JPMorgan: Not Enough Capitulation To Call A Bottom

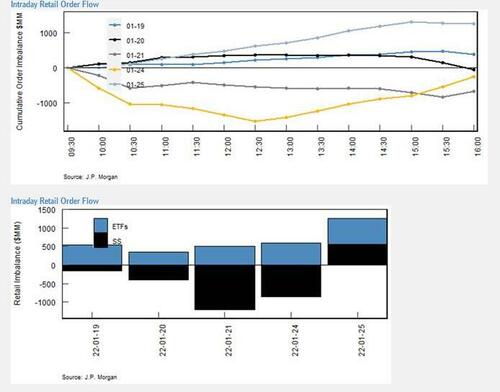

One day (and one week and one month) after JPM called again to buy the dip, at least one group inside the largest US bank – arguably the most important one – is getting cold feet on a quick bounce. As the bank’s trading desk writes this morning, while stocks reacted poorly to Powell’s unexpectedly hawkish comments, interestingly retail investors bought $1.69bn on the day: “this is the second most on record.”

This is a problem because it means that the market still refuses to capitulate and signal an all clear (see more below).

And while retail investors stubbornly continue to buy the dip, JPM also notes that it is still the case that “we hadn’t seen consistent signs of capitulation by HFs” and adds that it seems that there’s an impulse to buy the dip recently among a broad set of discretionary investors. “Given how much the market has declined recently, it does seem like we could see a bounce, but whether this is a sustainable rebound remains to be seen in our view.”

Here are JPMorgan Prime’s key points on recent flows:

- HF Flows – dip buying on Mon and Tues, post large selling on Fri:

- HFs bought the dip on Mon and Tues (just under +1z globally both days)

- Notionally, the biggest buying was in N. America (+1.4z on Mon and 1.2z on Tues). N. America buying on Tues was evenly split between longs added and short covered. L/S funds were net buyers on both days, although the majority of buying on Mon was short covering, while ~75% of buying yest came from longs added.

- EMEA also saw meaningful buying on Tues (+1.8z) following a week of neutral activity and most of the buying was due to longs added.

- In contrast, APAC saw selling increase on Tues (-2z) as flows reverse. Notably APAC had seen the largest acceleration in buying in late Dec and early Jan, but has seen flows turn much more negative as the broad indices have hit new lows (rather than just going back to early Oct levels like in NA or EMEA). The selling on Tues was mostly longs sold

- ETF Flows – turning more positive:

- Second day in a row of buying yest at about +2.8bn (vs. +1.4bn), after 7 days of net selling

- Note: these flows are based on a selection of broad index ETFs (e.g. SPY, IWM, QQQ) as well as sector ETFs (e.g. XLF, XLE)

- Retail Flows – reversal to buying (based on data from Peng Cheng, JPM QDS Research):

- Overall flows turned to >1Bn of net buying on Tues

- Notably, single-stocks saw net buying return (almost ~$500mm bought) vs. the selling of the prior 4 days

- Through Monday, single-stocks had been net sold for 4 days in a row. The 5d rolling net flows for single-stocks is at one of the most negative of the past 2 years…it only got a lot more negative in March 2020. Including ETFs, however, the 5d flows are still positive and the 20d are still very positive

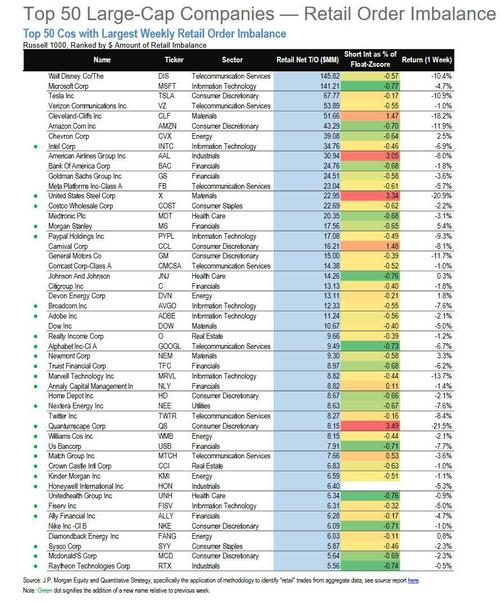

For those wondering what stocks retail is buying and selling, here is the answer: first the stocks with the largest retail order buy imbalance:

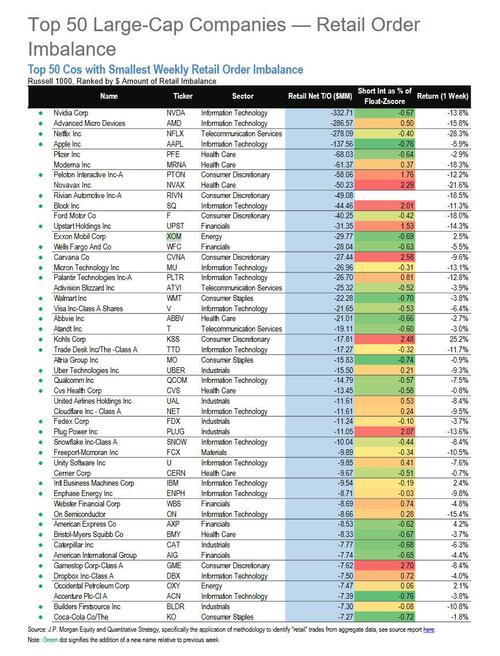

And here are the ones with the smallest:

Is the coast clear? According to JPM’s traders (and not its increasingly clueless sellside researchers who can only parrot “BTFD” every single week), given the set-up into the Fed and potential for earnings to be OK/better than feared, “it seems we could be in the rebound phase that often follows a large drawdown (i.e. nearly 10% or more).”

However, given the lack of strong capitulation, it is not yet clear to the bank whether this rebound should be any more than short-term and tactical in nature. In addition, how discretionary investors perform if there is a bounce over the next week or so could be critical.

Bottom line: “Given many have captured a large amount of the decline, if they don’t capture a lot of the rebound, it could continue to create risks.”

* * *

So what does this mean for stocks from here? According to JPM desk trader Andrew Tyler, one should buy the highest quality names “and we are seeing their bifurcation within the Tech sector, with FANG+ outperforming.” As for vol, it may remain elevated until we have liftoff at the Fed’s March 16 meeting.

Also, we should have seen Omicron dissipate in the US by that meeting as well as having completed this earnings season with the potential for positive pre-announcements/earnings revisions ahead of the April/May earnings period.

AS such, until March JPM advises clients to consider more of a market-neutral approach with a +high quality vs. –low quality within each sector of exposure. More broadly, the barbell trade (e.g. long FANG+, long Energy, long Metals/Miners, long Consumer Recovery, and long Transports vs. shorts in IG credit, Staples, and the SPX) feels like a prudent way to express risk, according to JPM.

Meanwhile, as the market moves toward a more fundamentally-driven approach, inflation concerns will dominate the 2022H1 narrative (at least until recession fears explode); but SPX companies have been able to weather these costs and 2021 was a year of at/near record margins. This may continue in 2022 as we see input costs decrease throughout the year, potentially more than offsetting any spikes to wage inflation.

Tyler Durden

Thu, 01/27/2022 – 14:59

via ZeroHedge News https://ift.tt/3o6Xg5Y Tyler Durden