Futures, Global Markets Jump As Bond Rout Eases

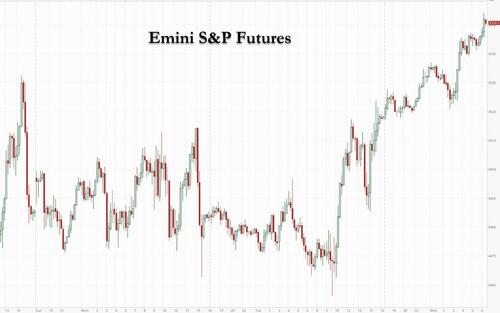

U.S. index futures jumped along with Asian and European markets, while the VIX declined for a fourth consecutive day, setting up Wall Street for a strong open as bond markets stabilized bringing some respite for markets whipsawed in recent weeks by concerns about tightening monetary policy. As of 730am ET, S&P emini futures rose 38 points or 0.84%, while Nasdaq futures were up 1.3% or 187 points, while Dow futures were up 0.60% or 215 points. The 10-year U.S. Treasury yield retreated from levels last seen in 2019, dropping from 1.97% at their high yesterday to 1.92%, and yields across Europe also fell after France’s central banker said markets may be getting ahead of themselves in pricing rate hikes for this year. A dollar gauge slipped and cryptos jumped.

Much of today’s rally is the result of Bank of France Governor Villeroy pushing back against market pricing yesterday, which suggests that there are indeed limits to just how far central banks are willing to be pushed by traders’ expectations. Still, despite today’s stabilization, the risk of market swings remains elevated ahead of U.S. inflation data on Thursday, with investors facing a likely “irreversible hawkish shift” by major central banks, according to Ipek Ozkardeskaya, an analyst at Swissquote. “The choppy trading is here to stay,” she said.

Investors are weighing up still-robust corporate earnings against worries about a rapid withdrawal of pandemic-era stimulus. Data this week is expected to show U.S. inflation continues to overheat, potentially stoking bets on a more aggressive Fed liftoff in March. About 76% of S&P 500 firms that have reported results beat earnings estimates, with profits coming in more than 6% above projected levels.

“We’re still in an environment where a lot is going quite well for the economy,” Lauren Goodwin, a multi-asset portfolio strategist at New York Life Investments, said on Bloomberg Television. “It’s still an all-cyclicals story from our perspective.”

Peloton shares rose 4.5% in premarket trading, extending this week’s bounce amid renewed speculation that the fitness company could become a takeover target, and following news that CEO John Foley will step down. Lyft dropped 4.4% as the number of reported active riders missed analyst expectations. Some other notable premarket movers:

- Alibaba (BABA US) could be active in U.S. trading after shares in Hong Kong jumped as SoftBank Group Corp. said it wasn’t involved in the Chinese tech giant’s filing of additional American depositary shares, allaying investor fears that the firm’s largest shareholder might be looking to cash out.

- Lyft (LYFT US) fell 4.7% after reporting mixed results on Tuesday, underlining Covid pressures on ridership and growth. Still, it reported revenue for the fourth quarter that beat the average estimate. Analysts focused on positive trends for 2022, and see light at the end of the omicron tunnel.

- Enphase Energy (ENPH US) gains as much as 19% in premarket trading after the solar company’s first-quarter revenue forecast beat the average analyst estimate.

- Chipotle Mexican Grill (CMG US) jumped in postmarket trading after it reported sales that topped estimates as smoked brisket, strong delivery orders and higher prices helped results in the fourth quarter.

- GlobalFoundries (GFS US) gained 4% postmarket after the semiconductor manufacturer’s first-quarter revenue and Ebitda forecast beat the average analyst estimate.

- New Relic (NEWR US) shares slumped 23% in extended trading on Tuesday, after the application software company reported its third-quarter results and gave an outlook where it widened its view for an adjusted full-year loss per share.

- Mandiant (MNDT US) rises 3.9% in premarket trading following an 18% surge on Tuesday after Bloomberg reported Microsoft is in talks to acquire the cybersecurity company. Mandiant also reported quarterly earnings after the close.

