Goldman Slashes 2022 GDP Forecast Again, Warns Of “Sharp Deceleration” In Growth”

Two months after we warned that the Fed is hiking into a recession, The downgrades of the US economy are now coming in fast and furious.

What time is Jean-Claude Trichet speaking to explain why the Fed is hiking rates into a recession

— zerohedge (@zerohedge) December 2, 2021

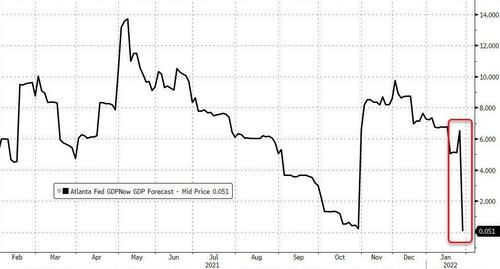

One day after Goldman raised its Fed funds forecast from 4 to 5 rate hikes in 2022, the bank did what it had done on at least 4 previous occasions in the past 3 months: it cut its US GDP forecast for both Q1 and the full year, perhaps prompted by a similar action by JPMorgan on Friday as well as the Atlanta Fed which as a reminder now sees the US economy “growing” at just 0.1% in the first quarter.

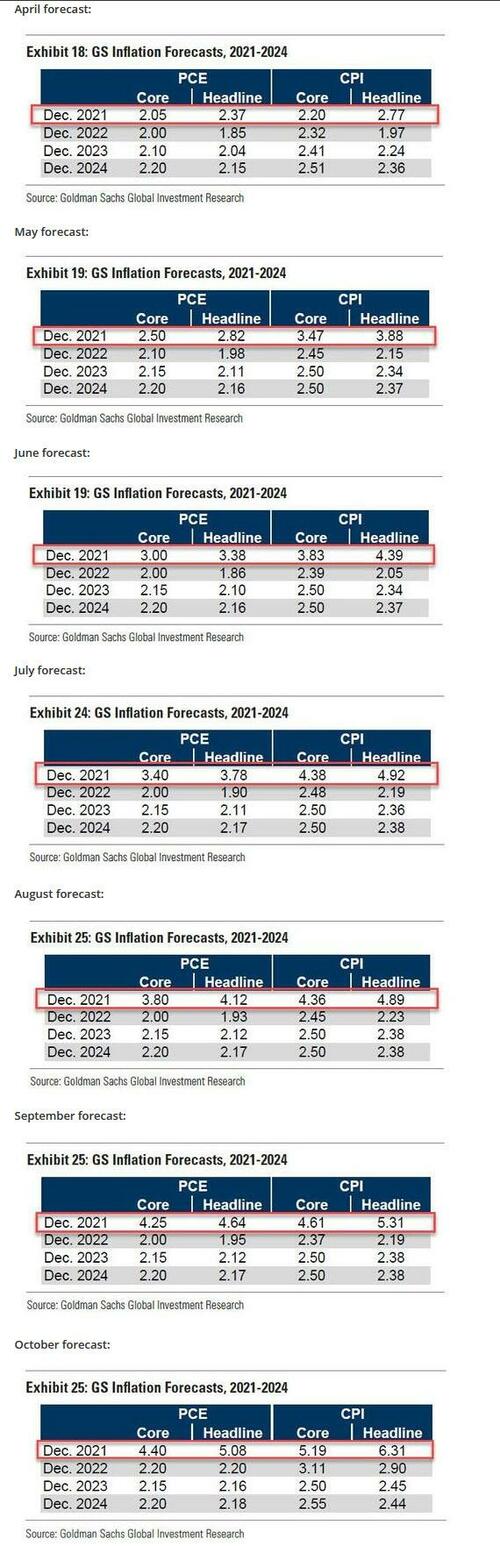

Of course, this should not come as a surprise: Goldman’s economics team has been atrocious in its forecasts over the past year (similar to the “inflation is transitory” Fed), not just when it comes to inflation, where the bank increased its year-end 2021 CPI forecast by 0.4% every single month starting in April of last year…

… but also when it comes to being overly optimistic about the state of the US economy, to wit:

