Still Extreme Levels Of ‘Ridiculousness’

Authored by Jesse Felder via TheFelderReport.com,

Despite the strong two-day rally to finish the month, January was the worst start to the year for the Nasdaq (down 19% peak to trough) since 2008.

And if not for that two-day rally, it would have been the worst start for the Nasdaq ever – and ever, as they say, is a very long time.

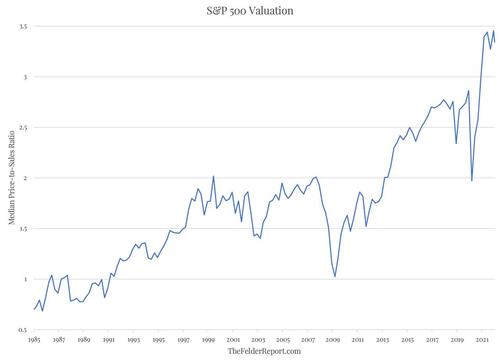

As a result, you might have thought that the decline would have made some progress in normalizing valuations but you would have been wrong.

The median stock in the S&P 500 Index is still roughly 20% more expensive than it was pre-pandemic and 70% more expensive than at the peak of the DotCom Mania in 2000.

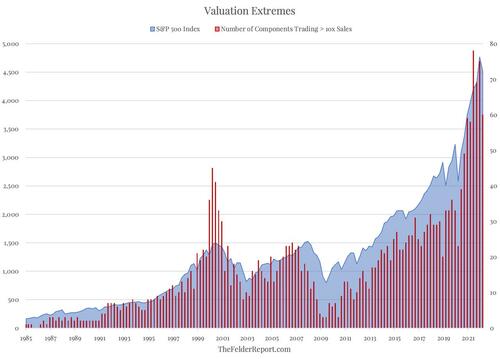

Moreover, there are still 60 stocks in the S&P 500 Index that trade at more than 10-times sales.

During the depths of the Dotcom bust (almost exactly twenty years ago) after witnessing his own stock price plunge by more than 90%, Sun Microsystem’s Scott McNealy famously suggested this degree of overvaluation was “ridiculous.”

By then, the number of stocks trading above this hurdle had fallen from a peak of almost 50 to about a dozen.

So if we are now seeing another bust in the most speculative segments of the stock market, it would appear it still has quite a ways to go.

Tyler Durden

Sat, 02/05/2022 – 11:29

via ZeroHedge News https://ift.tt/LlHGTqu Tyler Durden