- Gevo (GEVO US) is within months of hitting a potential inflection point in its cash flow profile, Citi writes in note initiating on stock with a buy rating and $5 target. Stock climbs 7.6% premarket.

- Sundial Growers (SNDL US) shares climb 9.5% in extended trading after the Canadian cannabis producer said it has received a 180-day extension to regain compliance with Nasdaq’s minimum bid price requirement.

- NCR (NCR US) shares jumped 11% in postmarket trading on Tuesday, after the company said it has launched a board-led strategic review process to evaluate a full range of strategic alternatives available.

- Paycom Software (PAYC US) shares climbed 8% in extended trading on Tuesday, after the company reported fourth-quarter results that beat expectations and gave a full-year forecast that was ahead of the analyst consensus.

- XPO Logistics (XPO US) gained 3.4% in extended trading after the transportation services company forecast adjusted earnings per share for 2022 that beat the average analyst estimate.

- Adtalem Global Education (ATGE US) shares tumbled in extended trading after the company lowered its full-year forecasts for adjusted revenue and earnings per share.

In Europe, the Stoxx Europe 600 Index rose 1.5% as technology shares bounced back and carmakers surged. A raft of mostly positive earnings reports lifted sentiment. Adyen NV jumped more than 11% after the Dutch online-payments company reported second-half revenue growth that met analysts’ estimates. Amundi SA, Europe’s largest asset manager, climbed the most in a year after raking in more client cash than analysts’ expectations. Banks underperformed after disappointing results from ABN Amro Bank NV and Svenska Handelsbanken AB. Here are some of the biggest European movers today:

- Adyen shares jump as much as 12% after the payments firm reported second-half net revenue in line with estimates and volumes that beat expectations. While analysts said the results were mixed, they are “enough,” given a negative buy-side view into earnings, Jefferies says.

- Banco BPM gains as much as 6.7% after results from the Italian lender which Citi says highlight a “profound transformation.”

- Pandora shares rise as much as 8.2% after the Danish jewelry maker reported results and provided guidance for the year. The forecast seems realistic, according to Citi.

- Menzies shares gain as much as 42% to 475p after it rejected a preliminary and unsolicited 510p/share proposal from a unit of Agility Public Warehousing.

- Vontobel shares jump as much as 8% after FY earnings exceed estimates and as the Swiss bank raised its dividend. The driving force behind the beat was the digital investing division, ZKB says.

- GlaxoSmithKline shares fell as much as 1.4% after 4Q earnings. Jefferies says the company’s 2022 outlook was “as expected.” Citi says results and guidance “will do little to change investor sentiment.”

- Transport giant DSV A/S said operating profit doubled in the fourth quarter, helped by rising freight rates and its most recent acquisition.

- Equinor ASA, Europe’s second-largest supplier of natural gas, boosted its share buyback and increased the dividend after profiting from a surge in prices for the fuel.

Asian equities jumped the most since Jan. 12 to snap a two-day slide, boosted by Chinese tech shares including Alibaba Group Holding Ltd. The MSCI Asia Pacific Index advanced as much as 1.5% to a two-week high, helped by Japan and a rally in a Hong Kong technology index with consumer-discretionary shares also gaining. Alibaba was the biggest contributor to the Hang Seng Index, which jumped 2.1% to lead Asian benchmarks, after SoftBank Group Corp. said it wasn’t involved in the Chinese e-commerce firm’s filing of additional American depositary shares. China’s broader market also rose after state-backed funds’ intervention helped stage a strong recovery late in Tuesday’s session.

“Now it comes to the point where people will start to focus on economics and corporate earnings growth,” said Eva Lee, the head of Greater China equities at UBS Global Wealth Management Chief Investment Office. “Upward revisions of earnings will be a crucial signpost that we’ll be looking for.” Investors will focus on key U.S. inflation data on Thursday that could impact the outlook for future U.S. rates. Market participants will also keep an eye on central bank policy decisions this week, including those in India and Indonesia

Japanese equities rose, driven by gains in electronics and auto makers after the yen weakened. Service providers also boosted the Topix, which gained 0.9%. SoftBank was the largest contributor to a 0.9% rise in the Nikkei 225 after reporting results and confirming plans for an Arm IPO. The yen gained slightly after dropping 0.4% against the dollar overnight. “U.S. rate hike expectations have been priced in somewhat by now,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management. “So there are going to be fewer situations where we see big selloffs triggered by rate-hike worries.”

