Solid, Stopping Through 7Y Auction Boosted By Surge In Direct Demand

After two stellar auctions, including a blockbuster 2Y and a record-beating 5Y earlier this week, moments ago the Treasury concluded the week’s coupon issuance when it sold $53BN in 7 year paper in yet another strong auction.

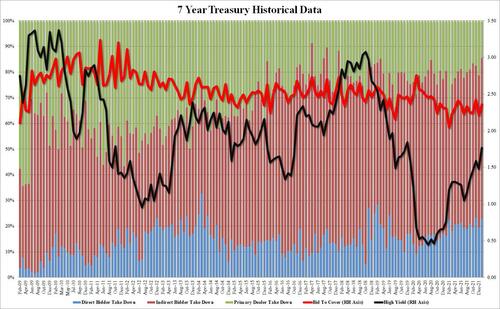

The high yield of 1.769% was the highest since December 2019, certainly higher than December’s 1.480% amid the current ongoing rate-hike panic, but stopped 0.1bps through the 1.770% When Issued, only the second stop through in the past 7 auctions, of which 5 tailed.

The bid to cover rose modestly from 2.21 in December to 2.36, which was above the recent six-auction average of 2.28, and despite the recent tightening frenzy, was high above “that” infamous 7Y auction in Feb 2021 when it tumbled to a record low of 2.045.

The internals were relatively unchanged, with Indirects posting a strong number, rising to 62.7% from 59.3%, above the recent average of 60.3%, and with Directs rising to 22.9%, Dealers ended up taking just 14.5%, the lowest since Feb 2018.

Overall, a solid if hardly remarkable auction, and the weakest of this week’s three coupon sales, although considering how strong the 2Y and 5Y sales were, this is hardly a criticism.

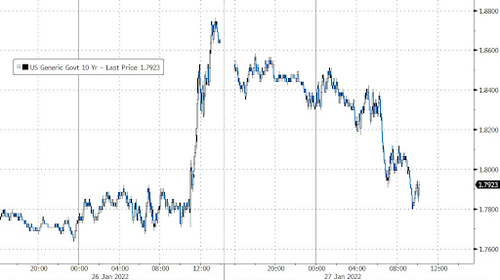

In response to the auction, the 10Y barely budged, trading just off the session lows.

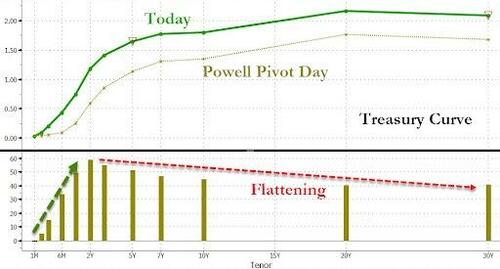

Finally, a reason to keep an eye on the 7Y for the rest of the day is to see if yields dip more: as of this moment, the 7s10s curve is just 2bps wide, and at the rate the curve is collapsing it will soon join the 20s30s in curve inversion.

Tyler Durden

Thu, 01/27/2022 – 13:19

via ZeroHedge News https://ift.tt/32DpePd Tyler Durden