Are There Some Secret Gems Hidden Inside The ARKK ETF At These Prices?

Submitted by QTR’s Fringe Finance

A funny thing has happened over the last couple of days: I’ve started to look at several technology companies (whose names I will disclose later in this article) that I think are becoming attractively priced as the market continues its plunge.

For example, on yesterday’s massive market plunge during the morning, I told my subscribers that my game plan was to sell of some of my exposure to oil, gold and index shorts, in order to nibble at a potential M&A target I like, a retail name that I think is too cheap to ignore and two “falling knives” I continue to catch as they move lower.

I also still think it’s a great time to look at one sector I think is primed for M&A, several ETFs that I think can reduce risk and a little noticed sector I think could catch a bid as part of the “wartime” trade.

But yesterday morning, chatting with friends about my gameplan for the day, I started discussing the state of tech stocks and, even though I think the NASDAQ still has lower to fall as an index, there are some names that have started to interest me.

These names included Microsoft (MSFT) at $270/share, a name I have been buying in a long-term dividend portfolio I have since it reported great earnings and fell under $300, Zoom (ZM), which actually trades at a somewhat normal PE of about 33x now at $125 a share and PayPal (PYPL), which I think is an interesting asset in the payment space worth a look at under $100 per share (and also now with a PE under 30x). Robinhood (HOOD) is a name I have been also buying from $14 and below and I find Palantir (PLTR) – which is expensive any way you look at it but has important ties with national security apparatuses – interesting at $10 or under.

I nibbled on some of these names yesterday in addition to purchasing some of the stocks and ETFs I talked about in my note yesterday.

I couldn’t help but laugh: I was starting to dabble in names (HOOD, PLTR, ZM) that Cathie Wood has tucked into her ARK Innovation Fund (ARKK), I realized.

I had to look in the mirror and have an internal dialogue with myself. Was I, too, becoming the world’s worst asset manager, simply buying whatever tech bullshit I wanted to because it offered the appearance of being cheap, even though maybe it wasn’t?

More specifically, how could I be writing to my subscribers about the fact that I think ARKK is going to move lower when I’m sitting here purchasing some of its components?

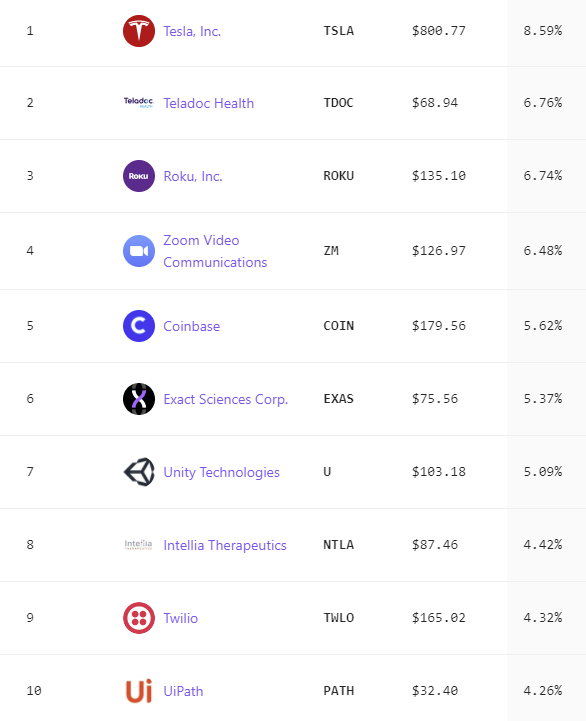

Then, I figured it out. It’s entirely possible for numerous ARKK components to be cheap and for the fund to still plunge, because so much of ARKK’s performance still depends on Tesla. Tesla, as of today, is an 8.59% weighting in ARKK.

And while the rest of ARKK’s components have been torched, Tesla is still up 7.9% over the last year.

This tells me several key things.

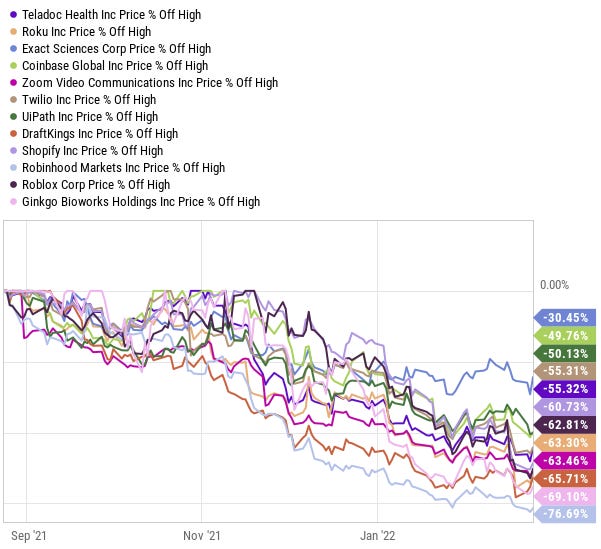

The first is that it is definitely possible for some components of ARKK to be undervalued or fairly valued here. Ex-Tesla, many names in ARKK are down 60% to 80% off highs. Don’t get me wrong, many of these names are still wildly overvalued and being “off highs” doesn’t mean shit when your “highs” (1) should have never happened in the first place or (2) were the result of gamma squeezes/other artificial prices.

