FOMC Preview: What Wall Street Expects Will Happen

Submitted by Newsquawk

Summary

- Today’s FOMC is expected to be a signalling event for a March rate lift-off as the Fed’s asset purchases near a conclusion, while near-term Omicron headwinds are not expected to dissuade the Fed.

- Hawkish risks of an immediate conclusion to asset purchases are a possibility, but seem unlikely.

- Powell’s guidance on rate hikes will be used for clues around the amount of tightening expected in 2022 and beyond with markets currently pricing four 25bp hikes this year, and only two more in 2023.

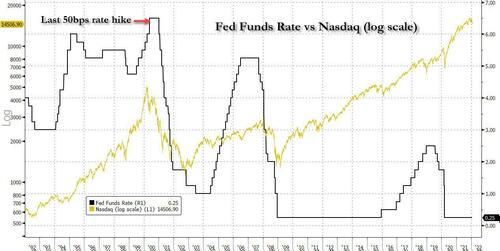

- Speculation around an initial 50bps hike is largely not expected to become a reality, although remains a tail risk likely dependent on inflation getting alarmingly further away from target.

- Guidance around the balance sheet runoff will also be eyed, with the rundown expected to begin around the middle of the year and at a faster pace than before.

2022 HIKE PATH: Bloomberg’s economist survey saw a majority of the 45 respondents predict this meeting to be used to telegraph a 25bp hike in March, although two look for a surprise 50bp hike (the largest since 2000); economists were evenly split between three and four hikes in total for 2022. Markets themselves have already priced in both a March hike and four hikes altogether this year. There have also been some eye-catching suggestions for as much as six or seven hikes this year from market participants, but really what that depends on is the inflation path. If price pressures continue to roar and long-term expectations become unanchored, the Fed will be forced to be more aggressive and making a high single digit number of hikes more likely; Fed’s Waller has said if inflation remains above 3% the Fed will have to rethink its strategy. However, the most likely outcome at this stage is three/four hikes, that being based on near-term full employment being met and an expectation that inflation comes further back down towards target heading through the year.

TERMINAL RATE: The December SEPs has the Fed’s median long run rate at 2.5% (also the highest that rates got to in the prior hiking cycle), with the range between 2.0-3.0%. However, the Eurodollar curve (proxy for forward Fed Funds) has flattened out at the end of 2023/early 2024 in the implied 1.50-1.75% target range region, which would mark six 25bp hikes over the next two years. The market has not fully priced the Fed’s forecast terminal rate, and it will be interesting to see how the Fed is viewing the divergence. JPMorgan’s strats opine, “we believe markets remain skeptical in the ability of central banks to fully normalize given risk of inflation pressure adjusting relatively quickly or economy responding negatively to the first few hikes”. But Morgan Stanley believes the market could adjust to the Fed’s target once/if it begins running down its balance sheet at a fast enough pace, as that would have a more notable curve steepening effect. Either way, the combination of the hiking path and the terminal rate are evolving key questions for markets now that lift-off has been established.

BALANCE SHEET: There remains a wild card of the Fed abruptly ending its asset purchases at the January meeting ahead of the existing March plan, although that seems not much more than speculation given Fed officials have not taken the opportunity to express an interest. We are looking to Powell’s presser for any guidance around balance sheet reduction. 29% of Bloomberg’s economists surveyed expect the runoff to occur between April and June and 40% from July to September. The median estimate looked for monthly reductions (caps) between USD 40-60bln, bringing the balance sheet down to USD 8.5tln by year-end from 8.8tln at present. Powell said at his renomination hearing that it will be discussed at the January meeting, but noted the balance sheet decision tends to take two to four meetings to work through. The Fed Chair also echoed the Dec FOMC minutes in saying the Fed would reduce its holdings sooner and faster than last time.

DATA: The January meeting is likely to echo recent commentary regarding expectations for poor activity data to start the year given the surge of the Omicron variant, but a return to stronger growth as that fades, and thus, not a reason to walk back on the removal of accommodation. Financial conditions remain very accommodative, that’s despite the latest turbulence in equity markets and more aggressive hike pricing, with the current real Fed Funds rate (deflated by core CPI) down beneath -5%. So as much as inflation remains hot, and to the extent that the Fed believes demand is accentuating the supply-driven pressures, there remains bandwidth for a significant amount of policy removal (hikes and balance sheet reduction) to bring financial conditions into more restrictive territory to reduce demand pressures.

Tyler Durden

Wed, 01/26/2022 – 12:54

via ZeroHedge News https://ift.tt/3u2vj2N Tyler Durden