Angry Stocks Come To Terms With Hawkish Fed As Yield Curve Screams ‘Policy Error’

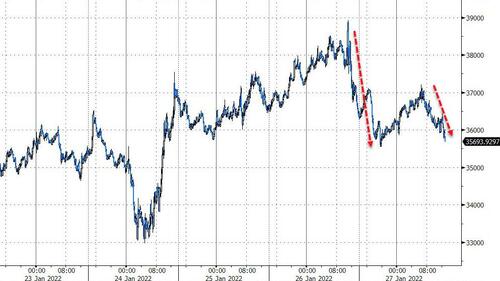

GDP “good news” appears to have been greeted as “bad news”, providing more cover for Powell to do what he said he would do with rates and QT… and while the algos lifted everything overnight, sellers appeared at the cash open and it was a one-way trip to yesterday’s lows (or worse) for the rest of the day. Small Caps are down 5% from pre-Fed, Nasdaq is down over 3%, and The Dow is down around 1% only

On the day, Small Caps are down over 2% in a massive whipsaw and The Dow is clinging to unchanged after swinging up and down 1000s of points…

Wonder how many of these meetings happened today… or are imminent…

NOTE that the moment the S&P managed to get back to even from pre-Fed, selling pressure built rapidly. Clearly, the algos were in stop-hunter mode…

The standard MO of crushing VIX to ignite momentum went into action but that ended rather badly for the vol-sellers this time…

The Russell 2000 closed (for the first time in this cycle) in bear market and the S&P is very close to closing in correction…

In other equity news, TSLA was clubbed like a baby seal after rallying on solid earnings last night (for context, that is one Ford in lost market cap)…

A year ago today, GME hit its record high at $483. Today it is down 80% from those highs… but still up over 350% from the pre-WSB-chaos levels…

Source: Bloomberg

Puts were heavily bid today relative to calls…

Source: Bloomberg

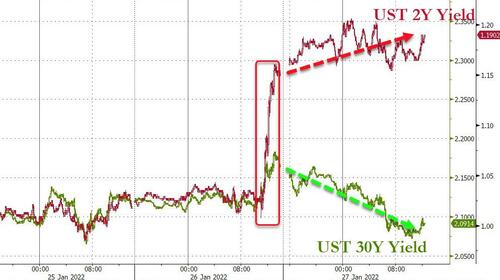

Treasuries were very mixed today with the long-end heavily bid and massively outperforming as the short-end adjusted for The Fed’s more hawkish rate trajectory…

Source: Bloomberg

For context, this is massive shift in the curve’s correlation regime with a huge flattening screaming at a Fed Policy Error being imminent…

Source: Bloomberg

2s30s utterly imploded today after yesterday’s very brief steepening…

Source: Bloomberg

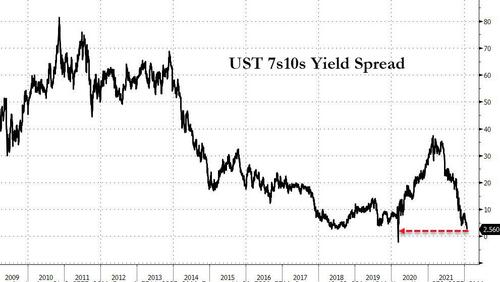

The 7s10s curve is on the brink of inverting (joining the 20s30s segment of the curve which has been inverted for 3 months). Bear in mind, apart from 3/9/2020, the 7s10s spread has not closed flatter than this…

Source: Bloomberg

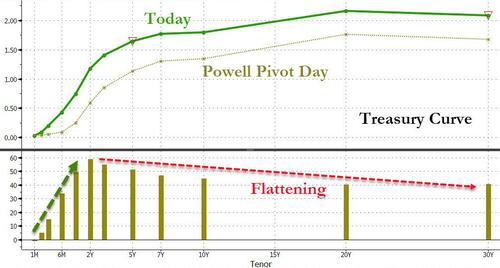

In fact, the yield curve has been flattening from the 2Y maturity out since Powell’s Pivot in late November…

Source: Bloomberg

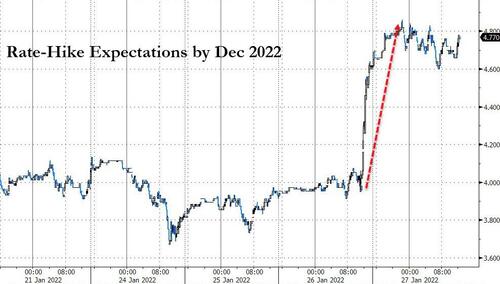

The short-end is now pricing an 80% chance of a 5th rate-hike by Dec 2022… (and a 25% chance of a 50bps hike in March)

Source: Bloomberg

Bitcoin slipped back below $36k…

Source: Bloomberg

Gold puked to $1800 amid hawkish Fed speak but buyers reappeared. However, as stocks started breaking down and rate-hike odds lifted, gold tanked back below $1800…

WTI fell back below $87 at today’s settle…

NatGas futures had a ‘moment’ into expiration today with the Feb 22 contract exploding over 50% higher into its close…

That’s quite a squeeze into contract expiration…

Finally, just like the overnight ramp last night reassured many dip-buyers, investor sentiment is at historically pessimistic levels…

Investor sentiment is at historic pessimism.

Worse than MARCH 2020.

Worse than DECEMBER 2018.

Even in 2008 – similar spikes led to violent Bear Market rallies.

And lastly – when investors finally got this negative, the 2000-2002 Tech Crash was *over*. pic.twitter.com/o1fhONVIHC

— Macro Charts (@MacroCharts) January 27, 2022

For some clarity on what just happened, where we are, and what happens next Brent Kochuba from SpotGamma and Darius Dale from ’42 Macro’ break down macro implications of The Fed Meeting and analyze the options markets impact…

Tyler Durden

Thu, 01/27/2022 – 16:00

via ZeroHedge News https://ift.tt/3IIKPVB Tyler Durden