In Catastrophic Month For “Smart Money”, Goldman Saw Biggest Hedge Fund Buying Since 2020 On Monday

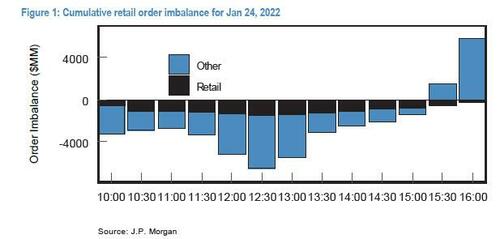

Amid record volumes and a sharp intra-day price reversal in the US equity markets yesterday, and with confused retail investors first panic selling then panic buying as they chased the unprecedented reversal in momentum on Monday…

… the Goldman Sachs Prime book saw the largest 1-day net buying since Nov ‘20 (a +3.9 standard deviation vs. the average daily net flow of the past year), driven by short covers and to a lesser extent long buys (1.6 to 1). North America was by far the most net bought region followed by EM Asia, while DM Asia was the most $ net sold.

Here is the breakdown from the latest Goldman Prime report. There are some staggering datapoints here.

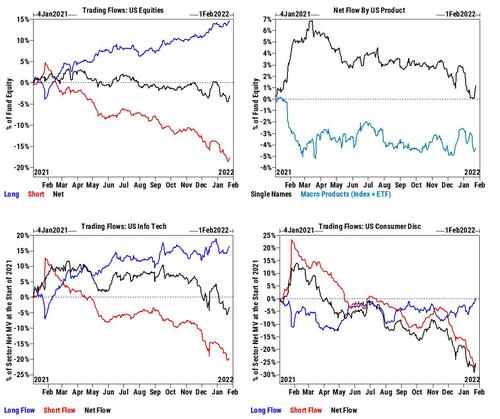

- After 8 straight days of net selling, US equities on the GS Prime book saw the largest $ net buying since Dec 17th (+3.4 SDs), driven short covers and to a lesser extent long buys (2.3 to 1).

- Yesterday’s $ short covering in US equities – driven by Macro Products – was the 5th largest in the past five years (+3.0 SDs).

- US ETF shorts decreased 4% (ex. MTM) – the largest 1-day reduction since Oct ’20 – driven by covers in Broad-Based Equity and Technology ETFs.

- Single Stocks saw the 3rd largest $ net buying in the past five years (+4.1 SDs), driven by long buys and to a lesser extent short covers (4 to 1).

- With the sole exception of Energy, all sectors were net bought led in $ terms by Consumer Disc, Info Tech, Comm Svcs, Health Care, and Industrials.

- Following 7 straight days of net selling, Consumer Disc stocks saw the largest $ net buying since Jun ’21 (+3.8 SDs) driven by long buys and short covers (1.4 to 1).

- Info Tech stocks were net bought for a second straight day and saw the largest $ net buying since Dec 17th (+2.1 SDs), driven by long buys and short covers (2.5 to 1).

- Most $ Net Bought Industries – Software, Interactive Media & Svcs, Hotels, Restaurants & Leisure, Internet & Direct Marketing Retail, Entertainment, IT Svcs, Biotech, Multiline Retail

- Most $ Net Sold Industries – Tech Hardware, Capital Markets, Oil, Gas & Consumable Fuels, Media, Pharmaceuticals, Metals & Mining, Banks, Household Durables

What about performance?

Well, on Monday, hedge funds lucked out: according to GS Prime, fundamental LS managers were down as much as -2.2% intra-day before recovering amid the price reversal, and closing -0.2% (alpha +0.2%) vs MSCI Total Return -0.6%. We suppose a similar pattern was observed on Tuesday.

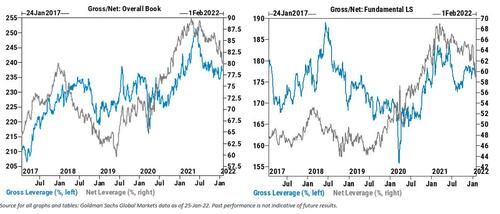

But while hedge funds may have been saved by that mystery put seller we profiled yesterday, they are still facing a world of pain (and unprecedented redemption requests): according to Goldman, so far in January, Fundamental L/S funds are down 7.2% (alpha -4.0%) after just 16 trading days in 2022.

And the devastating punchline: according to Goldman “since we starting compiling performance estimates using Prime positions in Jan ’16, Fundamental LS returns had only experienced worse drawdowns in March ’20, and Q4 ’18.“

And instead of having conviction one way or another and risking capital to justify their ridiculous performance fees, the so-called smart money is now absolutely clueless, and net leverage has collapsed to one year lows and sliding fast.

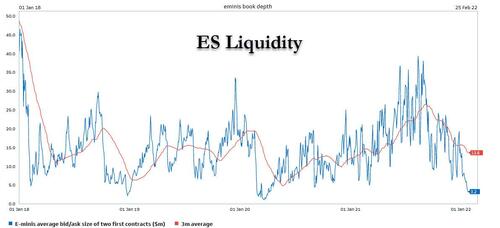

And in this environment where everyone is losing money and nobody knows what to do, it is not surprising that emini liquidity has cratered to levels not seen since March 2020… when the Fed had to inject $5 trillion and backstop the bond market with direct purchases of corporate bonds, to reboot the market.

Translation: good luck to Powell tomorrow and the Fed with those “six or seven hikes” and balance sheet runoff…

Tyler Durden

Tue, 01/25/2022 – 21:55

via ZeroHedge News https://ift.tt/3o1c1qG Tyler Durden