One Month After “Cash Is Trash”, Bridgewater Now Sees Stocks Crashing As Much As 20% More

Back in late November, when billionaire Bridgewater founder Dennis Gartman Ray Dalio issued his latest broken record prognostication that cash continues to be trash, telling CNBC that “cash is not a safe investment“…

… we reminded our readers that “Every single time dalio says “cash is trash” markets crash”

Every single time dalio says “cash is trash” markets crash

— zerohedge (@zerohedge) November 30, 2021

Just over a month later, this was (partially) confirmed when the Nasdaq and S&P entered a correction, and the Russell and most Asian markets tumbled into a bear market, down 20% from recent highs.

But instead of taking the L and quietly moving on – and no longer trying to predict the future when it clearly has no idea what will happen (or even what is going on right now) Bridgewater – which once was the feared giant of hedge funds and has since devolved into a bit of a comic sideshow – decided to take an already deep hole and make it much deeper when the firm’s co-CIO, Greg Jensen, predicted that stocks will drop as much as 20% more before the Fed bails out the market.

That’d put the S&P 500 below 3,500, or close to where it was before the Covid-19 pandemic began two years ago. The benchmark U.S. index closed Wednesday at 4,350.

The question of what the strike price of the Powell Fed Put (or, as some now speculate, Call) is, has obsessed Wall Street now that stocks have tumbled: after all an entire generation of “traders” has no idea how to trade a market without explicit Fed support. Of course, in retrospect it would have been much more useful to have this discussion a month ago before everything crashed (a discussion we held in mid-December as stocks were trading around 4800 in “As Markets Swing Wildly Seeking The Fed Put, Morgan Stanley Has Some Bad News“).

So not even two months after Dalio’s latest “cash is trash” effusion, Jensen “explained” that the Fed has little reason to halt the violent selloff that has savaged the most speculative stocks and spurred equity volatility to a 12-month high. On repeating tired and tried talking point, the co-CIO argues that with inflation in the U.S. is running at the hottest in four decades, labor is scarce and companies are building inventories because of supply-chain threats, the Fed will keep hiking (which it does so is anyone’s guess: after all, as we noted earlier and as even Powell recognizes, its actions have no impact on supply-driven inflation).

“Some decline in asset prices is not a bad thing from the Fed’s perspective, so they’re going to let it happen,” Jensen, 47, told Bloomberg in a Zoom interview. “At these levels, it would take a much bigger move to get the ‘Fed put’ into the money. They’re a long way from that.”

And so, the experts at the fund whose learned boss urged everyone to dump cash in November, are out with even more ludicrous predictions, and Jensen now says that it would take a drop of 15% to 20% more from here to alarm the central bank, and even that would depend on how fast the bottom falls out from under the market. So far, Jensen said, the decline over the past few weeks has been “mostly healthy” because it has “deflated some of the bubbles,” such as cryptocurrencies (incidentally, back in November, Dalio was also pitching cryptos, so… there’s also that).

Of course, judging by Bridgewater’s dismal track record in recent years, the increasingly frentic – and incorrect – forecasts are hardly new. They do however suggest that the $150 billion asset manager is starting at even more losses. As Bloomberg notes, “Jensen represents the house view at the world’s biggest hedge fund, with about $150 billion in assets. And in Bridgewater’s analysis, much of what has been happening lately is simply math: Asset prices were elevated by injections of “excess liquidity.” Now that policy makers are withdrawing that monetary stimulus, “there aren’t enough buyers to make up the difference,” Jensen said.”

The result is what he calls a “liquidity hole” affecting both stocks and bonds.

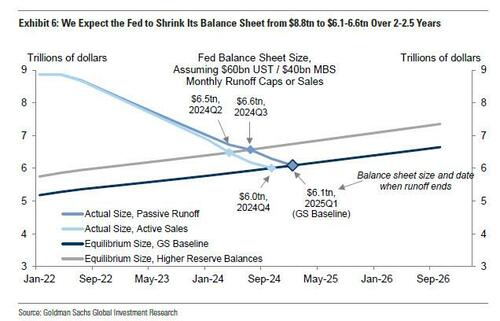

Well yeah… of course: a five year old can tell you that – it’s called the market discounting some $2.5 trillion in liquidity drainage.

