Used Car Prices Arrive At Yet Another Major Inflection Point

The Manheim Used Vehicle Value Index, a wholesale tracker of used car prices, rose to a new record high in January. Prices of wholesale used cars continued to move higher. Still, there are emerging signs momentum wanes on a monthly basis, which may suggest another potential inflection point — this one may actually be credible in light of growing speculation that supply chains are easing as chip shortages may improve.

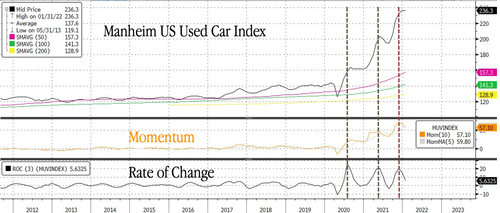

Over the last year, the used car market boomed because of a chip shortage for new vehicles. The latest data from Manheim shows that even though prices increased for January, momentum is stalling (and, in fact reversing). Manheim Used Vehicle Value Index expanded slightly to 236.3 last month, up 45% from a year ago. The non-adjusted price change declined about a percent compared to December, leaving the unadjusted average price up 40.8% year-over-year.

The chart below is the Manheim Used Vehicle Value Index on a monthly timeframe with two single-banded momentum indicators showing yet another infect point. The last two infection points turned out to be false flags as the index powered higher on persistent supply chain woes. Now we have credible leading indicators that may suggest this time is different.

There’s growing speculation from JP Morgan that global supply chain constraints have passed their climax. Focusing on major transpacific shipping lanes, we find container prices have reversed in some cases. Shipping rates are leading indicators that may suggest chip shortage could soon abate.

While we’ve identified a potential inflection point for used car prices, nothing is locked in, and there’s still a chance prices could move higher. But if snarled supply chains resolve ever so slightly and chip shortages ease, there’s the possibility that a peak in used car prices could be seen in the near term.

Tyler Durden

Wed, 02/09/2022 – 08:50

via ZeroHedge News https://ift.tt/Ng3yHlE Tyler Durden