO forecast is conditioned on an end to asset purchases in March 2022 and three rate increases in both 2022 and 2023—consistent with what will be needed to bring inflation back down to the 2 percent medium-term goal. But there are upside risks. Inflation could turn out higher than expected (if, for instance, supply disruptions persist and wage pressures feed into inflation). A different policy stance will be required if circumstances change. Communicating such changes will be a delicate task and risks prompting strong market reactions that could, in turn, result in tighter financial market conditions. Markets’ reactions to (actual or perceived) changes in Federal Reserve policies will govern how less-accommodative policy in the United States spills over to other countries, particularly emerging markets and frontier economies. Any miscommunication or misunderstanding of such changes may provoke a flight to safety, raising spreads for riskier borrowers. This may put undue pressure on emerging market currencies, firms, and fiscal positions

Is Jamie Dimon still sticking with “six or seven” rate hikes?

Tyler Durden

Tue, 01/25/2022 – 09:45

via ZeroHedge News https://ift.tt/3fWfJO3 Tyler Durden