Futures, Treasury Yields Tumble As Ukraine News Spike Risk Off Mood

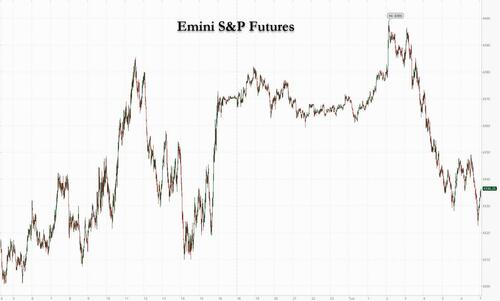

In a mirror image of yesterday’s overnight bounce, S&P futures and European markets have slumped to session lows as a risk off mood prevailed as US traders got to their desks having hit overnight highs of 4,399 just before the European open, as mood soured after the conflict in Ukraine intensified amid mounting penalties against Russia, and as participants look to a heavy data-docket ahead and Fed speak including Powell later in the week.

Any residual optimism was shattered after Ukrainian President Zelensky said that negotiations with the Russian side have not achieved required results while Russian Defense Minister Shoygu says Russia will continue operations in Ukraine until it achieves its goals. As a result, Nasdaq 100 contracts were down 0.9% as of 7 a.m. in New York after the cash index closed yesterday’s session with its second straight monthly decline, a trend not seen since October 2020. S&P 500 futures declined 0.7% or 30 points to 4,337 while Dow futures fell 0.7% or 230 points, reversing much of yesterday’s last hour ramp. Stocks trading in Moscow remained halted for a second day, and the VanEck Russia ETF plunged another 12%. Treasury yields fell for a second day to the lowest since January, and the dollar was steady. Brent crude jumped more than 5% as traders balanced the possible release of emergency stockpiles against fears of disruption to Russian energy exports.

Hopes of an early negotiated settlement over Ukraine faded after Russia vowed to continue its attack until its goals are met, and troops were seen moving in a large convoy toward the capital, Kyiv. Italian Prime Minister Mario Draghi said that Russian President Vladimir Putin’s threat to resort to nuclear weapons requires a “swift, firm, united reaction.” Meanwhile, Moscow imposed capital controls as Putin sought countermeasures against fresh sanctions walloping the economy.

Among notable premarket moves, Zoom Video tumbled 4.6% after its sales forecast for the current quarter fell short of Street estimates, while Lucid Group sank as much as 15% after cutting its production target for 2022 due to “extraordinary supply chain and logistics” issues. Other notable premarket movers include:

- Baidu’s (BIDU US) American depositary receipts rise 3.6% in premarket trading Tuesday after the company reported better- than-expected fourth-quarter revenue and earnings.

- Chevron (CVX US) raises its share buyback guidance to $5b to $10b per year. Stock up 1.6% premarket.

- Jack Henry (JKHY US) upgraded to outperform and price target set at Street-high $206 by Oppenheimer, which cites “bullish” view on competitive positioning following investor meetings with the company’s CEO. Shares up 0.6% premarket.

- Shares of EV and clean energy vehicle companies Tesla (TSLA US) and NIO (NIO US) decline in U.S. premarket after rival Lucid Group slashed its production target for 2022 citing “extraordinary” challenges with logistics and its supply chain.

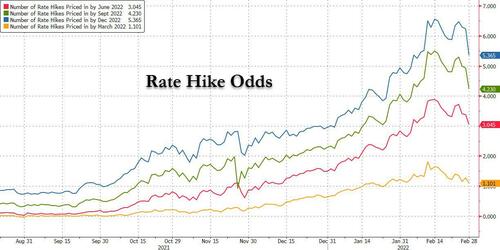

Meanwhile, as the March Federal Open Market Committee meeting approaches, expectations for how aggressive the central bank will be in its interest-rate path are sliding, with odds of a 50bps rate hike dropping to just 10% this morning.