Indian stocks gained for second straight session as automobile and banking companies rose on expectations that the monetary policy panel will keep benchmark interest rates unchanged to focus on growth. The S&P BSE Sensex climbed 1.1% to 58,465.97 in Mumbai, while the NSE Nifty 50 Index advanced by a similar measure. Eighteen of the 19 sector sub-indexes compiled by BSE Ltd. climbed, led by a gauge of automobile companies. The Reserve Bank of India’s monetary policy panel will conclude its three-day meeting on Thursday. All but one of the 39 economists surveyed by Bloomberg News expect the main repurchase rate to be held steady at 4%. Consumer prices in India rose for a third straight month in December. But the headline number is still within with the central bank’s 2%-6% target band, which allows policy makers the room to look away as some global peers lift rates to fight inflation. HDFC Bank contributed the most to the Sensex, increasing 2.5%. Carmaker Maruti Suzuki was the top gainer at 4.1%, its biggest surge since Jan. 25. Out of 30 shares in the Sensex index, 27 rose and 3 fell.

In rates, Treasury futures advanced paced by European bond rally after ECB policy makers pushed back on rate-hike expectations. Yields are richer by 2bp to 4bp across the curve led by intermediates, 10-year is down 3bps to 1.92%, flattening 2s10s by more than 1bp. Treasuries advance erodes outright concession for 10-year new-issue auction at 1pm ET. Fed speakers include Bowman and Mester. Auction cycle continues with $37b 10-year note, following strong demand for Tuesday’s 3-year sale, in which primary dealers were awarded record low share; cycle concludes Thursday with $23b 30-year new issue.

In FX, the Bloomberg Dollar Spot Index slipped as the greenback traded weaker against all of its Group-of-10 peers, with risk-sensitive currencies performing best. Benchmark Treasury yields fell up to 4bps, led by the long end as they halted a four-day rise. The euro bounced after a day low of $1.1403; yields across Europe fell after France’s central banker yesterday said markets may be getting ahead of themselves in pricing rate hikes for this year. Gilts rallied as traders pared their bets on Bank of England rate hikes, while the pound gained against a weaker dollar. Focus today will be on a speech from the BOE’s chief economist Huw Pill, with the market on the lookout for clues on the pace of tightening. Japan’s super-long bonds outperformed the benchmark 10-year note as the Bank of Japan refrained from stepping up bond purchases. The yen edged higher.

In commodities, oil held a drop as traders weighed tensions in Eastern Europe and the resumption of Iran nuclear talks. Aluminum traded near the highest level in more than 13 years. Bitcoin slipped below $44,000.

Looking at the day ahead data releases include the German trade balance and Italian industrial production for December. From central banks, we’ll hear from Bank of Canada Governor Macklem, BoE chief economist Pill, the ECB’s Schnabel and the Fed’s Bowman and Mester. Finally, today’s earnings releases include Disney, L’Oréal and Uber.

Market Snapshot

- S&P 500 futures up 0.7% to 4,543.50

- STOXX Europe 600 up 1.5% to 472.19

- MXAP up 1.4% to 190.27

- MXAPJ up 1.6% to 624.22

- Nikkei up 1.1% to 27,579.87

- Topix up 0.9% to 1,952.22

- Hang Seng Index up 2.1% to 24,829.99

- Shanghai Composite up 0.8% to 3,479.95

- Sensex up 1.1% to 58,445.55

- Australia S&P/ASX 200 up 1.1% to 7,268.33

- Kospi up 0.8% to 2,768.85

- German 10Y yield little changed at 0.21%

- Euro little changed at $1.1420

- Brent Futures down 0.5% to $90.37/bbl

- Gold spot up 0.1% to $1,827.06

- U.S. Dollar Index little changed at 95.56

Top Overnight News from Bloomberg

- After the inexorable surge of Treasury yields this year, investors are weighing how much of the damage from anticipating Federal Reserve rate hikes has already been done

