Stocks Surge After JPM Hears “Whispers Of CPI Below Expectations”; How To Trade Tomorrow’s Number

As Rabobank’s Michael Every writes this morning, “nobody is going to get excited about any economic data until Thursday’s US CPI report” and he is of course correct, so instead of analyzing real-time data Wall Street has taken on to building scenarios and forecasts what to expects at 830am ET tomorrow and how the market will react to it.

Perhaps the most succinct summary of the big picture ahead of what may be the most important CPI print in years – one which could push the Fed to hike 50bps in March if we get another sizable beat – comes from BofA’s trading desk which writes that we are approaching the “CPI print tomorrow with a palpable sense of ‘if not terrible, Tech rips.’ Felt like we are pre-trading that notion into it…so that dynamic may have been pulled forward.”

To be sure, one reason for “CPI miss” optimism ahead of tomorrow’s print is just mean-reversion exhaustion: as DB’s Jim Reid recently notes, “8 of the last 10 CPI releases have seen the monthly headline figure come in above the consensus estimate on Bloomberg” so purely statistically one would expect that Wall Street’s “experts” have gotten tired of missing the number and are perhaps overly aggressive ahead of tomorrow’s number.

That may explain why overnight JPM trading desk writes that “increasingly, there are whispers that Thursday’s CPI will print below expectations” although it hedges that “if CPI is inline or higher, then we may see the 10Y make a run at 2.00%, or higher.”

Picking up on this, JPMorgan’s Head of US Cash Trading, Elan Luger writes that “the CPI print this Thursday is getting more hype than any economic data in recent memory. Though I am still not intermediate or long term bullish on markets (in a nutshell I still think if growth holds up, Fed will keep hiking; good news will be met with a more hawkish Fed and bad news is well… bad news), it does feel to me like the risk/reward is skewed to the upside for CPI.

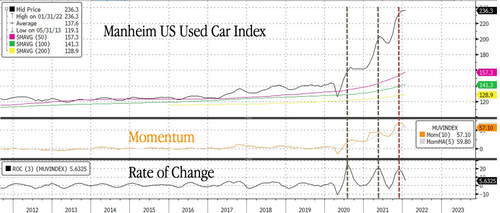

As Luger notes, after the most recent fed meeting it is clear that incoming inflation data is the only variable that matter for the Fed. “Core CPI upside has been driven primarily by rising auto and, to lesser extent, apparel and furniture prices, while transportation services costs and shelter prices growth continues to creep higher” and indeed as noted earlier, we may have hit another local maximum in used car prices…

… although we saw a similar headfake in the summer of 2021, only to see prices rocketing even higher.

Luger – as is customary for all JPM traders – takes the more optimistic view and writes that “real time data suggests used car prices have rolled over a bit. So net to me – with market expecting a hot inflation print and some signs pointing to a potential miss. I don’t think market goes down as much on higher CPI as it would go up on a miss. So tactically bullish for a few days here.”

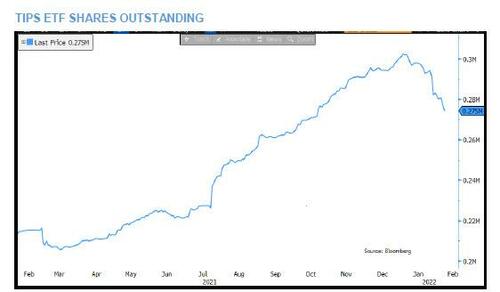

While it remains to be seen if this view is accurate, a look at recent TIPS flows suggests that both Retail and Institutional investors share the view that inflation may be peaking here…

… while bond market investors have largely priced in inflation at this point.

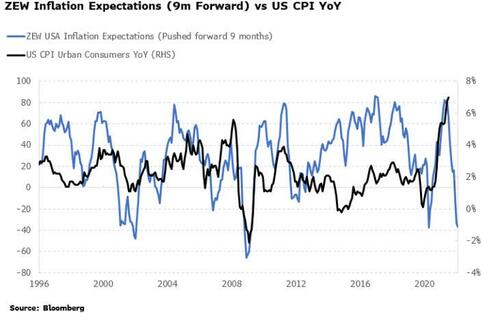

Boosting the view that either tomorrow’s CPI print will miss, or it will make the peak in the current inflation frenzy, is an analysis from Bloomberg’s Simon White who writes that “indicators show that forecasts for U.S. CPI are potentially underestimating the anticipated decline, leaving rate expectations vulnerable to a correction lower.”

According to the Bloomberg commentator, inflation is one of the most lagging economic indicators, making it relatively easy to find other indicators that have historically given a lead on it. White points to the ZEW inflation expectations survey as one such example, which has an “impressive record in leading U.S. CPI. It suggests the measure is very close to reversing some of its recent rise, potentially significantly.”

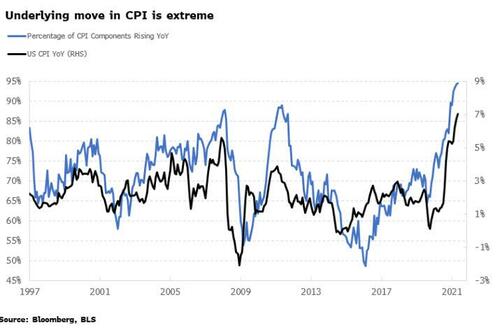

White also notes that the current move in CPI is extreme, “which also points to a potentially sharp short-term reversal. Looking under the hood, almost all of the underlying components in the CPI basket are rising on an annual basis. Such extremes normally mark an imminent decline in the headline index.”