But that doesn’t necessarily mean all of them are overpriced.

But regarding ARKK’s performance, this also tells me that if Tesla runs into some type of material negative event that forces the stock to re-rate lower and the rest of the components of ARKK stay relatively flat or move lower, it could be a treacherous blow to ARKK.

I’ve written before that Tesla is the only string ARKK is holding onto to prevent total collapse. I know this isn’t entirely brand new news, but the future of ARKK really seems to be teetering on the brink and Tesla will ultimately be the catalyst that will force it down the waterfall or prevent its plunge.

I couldn’t help but think of this later in the day yesterday, after headlines came out that the Securities and Exchange Commission was probing both Kimbal and Elon Musk regarding their November 2021 stock sales.

While I’m not sure that the outcome of this investigation will have a material impact on Tesla’s business (unless maybe Elon is forced to consent to some type of officer bar as part of a settlement), it goes to suggest that there are still significant risks bubbling under the surface with regard to Tesla.

On top of these types of unknown risks, there’s also legacy business risks for Tesla: the company is running face first into full scale global EV adoption. While the company deserves a lot of credit for breaking ground in the EV space first, the competition has never been more fierce than it is right now.

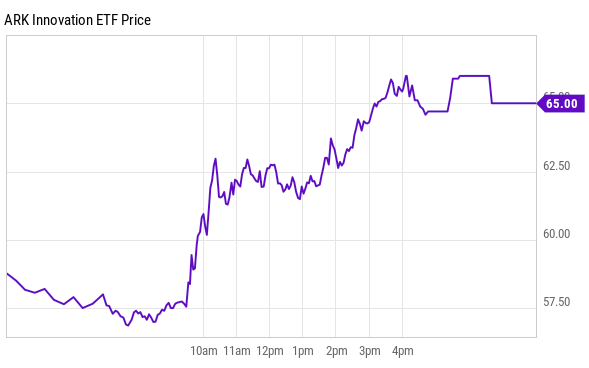

Cathie Wood’s funds were offered up a little bit of fresh air yesterday during the market’s face melting short squeeze, wherein the NASDAQ swung a wild 6% from trough to peak.

Wood is sticking to the same old “innovation is in ‘deep value’” bullshit she has been peddling for months now. You can listen to her entire 1 hour long interview with Scott Wapner from last week (why is she getting an hour to talk her book?) at this link on Spotify.

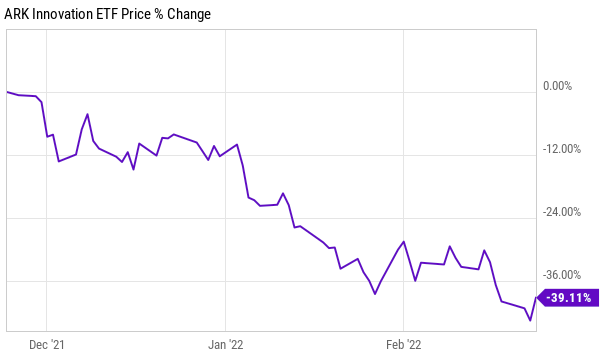

But now, it’s time to stop and look around again. From the $65 level ARK sits at today – with the ETF still down almost 40% in just 3 months, what levers need to be pulled for it once again to reverse the trend and start gaining ground?

If Tesla holds steady and some of the undervalued or attractive names that have already sold off in ARKK start to rebound, that could act as a tailwind. But if the broader overall tech sector stays flat and Tesla winds up running into any type of materially negative news, ARKK may still have room to plunge.

For now, ARKK remains in “stock pickers” territory. I am looking at some names in the ETF I like and adding them when opportune. Pair trades like being short ARKK and TSLA, while being long select components of the ETF, are extremely interesting to me. The fact that Cathie Wood recently got scared out of Palantir altogether is also interesting to me as I look to add the name around $10. I take this all with a grain of salt as I genuinely think the NASDAQ may still have at least 10% to 15% lower to move this year.

The rest of ARKK, for now, teeters on the brink of Tesla’s performance.

Disclaimer: This is not a recommendation to buy or sell any stocks or securities. I own or will own all names I mentioned or linked to in this piece. I own both ARKK puts and calls. I own TSLA puts and calls. I have nominal exposure to ARKG and ARKF in a long term dividend portfolio I own. I own, or will own, or have owned, all other names mentioned in this piece. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Mon, 02/28/2022 – 06:30

via ZeroHedge News https://ift.tt/t2ZHpc7 Tyler Durden