- A relief rally spread across the world’s biggest government bond markets on Wednesday after yet another policy maker from the European Central Bank pushed back against traders betting on a rapid pace of interest-rate hikes this year

- One of the biggest players in global trade signaled disrupted supply chains rattling economies from Vietnam to Germany may be just months from returning to normal, easing concerns of a more protracted period of shipping chaos that has fanned consumer inflation, wreaked havoc on retail inventories and slowed factory production

- Bank of Japan Governor Haruhiko Kuroda faces a growing challenge to convince investors that a policy pivot isn’t on the horizon following a wave of hawkish turns by global central bankers

- China has renewed its campaign to keep commodities markets in check, as the government tries to prevent raw materials prices from overheating while it takes steps to stimulate a faltering economy

- Iceland’s central bank delivered its biggest interest- rate hike since the 2008 crisis, trying to quell inflation spurred by a rampant housing market. The Monetary Policy Committee in Reykjavik lifted the seven-day term deposit rate by 75 basis points to 2.75%, the highest level in almost two years

A more detailed look at global markets courtesy of Newsquawk

Asian stocks traded higher with earnings releases in focus and following the positive handover from Wall St where the major indices finished near the best levels of the day despite participants remaining in limbo ahead of US CPI. ASX 200 (+1.1%) was lifted by notable outperformance in the tech and financials sectors with the latter boosted by firm gains in Australia’s largest lender CBA which reported a 22% jump in H1 cash profit. Nikkei 225 (+1.1%) rose above 27,500 with biggest gaining stocks driven by earnings releases including IHI, AGC and Nissan, while Toyota reported a record 9-month profit and SoftBank was boosted after it began to pitch the ARM IPO. Hang Seng (+2.1%) and Shanghai Comp. (+0.8%) conformed to the constructive mood after reports yesterday that Chinese state funds stepped in to slow the market decline and with Hong Kong firmly boosted by a rebound in tech.

Top Asian News

- Hong Kong Virus Cases Top 1,000 as Outbreak Overwhelms Hospitals

- Top UAE Lender First Abu Dhabi Bank Offers to Buy EFG Hermes

- Philippines in No Rush to Tighten Monetary Policy: Diokno

- Hong Kong Reports 1,161 Covid Cases; Hospitals ‘Overwhelmed’

European bourses are firmer in a continuation of positive APAC/US trade, catalysts light thus far going into Thursday’s US CPI. Sectors are all in the green with Banking and Tech names lagging and outperforming respectively given the yield environment. US futures post broad-based gains in a continuation of yesterday’s action awaiting Central Bank speak.

Top European News

- Adyen Rises Most Since IPO as Volume Growth Beats Estimates

- Inflation-Stoking Supply Crunch Is Set to Ease in Second Half

- Glaxo Expects Profit to Rise as Drugmaker Prepares for Split

- Japan Ready to Divert Gas to Europe If Russian Supply Disrupted

In geopolitics:

- French Presidency said leaders of Germany, France and Poland expressed joint support for Ukrainian sovereignty and implementation of Minsk ceasefire agreement, according to Reuters.

- European and US regulators told banks to prepare for the threat of a Russian cyberattack, according to Reuters.

- Russian Deputy Foreign Minister calls reports of possible US THAAD missile systems being supplied to Ukraine as a provocation, via Reuters citing Ria.

- UK Foreign Minister Truss is set to fly to Moscow today to meet with Russian Foreign Minister Lavrov; PM Johnson will meet the Polish PM/President and NATO Secretary General on Thursday.

- Satellite images showed unusual activity at a North Korean shipyard, according to Yonhap citing a US think tank.

- Syrian air defences downed a number of missiles from Israeli aggression, while the Israeli military said a Syrian anti-aircraft missile fired towards Israel exploded in mid-air, according to Reuters.

- Iran has unveiled a missile with a range of 1450km, via Tasnim.

