Hedge Fund Trade That Blew Up The Repo Market Is Making A Comeback

A popular hedge fund trade – known as the Treasury Basis Trade which, reminiscent of what LTCM did back in the day seeks to profit from minuscule differences between prices in the futures and cash markets for Treasuries by using massive amounts of borrowed money – is set to make a comeback as the Federal Reserve plots to shrink its footprint in the U.S. Treasury market, even though it nearly blew up the financial world in late 2019.

The strategy, which as we explained in detail most recently here, involves taking leveraged positions in Treasury notes and bonds in order to exploit price differences with the corresponding futures contracts, backfired both in Sept 2019 (leading to the repo market crisis which ushered in the Fed’s “NOT QE” phase of reserve replenishment) as well as the March 2020 liquidity crisis, when the normal relationships between cash and futures broke down completely.

Since then, the Fed’s relentless and gigantic buying of Treasury notes and bonds had stripped the volatility out of the cash-futures relationship, while also bidding up the value of the older Treasuries normally used in basis trades, effectively eliminating any monetizable arb in the basis trade.

But that is changing, and with the Fed set to end QE by March (until the next crisis that is) and to start QT later this year, arbitrage opportunities are set to return, Citigroup strategists Raghav Datla and Jason Williams said in a note late Friday, according to Bloomberg.

The policy shift “should remove the dampening effect that Fed purchases had on the futures net-basis” and yield relationships between older and new Treasuries, they wrote. Also, financing rates for Treasuries should rise “and drive more dislocations in cash/futures markets.”

In short: the trade that prompted the Fed to step in in 2019 and 2020 and bail out countless hedge funds (as we explained in “The Fed Was Suddenly Facing Multiple LTCMs”: An Explanation Of What Really Happened On Repocalypse Day“), is about to come back with a vengeance precisely because the Fed is about to step away and allow markets to return to normal.

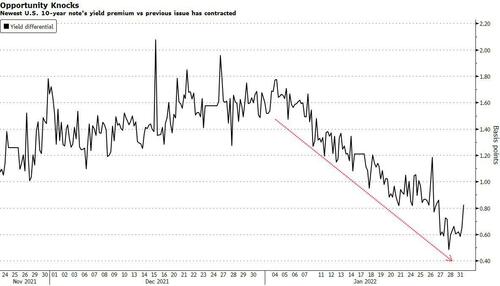

Sure enough, as shown in the chart below, since the start of the year, the yield differential between the newest 10-year note maturing in November 2031 and the second-newest, maturing three months earlier in August 2031, has shrunk. The older note’s yield is lower, but by a smaller margin than previously. That trend should continue as the increased supply of Treasuries in private hands leads to higher financing rates, the Citi strategists said.

As for the futures basis, it remains depressed for now despite strong investor demand for Treasury futures. The latest weekly CFTC data showed asset managers were net long almost 1.5 million five-year note contracts, near the highest level of the past two years. Expect this to change as well in coming weeks as the Fed’s footprints in the bond market fade leaving the bond market to crash at its leisure now that the buyer of first resort has stepped away if only until the next market crash.

Tyler Durden

Mon, 01/31/2022 – 22:20

via ZeroHedge News https://ift.tt/a2oO4GPEg Tyler Durden