- Jul 26, 2021: Goldman Sees Sharp Deceleration In US Economic Growth In 2022

- Aug 17, 2021: US Economic Growth Suddenly Collapses, As Even Goldman Says “Not Good”

- Aug 18, 2021: Here Comes Stagflation: Goldman Slashes GDP Estimate For Second Time In 3 Weeks, Sees “Bigger Inflation Surge”

- Sept 6, 202: Goldman Cuts Its US GDP Forecast For The Third Time In The Past Month

- Oct 10, 2021: Goldman Slashes 2021, 2022 GDP Forecasts Again, Blames Fiscal Drag, Slowing Consumer Spending

- Dec 4, 2021: Goldman Cuts GDP Forecast Due To Omicron, Setting The Stage For More Central Banks Stimulus

You get the picture. It was in one of these multiple GDP cuts where we said that while it remains to be seen just how positive the impact from reopenings will be “one area where we disagree profoundly with Goldman is the bank’s generous modeling of an upside boost to growth from “pent-up savings” which the bank expects to offset a substantial portion of the fiscal hit… The excess savings – in as much as they still exist – mostly benefit the top 1%, with the bulk of the population benefiting from only 30% of the total accumulated amount. As such the contribution to consumption from excess savings will end up being far smaller than most Wall Street strategists predict (since the propensity of the top 1% to spend their savings which are instead invested in the market, is far less than the broader population). The result: expect even more aggressive cuts to GDP growth in coming quarters – from both Goldman and its peers – even as inflation continues to rise, cementing a painful period of non-transitory stagflation for the US as the mid-term elections approach.”

Just a few weeks later, our bearish take was once again validated to the detriment of Goldman’s predictive acumen, when today the Vampire Squid admitted that it had greatly overestimated the spending capacity of the US households – that key driver behind 70% of US GDP – when in a note from Goldman’s econ team, the bank wrote that after last week’s GDP report which saw the US economy grow at the fastest annual pace since the 1980s, “growth is likely to slow abruptly in 2022, as fiscal support fades and, in the near-term, virus spread weighs on services spending and prolongs supply chain disruption.”

Specifically, the bank slashed its Q1 GDP forecast from 2.0% to just 0.5%, and while the bank fudged the other quarters modestly higher, it lowered its 2022 annual average GDP forecast by 0.2% to +3.2% (vs. +3.8% consensus) while warning that “the annual average masks the sharp deceleration in growth from 2021 into 2022, which is better captured by the 2022 Q4/Q4 rate, which we now expect will be +2.2% (previously +2.4%).”

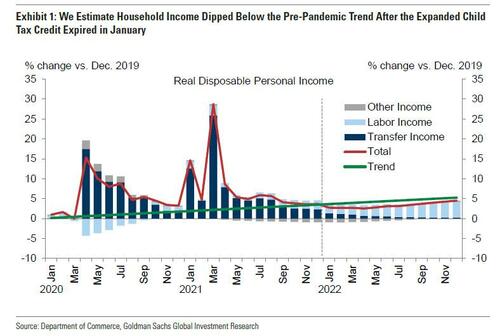

And while Goldman has yet to admit that the significant contribution to GDP from “pent up savings” will prove to be the latest fiasco by one of the country’s most respected economist teams, it had conceded that growth in 2022 will be fast slower due to three key reasons: i) the lack of extended stimmies, in this case the expiration of child tax credits; ii) drop in service spending due to the Omicron panic and iii) continued supply-chain disruptions of domestic production, which will weigh on inventory accumulation and exports in Q1.

Some more details on these three factors:

- 1. Fiscal Impulse slowing: Goldman calculates that fiscal support boosted real disposable income to 5% above the pre-pandemic trend on average in 2021, but following the lapse of the expanded child tax credit this month, disposable income has likely dipped below trend and will remain an average of 1% below the pre-pandemic trend in2022—even after penciling in strong gains in labor income. As Goldman’s Jan Hatzius writes, “this decline should weigh on consumer spending—and is a large part of why we expect growth to slow to only slightly above potential by the end of the year—but the impact should be cushioned by spending of excess savings built up during the pandemic that still total nearly $2½ tn.“

