Goldman Says Gold Is The Currency Of Last Resort; Trumps Treasuries As Haven-Of-Choice

In the last month, as global geopolitical tensions have soared, gold has dramatically outperformed peer ‘safe-havens’ such as US Treasuries, bitcoin, and the swiss franc.

“Gold may continue to outperform other haven assets, with an added tailwind from central bank purchases and also displaying its characteristic as an inflation hedge,” said Yeap Jun Rong, a strategist at IG Asia Pte.

“The conflict has not seen any signs of easing and further escalation may heighten risks of persistent inflationary pressures, which will continue to draw traction for gold prices.”

All three asset-classes had traded with a relatively high correlation for the last few years, but the last two months have that change dramatically…

As Bloomberg reports, the worst geopolitical crisis in Europe since World War II has redefined the limits of safety for investors as costlier commodities add to fears of accelerating inflation. Even the yen and the Swiss franc, which tend to strengthen during times of risk aversion, have fared poorly due to their respective central banks’ loose monetary policies.

“The whole crisis has gone to a level that we couldn’t have believed, and investors are no longer saying we’ll buy some defensive stocks or bonds,” said Global CIO Office chief executive officer Gary Dugan.

“It’s now about buying gold especially against the backdrop of inflation risks that have been made worse by the conflict.”

Goldman believes the outlook for the precious metal price is harder to call in the short-term, but still bullish medium-term.

-

On the one hand, gold’s unique role as the currency of last resort will likely be apparent if restrictions on Russia’s Central Bank accessing its offshore reserves leave it leveraging its large domestic gold stockpiles to continue foreign trade, most likely with China.

-

However, on the other hand, the required large sales of gold at below market prices, given the limited appetite outside of China for such trade settlement, would emphasize its potential limited scale in the future, with few other countries able to use gold as such a currency of last resort.

Ultimately, Goldman concludes that “the recent escalation with Russia create clear stagflationary risks to the broader economy, driven by higher energy prices, which reinforce our conviction in higher gold prices in coming months and our $2,150/toz price target.“

Specifically, Goldman’s Damien Courvalin writes that Gold is the currency of last resort.

Gold acts as an effective geopolitical hedge, but only as long as the geopolitical event is severe enough to impact the US economy. This may be due to the fact that the Dollar itself often acts as a safe haven when tensions arise in other parts of the world, rather than gold. But when the US itself is affected, gold acts as a hedge of last resort. In our view, the ongoing global energy crisis and above-target US inflation mean that any disruption to commodity flows from Russia and Ukraine could raise concerns of a US inflation overshoot and a subsequent hard landing, which would be bullish for gold.

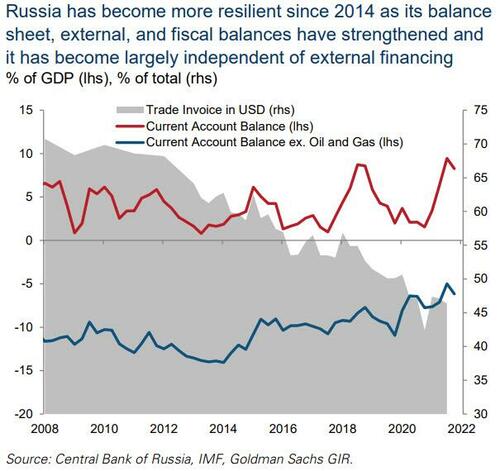

In addition, with energy prices high and Russia less dependent on external financing than in 2014, Russian sales of central bank gold reserves may be limited.

Russia’s “de-dollarization” could not be clearer…

On net, Goldman expects gold to maintain the cleanest positive correlation to the current geopolitical tensions, and serve as the most efficient hedge of last resort against them.

Tyler Durden

Mon, 02/28/2022 – 11:25

via ZeroHedge News https://ift.tt/5sGL4tX Tyler Durden