From Correction To Carnage: The Fed Is Walking A Tightrope

Authored by Sven Henrich via NorthmanTrader.com,

On January 2 I stated:

“the party is rapidly coming to an end and the Fed will want to curb inflation without causing a recession which will be a real task. How to accomplish it?

Easy, let markets drop, but not so much that it causes a systemic event but enough that year over year inflation numbers drop, declare victory and then flip flop policy again to prevent any major damage to markets by the time mid terms are on everybody’s mind.”

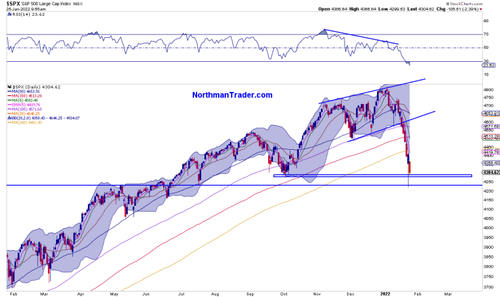

On January 4th $SPX made an all time high and we’ve gone down ever since.

$SPX -11% from the January highs, $NDX -17%, small caps -20% from their 2021 highs and of course crypto getting mauled. In short everything we’ve been talking about for the last year. Liquidity goes and the bid goes. In this case the liquidity hasn’t really gone at all, they just talked about it. And speaking of liquidity: One source of liquidity that has disappeared, buybacks, is coming back again starting this week and more forcefully into February.

But the main point: If the goal was to fight inflation by letting markets drop to take some of the excess out without actually tightening in a major way: Congrats, mission accomplished.

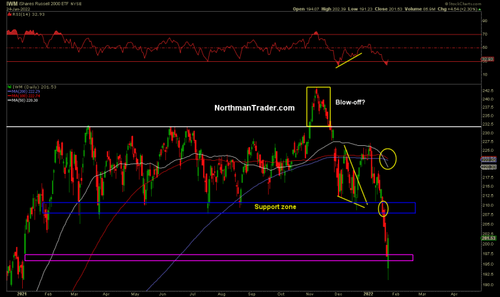

It all looks like a “garden variety” correction, but some of the charts tell a completely different tale, that of absolute carnage highlighting again the weakness underneath that had been building for months. I talked about it in mid December in The Unraveling before the expected Santa rally:

“A potential Santa rally notwithstanding storm clouds are not only gathering but they are already all around us. I suggest paying close attention, despite the expected upcoming holiday lull….While main indices are making new all time highs & give the appearance of a raging bull market underneath there already is a raging bear market in individual stocks. Not only do prices remain far outside the historical resistance of the upper quarterly Bollinger band, $SPX also remains far above its quarterly 5 EMA. A chart that demands its eventual technical reconnect, a process many of its components have already undertaken.”

This reconnect has now taken place:

And that reconnect has come at a price.

Basically, holy shit:

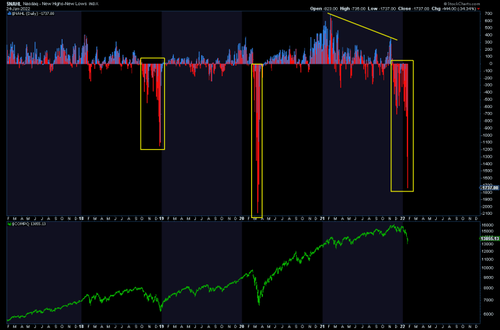

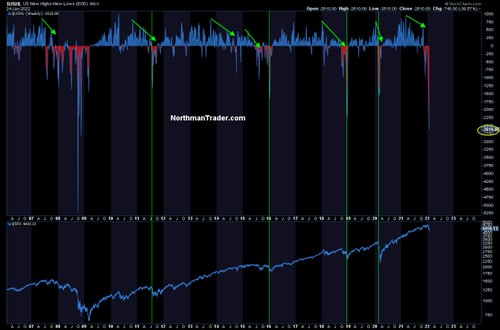

Nasdaq new highs/new lows:

Almost as bad as March 2020.

But change the reference to a weekly close and all of a sudden you get a different perspective:

Worse than 2020, worse than 2018, not even during the depths of the financial crisis have we seen anything like it.

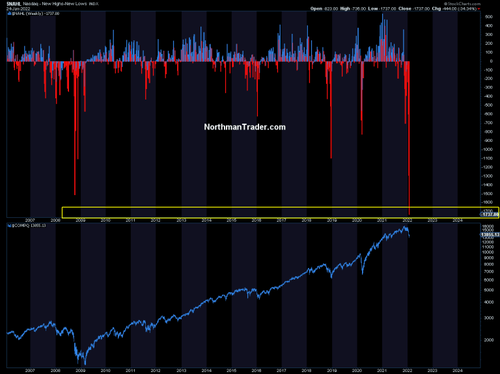

The monthly perspective knowing the month is not over? Just wow:

Never seen this before. The only thing that came close is 1998, a 20% correction that ended up being a massive buying opportunity for a blow off top move coming.

The first conclusion I draw from these charts is that this sell off in its current state is one of the worst we’ve ever seen in terms of the underlying damage inflicted on individual stocks. But given the time references there is also opportunity the erase these most extreme readings before the end of the week and month. We have 5 trading days left this month and a monthly read like this is simply unprecedented. So there is lot of opportunity to change this reading for the better on a monthly close.

These charts also show that on an individual component basis the carnage underneath is historic.