In Fixed Income, bonds regroup after Tuesday’s meltdown, but fade ahead of 10 year T-note supply and two Fed speakers. Spanish Bonos underpinned by strong demand and tight pricing for new 30 year benchmark. Bunds marginally outpace Gilts post-ECB’s Villeroy questioning the hawkish reaction to revised guidance and pre-BoE’s Pill.

In FX, the greenback ground down, but off recent lows ahead of Fed speakers on the eve of US CPI. High beta and cyclical currencies outperform on risk and relative rate or policy outlook dynamics. Yen underpinned by softer UST yields and protected by Fib resistance below decent option expiry interest. Euro retains grasp of 1.1400 handle irrespective of ECB’s Villeroy expressing the view that markets have reacted too hawkishly to policy pivot. Rouble remains optimistic about reaching a resolution to feud with Ukraine and the West Russian government and CBR have agreed on crypto regulation and Russia will recognise crypto assets as currencies, according to Kommersant

In commodities, WTI and Brent are choppy and relatively rangebound awaiting fresh developments amid incremental geopolitical updates.

White House Economic Adviser Bernstein told CNN that releasing more oil reserves from the SPR is an option. Japan, at the request of the US government, has decided to secure necessary LNG stocks and accommodate some of this for Europe, via NHK citing sources; subsequently confirmed. Russian Permanent Representative to the EU Chizhov says that Russian can raise nat gas supplies to Europe once a request is made to do so, according to Sputnik News Spot gold/silver are steady and continue to reside around familiar levels and technical marks. Turkey will announce a scheme this weekend to encourage households to convert gold into Lira according to Reuters. Copper initially benefitted from the upbeat risk sentiment but then faltered in late trade and with China eyeing iron ore price stability measures. China’s market regulator says will take further measures to ensure iron ore price stability, while it will strengthen market supervision and crackdown on price irregularities and hoarding.

US Event Calendar

- 7am: Feb. MBA Mortgage Applications -8.1%, prior 12.0%

- 10am: Dec. Wholesale Trade Sales MoM, est. 1.5%, prior 1.3%; Wholesale Inventories MoM, est. 2.1%, prior 2.1%

DB’s Jim Reid concludes the overnight wrap

Our latest monthly EMR survey aimed at market participants is now live. Given the major rates selloff so far this year there’s a heavy bias towards questions on that and its implications, such as where you think the Fed and ECB will take policy this year. We also ask whether you think the Russia/Ukraine situation will be worse, similar or fading from view in a couple of months? Given the recent vol this will hopefully be a good gauge of current sentiment, so all help filling it in is much appreciated. The link is here and it’ll close on Friday.

That global bond rout showed no sign of abating in yesterday’s session, with yields climbing to fresh highs as markets digested sovereign issuance on both sides of the Atlantic and investors continued to brace for tighter global monetary policy. For a sense of quite how unprecedented this current run is, yesterday marked the 11th consecutive session in which 10yr bund yields moved higher, which overtakes a run of 10 successive increases we saw around New Year 2000 and is something we haven’t seen in the data going all the way back to German reunification in 1990. That 11th straight gain saw them rise a further +3.9bps to a post-2019 high of 0.26%, just as 10yr French OATs (+5.7bps) also hit a post-2019 high of their own yesterday. As on Monday however, higher yields across the continent coincided with a further widening in peripheral spreads, with the gap between 10yr BTPs and bunds up another +2.7bps to 158bps, whilst the Spanish 10yr yield spread over bunds also widened +0.8bps to 86bps. In both cases that leaves them at their widest since July 2020, although Greek spreads were a notable exception after the massive +22.0bps widening on Monday, and actually came down -4.9bps yesterday to 218bps.

After the European close, we did begin to see some initial pushback against the market’s very hawkish interpretation to the ECB’s decision last week, with Bank of France Governor Villeroy saying that “I think there were perhaps reactions that were very high and too high in recent days.” That saw the Euro slip back slightly immediately after the remarks, though it swiftly recovered to only end the session down -0.24% against the US Dollar. This afternoon we’ll hear from Isabel Schnabel on the Executive Board who’s taking part in a Twitter Q&A, so it’ll be interesting to see if she echoes those comments.

