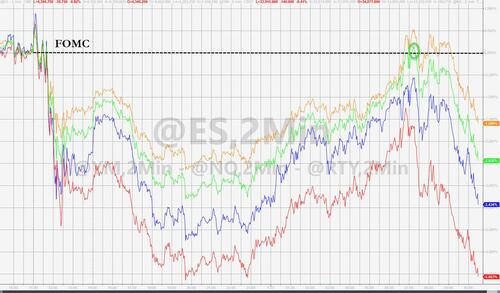

Stocks Are Puking To Post-Powell Lows, Yield Curve Is Collapsing

Having ramped overnight, seemingly on the usual nothing at all, the algos achieved ‘mission accomplished’ by getting the S&P green post-FOMC… but the moment the S&P peeked its head above water, the selling began and is now accelerating back to yesterday’s lows…

FundStrat warned earlier in the day that “the severity of Wednesday’s reversal in US stocks likely means a retest has begun, which should take SPX back down to test and even breach Monday 1/24/22’s lows …”

It appears the cash-market open also triggered selling as algos switched from futs…

Specifically, with regard S&P levels, FundStrat notes that “4287, .. if breached, should lead down to 4222 and then under 4180-4200 ..”

Meanwhile in bond-land, its crazytown as the yield curve flattens dramatically…

Simply put, The Fed has lost control.

Tyler Durden

Thu, 01/27/2022 – 13:38

via ZeroHedge News https://ift.tt/3rQEwIS Tyler Durden