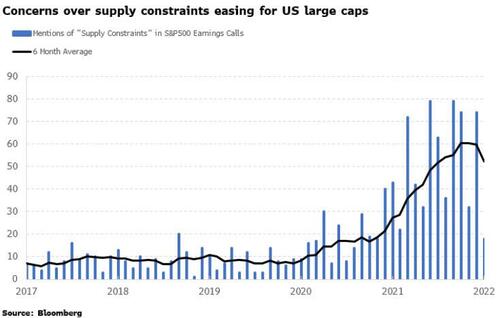

As has been well documented, the current rise in inflation has been driven by a shortage of supply (which the Fed has no control over) rather than a swelling in demand. Company concerns around supply bottlenecks – as quantified by the number of mentions of “supply constraints” in company earnings calls – also appears to have peaked for now, suggesting price pressures should soon see a significant short-term easing from this source.

And with markets positioning aggressively for tomorrow’s print, here is How to Trade the Print once it hits:

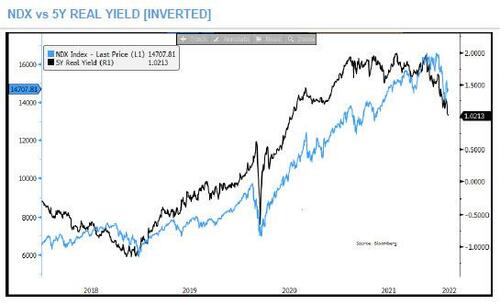

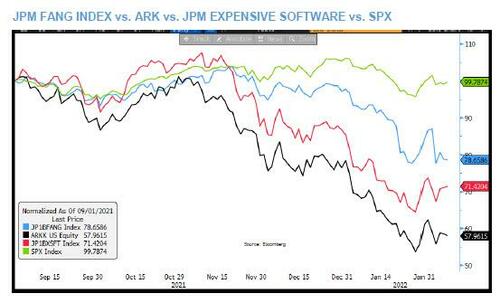

According to JPM, in the event we see a CPI miss, we will see a scenario where yields move lower, taking real yields with them. In this case, it is likely that Growth outperforms. It is unclear if a downside print in CPI would be enough to create a bid in the more speculative parts of Tech.

A status quo view on trading CPI

Of course, it is possible for CPI to surprise to the upside, and for investors to get 9 CPI beats in the past 11 prints. JPM’s Mike Feroli has the CPI printing +7.3% YoY, an inline or slightly stronger print than expected, which he says could push the 10Y yield up/through 2.0%: this would likely continue to push the Value rotation.

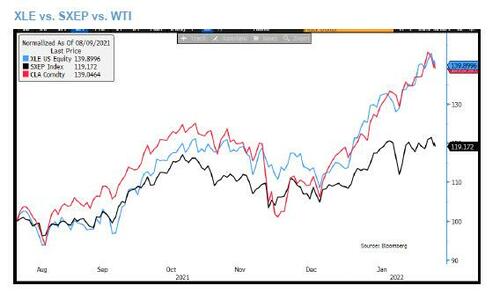

Here, JPM’s trading desk notes that with value, using a factor to express a view may be too broad of an instrument, and instead urges investors to consider looking at the sector level and then scanning geographies. For example, consider going long EU Banks instead of US Banks where the EU Banks have relatively higher operating leverage to rates – JPM’s EMEA team calculates that every 25bps move in yields tends to add 7% to EPS. In Energy, the US has seen outperformance and may continue to do so; take a look at XLE vs. SXEP (below). Consider that the Russia/Ukraine situation has led to a +Energy/-Russia trade within EMEA. A peaceful resolution may see that crowded trade unwound, further benefiting the US names.

Whatever the final result, perhaps in response to the growing market optimism that tomorrow’s CPI print will miss (or at least won’t surprise to the upside), yields have come back down strongly today and risk assets are surging, with eminis trading at session highs of 4,570, some 110 points above yesterday’s lows.

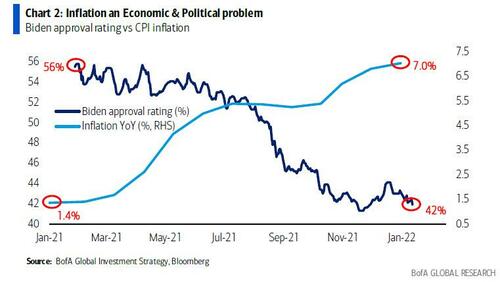

In conclusion, we won’t dig up any more tea leaves – we leave that for the bankers – but we will note that with soaring inflation crushing Biden’s approval rating…

… and with Democrats in desperate need of a hail mary ahead of the midterms to avoid a blowout loss…

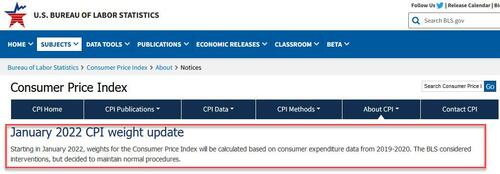

… we’ll remind readers that it is quite likely that tomorrow the BLS will use the nuclear option and revise much if not all of the recent inflationary surge…

… just as it did with the recent labor market weakness, which was magically “seasonally adjusted” away with the click of a button.

Tyler Durden

Wed, 02/09/2022 – 10:39

via ZeroHedge News https://ift.tt/cIfTvnw Tyler Durden