Who Bought The Dip: Retail Puked In The Morning, Panic Bought In The Afternoon

In a hurried attempt to explain the dynamics behind yesterday’s market plunge, Bloomberg rushed out an article just after the market closed on Monday, titled “Retail Traders Bailed on the Market Right Before Stocks Rebounded” and which cited data from JPM retail flow tracking quant Peng Cheng noting that in “a spasm of panicked selling early Monday, retail investors offloaded a net $1.36 billion worth of stock by noon, most of it in the first hour.” Adding that “the retail morning exodus was a stark about-face from recent sessions, when die-hard day traders snapped up a record $12 billion of equities during the two weeks through last Tuesday”, Bloomberg’s conclusion was the the early puke was at least partially facilitated by retail capitulation.

Setting side that retail flows are minuscule in the grand scheme of things (CTA flows are measured in the tens of billions, buybacks are around $5 billion or more each day), Bloomberg’s assessment was correct, but incomplete, because Bloomberg used JPM data tracking just the first half of the trading day. Had it waited just a few more hours, it would have gotten the full picture, which is very meaningful because as JPM shows, what happened in the afternoon was a mirror image of the retail puke in the morning.

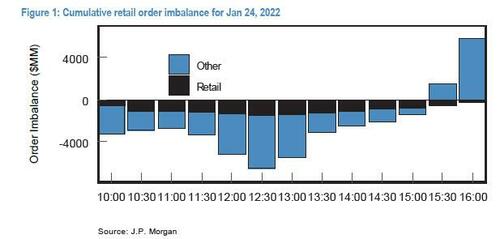

In a note published early on Tuesday morning, JPM’s Peng Cheng answers the question of “who bought the dip on Monday” and writes that the order flow on Monday showed a significant reversal around mid day: “while retail traders sold heavily in the morning, and the net selling peaked at -$1.5B around 12:30PM. In the afternoon, however, they turned aggressive buyers, and bought close to $1.3B between 12:30PM and 4:00PM.”

All in all, the retail order imbalance ended the day at -$252MM, “a relatively modest number considering the intraday volatility.”

The directional bias on the remaining order flow (i.e. order flow which is not classified as retail) showed a similar trend. Net selling peaked at -$5B at around 12:30PM. The reversal in the afternoon was even more dramatic, and a total of $10.8B was bought by non-retail investors between 12:30PM and 4:00PM. Non-retail order imbalance ended the day at +$5.8B.

For those wondering what retail bought and sold on Monday, here is a summary of the names with the highest/lowest retail order imbalance.

Of course, any attempts at pointing the finger at retail investors as being decisive in either sparking the dump or the reversal are laughable – at best, what retail traders do is merely chase the market momentum and they did precisely that yesterday. For the complete answer who was behind yesterday’s dramatic intraday reversal, please read our article overnight “Thank This Mystery Put Seller For Today’s Historic Market Reversal.”

Tyler Durden

Tue, 01/25/2022 – 10:14

via ZeroHedge News https://ift.tt/33SFxrP Tyler Durden