Nomura: Here Comes ‘The Big One’

Authored by Charlie McElligott, Managing Director of Cross-Asset Strategy at Nomura,

“Pre-FOMC drift” – but this time, thanks to a massive “kick-save” from Microsoft guidance which turned the entirety of global risk-assets from cratering lower in the after-hours trade last night to now, spasming higher into Fed later today (NQ +4.4% low to high) and with still substantial “short Gamma vs spot” out there for Dealer hedging purposes, as well as sharply “netted-down” exposure from Fundemental investors and outright “shorts” in CTA Trend….while conversely, we currently see a quiet Rates trade (we did see a buyer FVH2 in 5k / $254k / 01 of UST belly, as well as UPSIDE protection against a “dovish surprise,” e.g. FVH2 120C ppr pays 14-1.5 on 4k…although later see more of the same “momentum” reloading back into large downside FVH2 119.5 / 119 PS ppr pays 13.5 on 25k…and also a fairly largly “buy” of ED$ May Put Fly)

However, the meat of the note today into the FOMC will touch-upon the “potential” that a “no hawkish surprise” or even “dovish hawk” Fed commentary (vs well-managed expectations) in-and-of-itself could see some of that recent “downside Crash” hedge buying get unwound, which then could set-off a +++ “virtuous feedback loop” spiral from Vol –space into the Equities –space, where exposure has been netted-down with violence on the fundamental / discretionary side, is at a historically “low” allocation from the Vol Control side, and of course is outright “Short” on CTA Trend

This is going to come down to “Jerome Semantics”—the main “hawkish” risks being the 1) balance-sheet conversations (potential to end QE a month early per Rob Dent, or mention possibility of selling MBS as part of the normalization process) and, in my eyes, 2) the FCI convo also risking disappointment for Equities folks looking for a sympathetic eye”…although I will say that with March liftoff already a certainty and with 4 hikes back to being fully priced-in for ’22 as per FFF, “hawkish surprise risks” there are fairly limited here as it pertains to actual policy rate path

Any modicum of “dovish surprise” / “dovish hawk” vs these already high and well-messaged “hawkish” expectations, however, then risks a “momentum shock,” disrupting a currently crowded “trend” friendly market, as per CTA positioning in 1) bearish / hawkish in Bonds and Rates along with the aforementioned 2) “short” Equities…but again, the local / tactical Equities “upside” catalyst on a “dovish hawk” message vs expectations would be the Vol space as catalyst the Equities “virtuous feedback look,” via Vanna- and Gamma- impacts from Client downside hedges being hammered & unwound (as Dealers then cover their futures “short hedges” and further squeezing stocks and hitting vol lower—rinse / repeat), then sling-shotting Equities higher

The perverse thing is (and as mentioned yday) that the more bullishly that Equities- and Risk- trades, the more scope markets then have to price in more “hawkish” Fed action down the pipe—i.e. a longer rope to hang ourselves with IF inflation stays sticky and the Fed simply is forced to “tighten FCI” more aggressively (either with more hikes, faster BS or both)—hence, this will remain a “traders’ market” as long as the we remain in a “tightening” regime

-

Nasdaq (and broad Risk-Assets) rescued from a potential re-entry into the “Gates of (more) Hell” overnight, as the initially underwhelming Earnings results from crowded Mega-Cap Tech Growth bellwether MSFT led Nasdaq futures -1.8% after the US Cash Eq close on the lows…but later then turned into a raucous relief rally, with NQ +2.4% on the highs, as on the call, the company guided v bullishly in its Cloud business, while also positive on commercial bookings and the overall supportive IT spending backdrop—which might have single-handedly saved the entire Software space (remember, IGV -25.5% since mid-November!), and is now lifting all cross-asset market risk-sentiment

-

As Nasdaq swung efffectively ~+4.4% low-to-high in the after-hours trade on this “OMG Software / Secular Growth isn’t Gonna Die!” relief print, we have seen the return of some incremental “animal spirits” across Global Equities (Eurostoxx +2.6%), Commodities (Copper +1.5%) and Crypto (ETH +7.2%)

-

Separately, “stretched” Equities Vol is tiling “heavy” on the MSFT kick-save and even before the FOMC, and as I like to to say is at risk of “collapsing under the weight of its own implied expectations” after the recent grab for “Crash” into the Monday morning liquidation / capitulation and ahead of the Fed “hawkish” event-risk

-

VVIX closed north of 150 yday—a +3 z-score over the past 10 years—as an expression of the sudden renewal in “tail”demand seen Friday and Monday at the peak of the capitulation

-

-

Obviously Equities Vol is not going to completely come “undone” AHEAD OF today’s all-important Fed meeting—as there is just too much information regarding 1) FOMC timing and particulars of the BS / QT path (risk of earlier end to QE by a month, but also any specific guidance on run-off “caps” or specific commentary on plans for MBS to see outright sales), along with 2) the anticipation of the Fed Chair’s language in acknowledging the recent “financial conditions” tantrum, which was almost exclusively an Equities-driven dynamic

