Inflation Comes For Your Closet: Cotton Prices Hit Decade High Amid Global Deficit

The global fashion industry is on the rebound as BMO Capital boosted Under Armour’s rating to Outperform from Sector Perform. Fashion retailers breathe a sigh of relief as demand picks up but comes at a high price for consumers.

This year, about two-thirds of fashion executives expect to increase costs due to snarled supply chains. Average prices are expected to rise about 3% across all clothing and apparel, according to the State of Fashion 2022 report by the Business of Fashion and McKinsey & Co.

About 15% of respondents said clothing and apparel prices could jump by more than 10%.

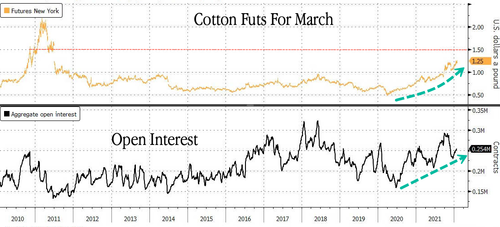

Inflation in fashion hasn’t just been due to transportation bottlenecks and rising shipping costs but also rocketing commodity prices. Bloomberg reports cotton futures have soared to a decade high on Monday due to a “global deficit of the fiber squeezing mills holding huge short positions.”

March cotton futures in New York rose as much as 2% to $1.26 per pound, the highest since June 2011. Prices are up for the seventh straight quarter, the longest streak since 1959.

“Supply disruptions and soaring costs pushed the industry to draw on stockpiles, which have practically vanished at ICE Futures U.S., with higher prices unable to lure supplies into the exchange-tracked warehouses,” Bloomberg said.

High prices for the fiber indicate inflation is coming to shirts, blue jeans, dresses, sweats, and so much more.

Demand for cotton worldwide “is simply not being met,” said O.A. Cleveland, a consultant and professor emeritus at Mississippi State University.

“Industry group Cotlook on Friday shifted its global outlook for 2021-22 back to a deficit, the second shortfall in a row, citing diminished production in top exporter U.S. and India. More plantings in the coming season have been put into question by soaring costs for crop inputs including fertilizer,” Bloomberg continued.

Cleveland said the cotton dynamics are “extremely bullish,” and the “last time I recalled such a situation, I stopped forecasting futures prices once the market reached $1.50 a pound. Will the May or July futures price ascend to such a level? I do not know. This is a no man’s land.”

It’s still unclear how consumers will act when their favorite clothing brand prices continue to rise. But since clothes are considered discretionary spending, there will be a point where consumers will buy fewer of them due to higher prices.

Tyler Durden

Mon, 01/31/2022 – 20:40

via ZeroHedge News https://ift.tt/Dm7fKpVR0 Tyler Durden