In the US, treasury yields followed the selloff in Europe, as the 10yr yield continues to get closer to breaching 2% for the first time since August 2019, coming within 3bps at its intraday peak of 1.97%, before ultimately closing up +4.7bps yesterday to 1.96%. Treasury yields have lagged the selloff in European sovereign yields since the hawkish showings from the ECB and BoE last week, though Treasuries made up ground following the strong employment and average hourly earnings data Friday morning, which has raised the stakes for tomorrow’s CPI as a potential catalyst for US rates. Fed funds futures are currently pricing approximately a 35% chance of a 50bp rate hike in March, and 5.45 rate hikes (assuming 25bp increments) for 2022 as a whole. For reference, our US economists see the year-on-year CPI increasing to +7.2%, which would be the highest going back to 1982.

The latest spike in yields didn’t prove as damaging to equities as some might have expected, with the S&P 500 (+0.84%) paring back early losses to move higher on the day, as part of a broad-based advance that left 381 companies in the green, and only three sectors lower on the day. The NASDAQ (+1.28%), FANG+ Index (+1.97%) of mega-cap stocks, and the small-cap Russell 2000 (+1.63%) all outperformed the S&P, with the Russell 2000 posting its third consecutive advance. For Europe there was a more muted performance and the STOXX 600 (+0.01%) eked out a marginal gain, but the prospect of ECB rate hikes has continued to be incredibly supportive for banks, and the STOXX Banks index (+2.24%) hit a post-2018 high, with its YTD performance now standing at +13.60%, the best performing STOXX 600 sector YTD.

One factor helping sentiment yesterday were more positive noises on the geopolitical front, with the latest meetings between various leaders raising hopes among investors that there could be some sort of de-escalation between Russia and the West over Ukraine. Obviously this can and has fluctuated day-to-day, but comments yesterday from President Macron that he “obtained that there will be no worsening and escalation” from his meeting with President Putin helped take some of the geopolitical risk premium out of various assets. Indeed by the close, Brent crude oil prices were down -2.06% to $90.78/bbl, which is their largest daily decline of 2022 so far, the MOEX Russia equity index surged +2.33%, and European natural gas futures were down -2.88% to a one week low.

Overnight in Asia, equity markets got off to a strong start following the positive performance on Wall Street. The Hang Seng Index (+1.98%) is leading the gains, with Alibaba shares up +7.28% in Hong Kong after SoftBank said they weren’t involved in the filing of further American depositary shares. Additionally, the Shanghai Composite (+0.40%), the CSI (+0.25%), the Nikkei (+1.09%), and the Kospi (+0.93%) are all trading in the green this morning. Going forward, equity futures are indicating a positive start in the US and Europe as well, with contracts on the S&P 500 (+0.44%), and DAX the (+0.66%) both advancing.

Otherwise, yields continued to rise in Japan with the 10-year JGB yield moving up to +0.215%, closer to the BOJ’s +0.25% ceiling, although those on 10yr US Treasuries are down -2.3bps this morning. Meanwhile, Iron ore futures in Singapore slumped from a 5-month high of $153 to $144 per ton after Chinese regulators cautioned information providers against fabricating prices to drive them up.

On the data front, the US monthly trade deficit came in at $80.7bn in December (vs. $83.0bn expected), which leaves the annual deficit at $859.1bn. That’s a second consecutive annual increase in the US trade deficit, having been at $676.7bn in 2020 and $576.3bn in 2019. Otherwise, the NFIB’s small business optimism index in January fell to an 11-month low of 97.1 (vs. 97.5 expected), but Italian retail sales unexpectedly rose +0.9% in December (vs. -0.3% expected).

To the day ahead now, and data releases include the German trade balance and Italian industrial production for December. From central banks, we’ll hear from Bank of Canada Governor Macklem, BoE chief economist Pill, the ECB’s Schnabel and the Fed’s Bowman and Mester. Finally, today’s earnings releases include Disney, L’Oréal and Uber.

Tyler Durden

Wed, 02/09/2022 – 08:01

via ZeroHedge News https://ift.tt/Fay6frS Tyler Durden