Wall Street Banks Award Billions More In Bonuses To Top Earners

Regular Americans struggling to make ends meet as inflationary pressures drive prices higher on everything from fast food to cars to rent are seeing wages rising thanks to a labor crunch that we have discussed in more detail here. Unfortunately for many, rising wages still aren’t enough.

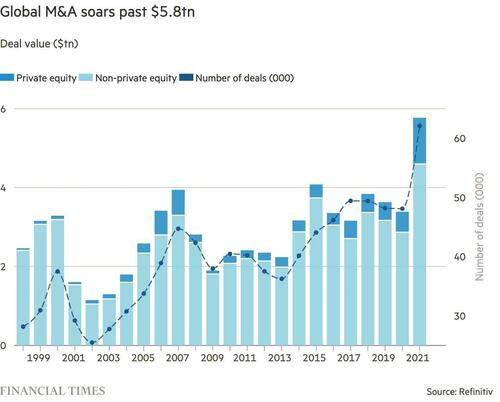

But bankers aren’t having that problem. From Wall Street to Europe and beyond, bankers have been lavished with massive bonuses following the dealmaking bonanza of the last two years. And over the last day or so, we have seen a flurry of headlines in the financial press touting new bonus packages at BofA, Deutsche Bank and Goldman.

Bloomberg reported yesterday that Bank of America had decided to take a $1 billion pool of company shares and use it to distribute bonuses to nearly all of the bank’s employees. 97% of the bank’s workforce is eligible:

The incentive, to come on top of regular compensation, goes to staff who earn as much as $500,000 a year, according to a memo from Chief Executive Officer Brian Moynihan. About 97% of the global workforce is eligible. This is the fifth year the firm has paid the compensation awards, which now total $3.3 billion, spokesman John Yiannacopoulos said.

“Our Sharing Success awards are one of many ways we invest in our teammates,” Moynihan wrote.

Each eligible employee will receive between 65 and 600 restricted stock units, based on compensation, according to the memo. Employees will be awarded the full value in March, and shares will vest in equal payments over four years starting in 2023. CNN previously reported the stock payment.

Meanwhile, a separate BBG report claimed Deutsche Bank was weighing a 15% hike in bonus payments as a “global talent war” continues. Unlike BofA, which is trying to spread the wealth across the bank’s vast workforce, DB’s boosted bonuses will likely be reserved for front-office investment bank staff. Those stuck in the back office might even see their pay drop.

DB’s generous bonuses are coming amid a a broader turnaround that has produced some of the bank’s first profitable quarters in years. However, it wasn’t that long ago that the ECB chided the bank to keep bonuses in check.

High bonuses for the investment bank, led by Mark Fedorcik, come as the division generated a pretax profit of 3.4 billion euros ($3.8 billion) in the first nine months of 2021 — almost double the amount achieved by the lender’s three other operating divisions combined. The unit is likely to continue playing an outsized role for Chief Executive Officer Christian Sewing even as trading activity is set to recede.

Sewing has said he wants to pay top performers “competitively” amid demand for investment banking talent that Fedorcik recently described in a Bloomberg interview as “the highest I’ve ever seen.”

That competition has led Wall Street rivals including Goldman Sachs Group Inc. and JPMorgan Chase & Co. to ratchet up bonuses and incur some of the highest expenses in years.

Goldman’s latest wave of bonuses will accrue to an even more rarefied group of bankers. BBG said that the Vampire Squid is preparing to reward 30 of its most senior leaders with generous equity packages designed to lock them in at the bank with vesting schedules and performance targets. Despite the relative perofrmance of its shares in recent months, GS has been doling out bonuses at the most generous pace in a decade.

It’s all about stemming “defections”.

The new equity awards will be doled out to members of Goldman’s management committee, its top decision-making body, according to people with knowledge of the plan. The packages are designed to cajole executives to stick around longer by putting them in line to unlock millions of dollars if the bank stock hits certain targets, the people said.

A spokesman for Goldman Sachs declined to comment on the new rewards. The new grants would be offered in place of the one-time, guaranteed stock award that’s been presented to other partners, one of the people said. It would be structured similar to the incentive awards announced in October for Chief Executive Officer David Solomon and his deputy, John Waldron, who aren’t included in this latest round of grants.

The measures are one way for the firm to try and stem defections from its leadership as Goldman mines record profits from its core Wall Street operations. But rising compensation costs are starting to give shareholders pause. Since the company posted annual results early this week, the stock has dropped almost 9%, with investors focused on a 33% jump in personnel expenses.

While Wall Street bankers enjoy the spoils of the M&A boom, employees at the world’s retail banks must settle for whatever overtime they can get. Although, in Ireland, a union of retail bankers has decided that it wants more from management. Instead of having to constantly squabble for raises, the Irish bankers are pushing for a deal that would grant them “inflation-proof” pay packages for the foreseeable future.

Union President John O’Connell said in a statement that this would be an appropriate reward following retail bankers’ courageous work during the pandemic.

Tyler Durden

Thu, 01/27/2022 – 07:00

via ZeroHedge News https://ift.tt/3u55Upa Tyler Durden