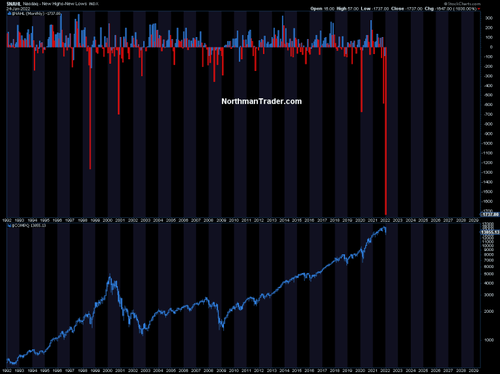

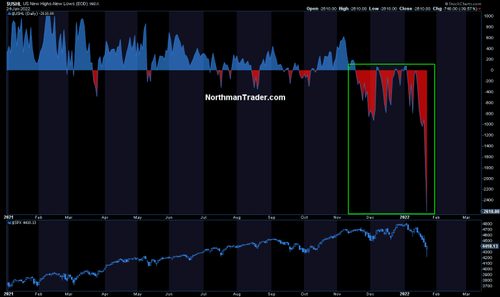

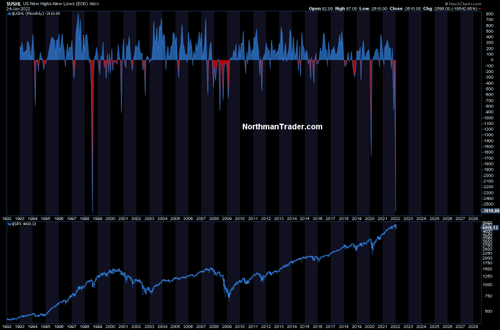

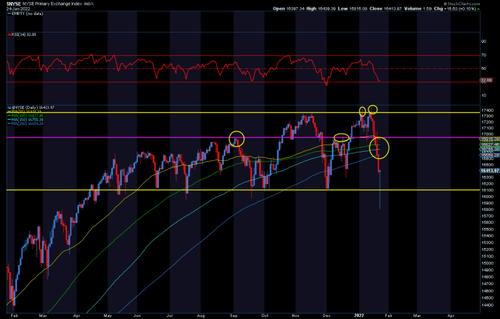

But it’s not only on the Nasdaq, US new highs/new lows tell a similar story:

See the weekly read and you get an appreciation how severe this correction is:

The previous negative divergences building last year again following the historic script culminating in the roll over we see now.

The monthly perspective:

Yea. Again that 1998 reference.

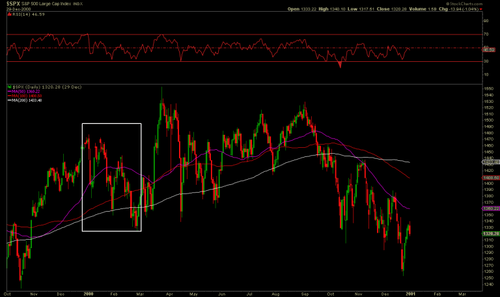

Principally early January weakness is not unprecedented in context of another correction that occurred before another blow off move. Who can forget 2000:

A dip below the 200MA and then rally. But 2022 has been the worst drawdown for stocks in history so far.

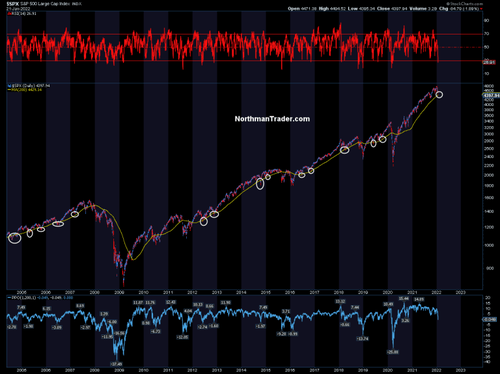

We just came out of the 4th longest period without a tag of the 200MA. Dips below on a tag? Plenty of times below:

And now with an RSI in the 20’s. Yes history says this can get a lot worse, but more often we’ve seen meaningful bottoms emerge from such tags as well.

Bottomline here: The bubble warnings voiced last year due to unprecedented liquidity were largely ignored, investors piled into unrealistic valuations while internals slowly deteriorated last year as indices maintained their trends and now it’s ended in a valley of tears as wide price ranges simply got taken out in a matter of a few weeks.

Yesterday $SPX hit the lows of July, 6 months of buying wiped out:

$NYSE showing an even broader time frame dropping below the March lows:

And small caps losing the entire 2021 price range:

Putting ALL 2021 buyers under water.

We are very oversold and there is plenty of bounce motivation to be had in the days and weeks to come, but be absolutely clear: There is not only tremendous carnage that has taken place, there is massive technical damage inflicted on charts with lots of trapped supply above all of which will be resistance on the way up and as long as indices can’t get above their broken moving averages risk remains lower.

I’ve long contended the Fed overdid it by insisting on buying trillions of assets while fiscal stimulus was flowing through the system already. This excessive inflow of liquidity caused asset prices to melt up into a historic bubble and now investors and traders who chased the liquidity party have paid the price. Not only with massive losses but now with inflation to boot. Well done Fed. And now tightening. Into slowing growth and a massive market correction.

Best of luck:

If markets keep dropping like this we’ll be in a recession before the Fed even raises rates.

— Sven Henrich (@NorthmanTrader) January 24, 2022

The Fed is walking a tight rope, the very tight rope they have laid out themselves by fomenting another boom and bust cycle.

As I also said on January 2nd: “My base expectation for 2022 hence will be much broader price ranges in indices and for the things that haven’t mattered to matter again.”

This expectation has already come to fruition and 2022 certainly is already a very different year. Happy trading.

* * *

For the latest public analysis please visit NorthmanTrader and the NorthCast. To subscribe to our directional market analysis please visit Services.

Tyler Durden

Tue, 01/25/2022 – 14:55

via ZeroHedge News https://ift.tt/3H2a84J Tyler Durden