Blowout 10Y Auction Sees Huge Buyside Interest, Record Foreign Demand

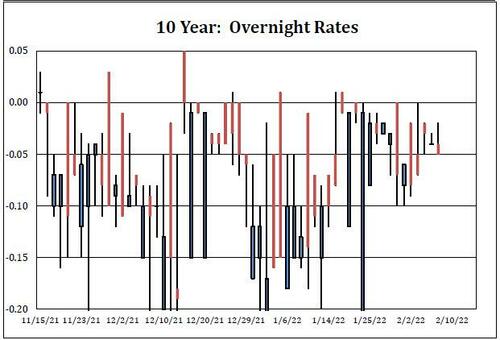

Ahead of today’s auction, even though repo action was muted suggesting little in terms of short covering into today’s auction…

…. all signs pointed to another stellar auction following yesterday’s stellar 3Y auction, including a $2 billion cut to the auction size from January (now at $37BN vs $39BN), a sharp reversal in mood in the bond market in recent days, not to mention what was set to be the highest yield since the summer of 2019.

And the auction did not disappoint, coming in at metrics that can only be described as absolutely blockbuster.

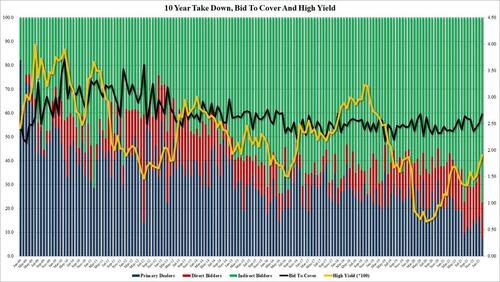

The high yield of 1.904% was above January’s 1.7230% and was the highest since July 2019 (which was the last 2%+ auction), but more importantly it stopped through 2.2bps the When Issued 1.9260% as there was much more demand for the paper than the secondary market could accommodate.

The Bid to Cover was also impressive, and at 2.68, it was the highest since May 2020, up from 2.51 last month.

But once again it was the internals that were most impressive, with Indirects, i.e., foreign buyers, taking down a record 77.6% of the auction, up from 65.5% last month, and well above the six-auction average of 71.3%. And while Directs were slightly below last month’s 17.9%, at 15.0%, the lowest since August, Dealers were left with just 7.4%, the lowest on record.

In short, this was a stellar auction and one which may be reflecting not just the economy’s prospects in the medium-term (hardly a runaway inflation outlook and if anything, bonds are saying the Fed is well ahead of itself again), but also speculation that tomorrow’s CPI print will be a miss and will send yields across the curve sharply lower. On the other hand, should CPI be the 9th beat of the past 12, brace for pain as 10Y yields jump above 2.00% on short notice.

Needless to say, the market was pleasantly surprised by the massive foreign demand, and with yields already trading near session lows ahead of it, the 10Y dropped as low as 1.904% after the print, as markets realize that they may have gotten well ahead of themselves again.

Tyler Durden

Wed, 02/09/2022 – 13:20

via ZeroHedge News https://ift.tt/3lBu4NT Tyler Durden