So regarding my expectations for the Fed today:

-

It is my view that balance-sheet commentary is the chief source of “hawkish risk” today, including Nomura Economist Rob Dent’s out of consensus view that we could see the potential end to QE purchases a month earlier than expected (Feb instead of Mar, which gives you more optionality on QT runoff timing IF inflation continues with its sticky-persistence), but also the market anticipating more specific guidance on run-off caps, and even the potential for clarity on their plans for MBS

-

Similarly, as it pertains to questions on FCI, Powell could also “disappoint” Equities too in the sense that I would expect him to counterbalance any (hope-based) “dovish” mention of recent Equities Volatility by simultaneously then-noting that more “economically important” Credit Spreads remain near both post COVID- and post GFC- “tights”…thereby downplaying the recent FCI tightening and proving-out that “it IS different this time” vs the 4Q18 / 1Q19 “Jerome bends the knee to markets” pivot

-

However, I will acknowledge that there are ABSOLUTELY “dovish hawk” (!) scenarios out there, particular relative to what market-pricing and expectations have been managed-to on the hiking-side

-

For instance: What if, theoretically, Powell signaled that despite with the March hike as a “lock,” he instead indicates that the current preference is for “just” 3 total hikes in ’22 as it stands now (with “openness” to consider 4), and that the Committee actually prefers balance-sheet adjustments instead of “more hikes,” with the usual “data dependent” (Inflation, Inflation Expectations, Wages) caveat?!

-

Despite most intellectually-honest folks realizing that the above hypothetical “dovish hawk” outcome would be outrageously counter-productive to the goal of reining-in “too loose” financial conditions, which have facilitated said excesses in markets / valuations as well as the need to try and crimp some of the “demand” impulse which too is feeding into inflation and thus ultimately HAS TO BE REVERSED by an escalation of Fed tightening as we move forward…HOWEVER, I am certain that Equities would rip higher on any “Dovish” Rates market “short squeeze” response as it relates to v hawkish FOMC expectations, with the added “crowded positioning” dynamic of 1) hawkish USTs / Rates trades and 2) large Equities underweights as fuel for unruly “reversal” moves higher in both (a.k.a. “Risk Parity Heaven”), in addition to a huge Vol market “upside kicker” in this case

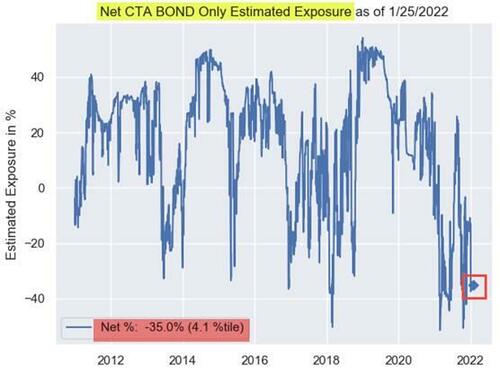

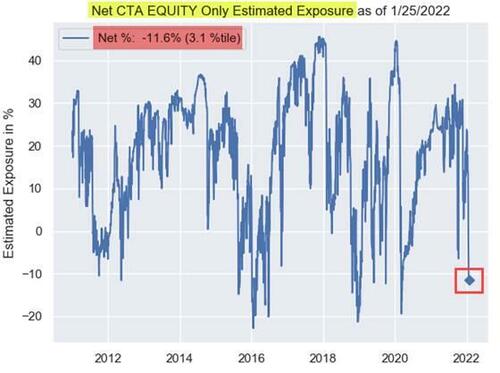

To this “crowding” point, a “dovish hawk” message would be a strong “reversal risk” vs current CTA Trend positioning, which as highlighted of late is almost consensually “short G10 Bonds & MMs” alongside “short Global Equities” futures—hence risking a “momentum” shock on any “not hawkish” or outright “dovish” squeeze…

Bond Positioning…

Equity Positioning…

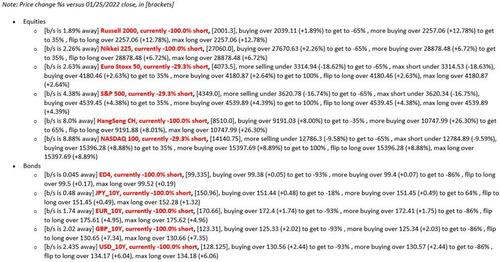

Here are the trigger levels for the next moves…

Source: Nomura

However, the larger upside “sling-shot” risk for Equities is that all of the aforementioned grab for “Crash-y downside” hedges seen Friday and Monday—which has ABSOLUTELY exacerbated the extreme “Negative Gamma” dynamic that has been throwing us from one side of the boat to another, with hedge flows “chasing” in both sell-offs and rallies—could finally allow for a “Vol Crush” IF we clear Fed with “no new hawkish surprises” or even a “dovish Hawk” message, and those Puts are precipitously unwound, sending Vol lower and forcing Dealers to buy-back hedges