However the actual question is how soon with everything break as the Fed sets off on this massive tightening experiment. Our bet: a few more rate hikes, a few months of QT and it will all be mercifully over as the Fed Put vigilantes make it clear that “this aggression will not stand” and after a brutal correction, the Fed will capitulate again, as it always does.

But that does not stop Jensen from plowing on with what is some of the most naive, rudimentary analysis we have seen from a person of this caliber. And instead of thinking ahead, Jensen extrapolates current conditions indefinitely – as if $90 oil is sustainable in this economy, and as if the US won’t slump into a recession at this rate now that Biden’s stimmies are all gone – and told Bloomberg that anyone who expects the Fed to blink, as it did after the last pre-pandemic selloff in late 2018, is misreading the economy: “Things were different then. Inflation was below the Fed’s 2% target and big companies were buying back shares instead of adding capacity, stockpiling supplies and raising wages.”

Jensen wasn’t all wrong, however: he did correctly pinpoint the genesis of the Fed’s relentless bubble-blowing skills:

“Since the 1980s, problems have always been solved by easing. That was true fiscally and monetarily, and the countries that eased more did better than the countries that eased less,” he said. “We’re at a turning point now and things will be much different.”

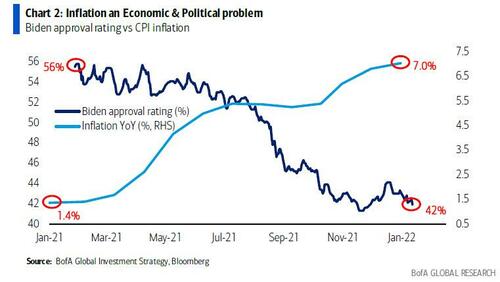

Echoing what we said months ago (when we alone amid an army of incompetent economists and sellside analysts said inflation was not transitory but was here to stay) Jensen said that for the first time since Paul Volcker’s Fed of the early 1980s, inflation has accelerated so fast it’s become a political issue and Biden may well be calling Powell daily to do something about the current climate which is devastating for Biden’s polls and democrats in general.

Powell, speaking to reporters after the Fed’s meeting on Wednesday, acknowledged the central bank may have to jack up borrowing costs faster than the market anticipated to stop prices from spiraling higher. Of course, all of that will change once the US economy contracts and/or enters a recession, an outcome which we anticipate can become reality in just a few months.

But not Jensen, who made the deep hole even deeper and said the 10-year Treasury yield has to reach 3.5% or even 4% – up from less than 1.9% today – before private investors are ready to absorb all the government debt that the Fed has been monetizing.

In that scenario, with Treasury prices set to decline further, bonds fail as a hedge against stocks and the traditional 60/40 balanced portfolio is useless as a diversification tool. Jensen said a 1970s-style “stagflation” playbook is more appropriate – echoing what we said months ago when we were mocked for this view – and investors need to increase their commodity holdings (such as pushing Exxon since 2020), trade out of U.S. stocks in favor of international equities and use breakevens to combat inflation.

“Expecting the environment to feel like it did over the past couple of decades is a big mistake,” he said,

And incidentally, Bridgewater is wrong again because no matter how bad stagflation gets, if it means sacrificing the markets, the Fed will pick throwing retail under the bus any time: the last thing Powell will dare to do is undo decades of “wealth effect” creation just to offset inflation which everyone knows will reverse in very short course on its own due to the three D: demographics, debt and disruption.

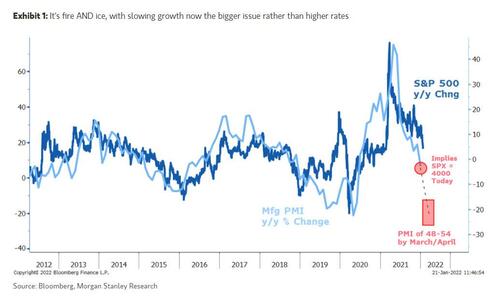

Incidentally, those wondering where the market will truly bottom should look to the latest note out of Morgan Stanley’s Michael Wilson who has been spot on in his bearishness so far: he sees a fair value for the S&P around 4,000 today and then sliding more unless the collapse in PMIs is contained, which it will be as the alternative is a recession.

Tyler Durden

Thu, 01/27/2022 – 11:10

via ZeroHedge News https://ift.tt/3g0EYP5 Tyler Durden