Rate-Hike Odds Spike After Hottest CPI In 40 Years

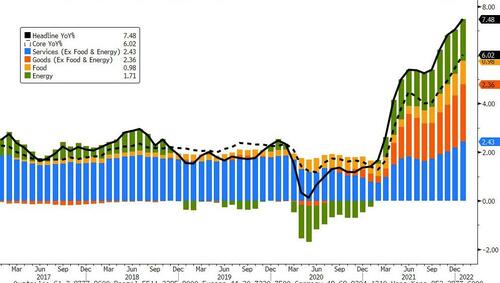

Expectations for this morning’s must-watch CPI were a continued non-transitory acceleration to +7.3% YoY (Core +5.9% YoY), but they underestimated as the headline printed a shocking +7.5% YoY – the highest since March 1982.

Source: Bloomberg

This is the 20th straight monthly rise in CPI, with both goods and services costs rising…

Source: Bloomberg

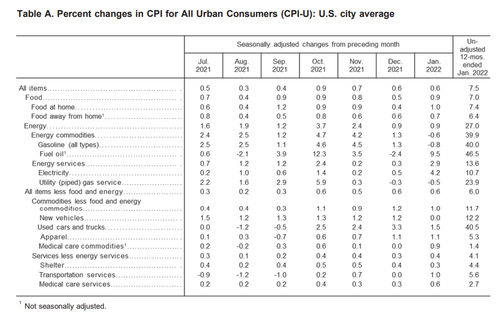

Below the headline print, core consumer prices rose 6.0% YoY (hotter than the 5.9% expected and highest since Aug 1982) as food, energy, and used car prices were the biggest drivers. The energy index rose 27.0% over the last year, and the food index increased 7.0%.

Source: Bloomberg

The food index increased 0.9 percent in January. The food at home index increased 1.0 percent over the month after rising 0.4 percent in December. Five of the six major grocery store food group indexes increased in January. The index for cereals and bakery products increased the most, rising 1.8 percent over the month. The index for other food at home increased 1.6 percent in January, while the index for dairy and related products rose 1.1 percent. The fruits and vegetables index rose 0.9 percent over the month, and the meats, poultry, fish, and eggs index increased 0.3 percent. The only grocery store group index not to increase in January was the index for nonalcoholic beverages, which was unchanged.

The energy index increased 0.9 percent in January. The electricity index rose sharply in January, increasing 4.2 percent. The gasoline index fell 0.8 percent in January after rising rapidly in the autumn of 2021. (Before seasonal adjustment, gasoline prices rose 0.1 percent in January.) The index for natural gas also declined in January, falling 0.5 percent after declining 0.3 percent in December.

Finally, we note that CPI-PPI – a proxy for margin compression – remains at extreme levels (and just this morning Unilever showed)

Source: Bloomberg

So, will this print pushed the market up from 30% to 55% odds of a 50bps rate-hike in March.

Tyler Durden

Thu, 02/10/2022 – 08:36

via ZeroHedge News https://ift.tt/mciYjWS Tyler Durden