The potential “virtuous” feedback loop for “higher Equities” on the impacts of iVol again “bleeding” lower are many:

-

VIX at 29 close yday roughly implies ~1.8% daily SPX change—which is a lot of movement to sustain

-

Vol is mean-reverting, thus my constant mention of the idea that high absolute levels of Vol tends to “collapse under its own weight,” heading lower as the market simply cannot consistently meet 1.8% daily change-type days over time, because exposure trimming and deleveraging from VaR management ultimately “clears” and more importantly, “rich vol” is sold / monetized

-

So IF markets were to clear Fed “event risk” with no new “hawkish surprises” today…or even get that “dovish hawk” scenario…. downside Puts / hedges should begin getting cratered and unwound, so this already very-high implied Vol is gonna come off / move lower

-

And this is the critical “Vanna” second-order impact, where lower iVol will see the Delta on those OTM Puts they’re short to clients then decrease—which means that options Dealers will have to cover some part of their “short hedges,” buying-back Futs and lifting the market in the process

-

With the market running higher and spot rallying further away from those downside strikes, you’ll get more covering, which too will see Vol drop even further, which incentivizes more hedge puking, rinse / repeat—hence “virtuous”

-

Additionally with a declining iVol dynamic, there is a + Gamma impact too as Gamma tends to get “longer” as Vol goes lower, which will then further act to reduce / reverse the recently hyperactive “Short Gamma” accelerant hedging flows and instead, act as a “stabilizing” cushion

Notably, these “bullish” scenarios are separate from the current “constructive / bullish” flows that we are seeing, which are:

1) “sell Put, buy Call / CS” Riskies variety in both Index / ETF and single-name; we are also seeing…

2) EM Call buying (25k EEM Mar 50 Calls for $0.88 and we saw a buyer of 36k ASHR Apr 40 Calls for $0.50) and…

3) Credit upside buying (LQD Feb 128.5/129.50 1×2 Call Spread 20k x 40k. We also saw a buyer of 5k LQD Apr 130 Calls delta-neutral) for the first time in a long while, on top of…

4) more ongoing “overwriter” flows selling “rich” optionality as traders get increasingly comfortable with “upside / downside” of the market here

(H/T Alex Kosoglyadov on aggregating these flows)

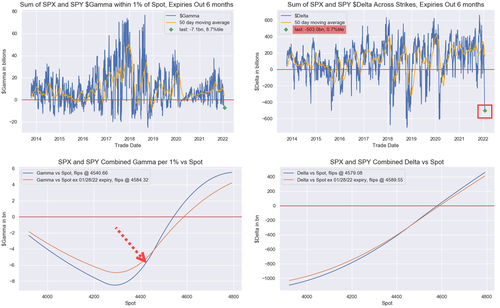

In the meantime, key Options metrics / levels for “the big two” SPX and Nasdaq:

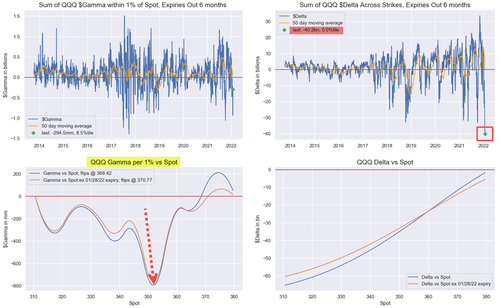

SPX / SPY $Gamma -$7.1B (8.7%ile), currently ~ -$6B per 1% move (ref 4415), “max short Gamma vs spot” at ~4300, Gamma “flip” up at 4540; Net $Delta is insanely Short / Negative at -$503.0B (0.7%ile), Delta flips positive up at 4589

Source: Nomura

QQQ $Gamma -$294.5mm (8.5%ile), currently ~ -$800mm per 1% move and currently at “max short Gamma vs spot” here at ~$352, Gamma “flip” up at $368.42; Net $Delta is “off the charts” Short / Negative at -$40.2B (0.0%ile)

Source: Nomura

Nevertheless despite this hypothetical Fed “dovish Hawk” reaction scenario above, the perverse thing is (and as mentioned yday) that the more bullishly that Equities- and Risk- trades, the more scope markets then have to price in more “hawkish” Fed action—i.e. a longer rope to hang ourselves with IF inflation stays sticky and the Fed simply is forced to “tighten FCI” more aggressively (either with more hikes, faster BS or both)—hence, this will remain a “traders’ market” as long as the we remain in a “tightening” regime

Tyler Durden

Wed, 01/26/2022 – 10:15

via ZeroHedge News https://ift.tt/3ICRocd Tyler Durden