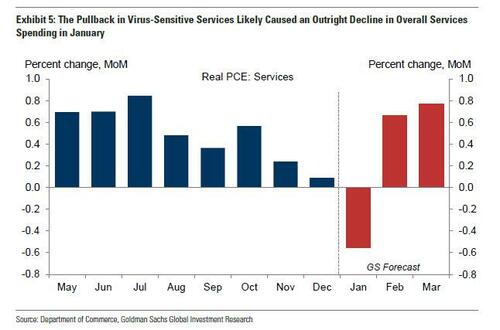

- 2. Omicron hit to service spending. Goldman writes that Q1 growth is likely to be particularly soft because the fiscal drag will be accompanied by a hit from Omicron: “High frequency data indicate that spending on virus-sensitive services has declined sharply since early December, and overall real services spending declined by 0.6% in January.” The good news is that the rebound from Omicron is expected to be quick, and the bank estimates that consumption will grow at a modest 1.5% annualized pace in Q1.

3. Continued supply-chain disruptions. Virus spread has also hit the supply side of the economy, according to Goldman which notes that “worker absenteeism appears to have peaked at 3.5% of the adult population in early January, and renewed foreign virus restrictions will likely prolong supply chain disruptions and interrupt domestic production. This is likely to weigh on inventory accumulation and exports in Q1.”

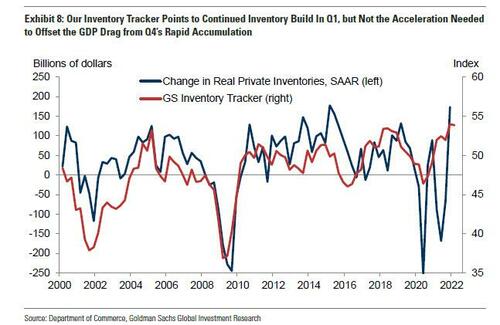

The lack of continued inventory restocking will also hit Q1 GDP, as we said after last week’s GDP report. According to Goldman’s estimate, Q1 will see +$65bn (annualized) in inventory growth (vs. +$173bn in Q4), which would subtract 2% from Q1 GDP growth. This reflects an expected drawdown in auto inventories based on production schedules and recent company commentary. The bank also assumes moderately slower growth in broader manufacturing and trade inventories, in part because Omicron has already caused a disruptive wave of worker absenteeism in the US and threatens to be more disruptive abroad, especially in China.

Putting it all together, Goldman writes that it “lowered our Q1 GDP forecast by 1.5pp to +0.5% (qoq)—mainly reflecting our expectation for a large negative contribution from the inventories component of GDP—and we have nudged up our Q2 forecast by ½pp to +3.5%, which will benefit from the post-Omicron rebound. We have raised Q3 slightly to +3% (from +2.75%) and left Q4 unchanged (at +2.0%), which lowers our 2022 annual average GDP forecast by 0.2pp to +3.2% (vs. +3.8% consensus). However, the annual average masks the sharp deceleration in growth from 2021 into 2022, which is better captured by the 2022 Q4/Q4 rate, which we now expect will be +2.2% (previously +2.4%).”

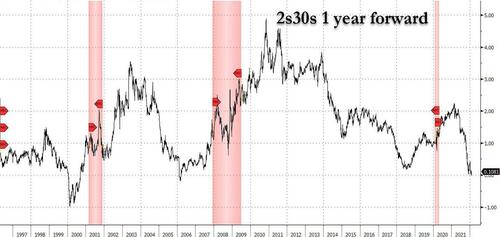

Ironically, despite this admission that all of its previous rosy growth forecasts were wrong, and that the US is facing a “sharp deceleration” in growth, the bank raised its forecast for the total number of Fed rate hikes in 2022 to 5. Needless to say, something will give – either the US economy will have to grow much faster, or the Fed will have to capitulate in a few months and pivot dovishly away from its aggressive tightening path which will send the US into recession, something which the bond market is already saying is virtually certainly.

And since the US economy will not find some deus ex engine for faster growth, the Fed is facing two stark choices as Morgan Stanley explained yesterday: a recession or years of very high inflation.

Tyler Durden

Mon, 01/31/2022 – 22:00

via ZeroHedge News https://ift.tt/fJXlzgdDO Tyler Durden