“Expectations for interest rate rises were built on confidence of economic growth, however the invasion dampens these hopes,” said Lewis Grant, senior portfolio manager of global equities at Federated Hermes. “If growth starts to become more scarce, you could see a further shift in risk appetite, especially considering the huge amount of uncertainty around Russia’s next move and the West’s response.”

In Europe, the Stoxx 600 slumped 1.9% with travel and leisure, utilities and auto stocks among the biggest decliners as traders assessed the effect of sanctions. Bayer AG gained after positive results, but warned that the Ukraine conflict poses a risk to its outlook. The Stoxx Europe 600 Basic Resources Index gave up an earlier 2.1% gain to be little changed but still the top sector in Europe and outperforming the broader market, as iron ore rises on China manufacturing data, while base metals gain on supply concerns. Basic resources was the only sector in the green as commodity prices extended a rally.

Here are some of the biggest European movers today:

- Thales shares rise as much as 8.1%, its sixth day of gains, as Jefferies upgrades, citing momentum for defense stocks from the war in Ukraine

- Beiersdorf jumps as much as 5.8% to the highest since November after the company reported sales for the full year that met the average analyst estimate

- Man Group gains as much as 5% after results that UBS (buy) said topped consensus.

- FD Technologies rises as much as 27% after the firm entered a strategic partnership agreement with Microsoft to expand the reach of FD’s KX Insights streaming data analytics platform.

- U.K.-listed Russian metal stocks plummeted: Polymetal drops as much as 29%, given Russia has all the hallmarks of an uninvestable market for global investors

- Flutter Entertainment drops as much as 15% after full-year results that Shore Capital said were at the low end of guidance.

- Atos plunges as much as 16% after the French IT-services company gave an outlook for 2022 that Citi said implies a further 25%-30% cut for consensus Ebit estimates. Oddo downgraded the stock.

- Zalando slumps as much as 11%, the most since Nov. 3, after the online fashion retailer provided an outlook that Bryan Garnier called “mixed.” There may be some “small downgrades” to consensus expectations, according to Morgan Stanley.

European bonds gained, with Germany’s 10-year yield heading back below zero percent for the first time since January. Traders are betting the European Central Bank will put off raising interest rates until next year as the economic fallout from Russia’s invasion of Ukraine dents growth in the region. In fact, odds of the first rate hike by the ECB were just pushed back to 2023 from Dec 2022.

With Russia keeping its local stock exchange closed for a second day, foreign-listed shares in Russian companies tumbled again on Tuesday, in an indication of how they may react to sanctions when local trading reopens. The ruble stabilized after its worst plunge on record on Monday. But as Bloomberg reported overnight, there’s a growing risk that Russia’s stocks and bonds could be kicked out of major investment benchmarks as they become increasingly hard to trade.

Here are the latest geopolitical news surrounding Ukraine:

- Satellite image company Maxar said new images showed military convoy seen north of Kyiv is considerably longer than the 17 miles initially reported with the convoy stretching approximately 40 miles.

- EU Competition Commissioner Vestager says Russian gas cannot be banned completely, via Spiegel.

- Ukrainian President Zelensky says that negotiations with the Russian side have not achieved required results, via AJA Breaking.

- Russian Foreign Minister Lavrov says Ukraine still has Soviet nuclear technologies, cannot fail to respond to this danger, Russia is prepared for joint work with the US on strategic stability. Unacceptable for Russia that some European countries host US nuclear weapons, and should be returned to US territory.

- Russian Defense Minister Shoygu says Russia will continue operations in Ukraine until it achieves its goals, according to Interfax.

- Russia’s Kremlin says it is too early to assess results of talks at the moment; no plans at the moment from President Putin to speak with Ukraine President Zelensky.

- Belarus troops have reportedly entered Ukraine territory through Chernihiv region, according to Ukrainian parliament twitter.

- Russia stated that the US expulsion of 12 diplomats is a hostile act, according to AFP.

- SWIFT Messaging System says it is engaging with authorities to understand which entities are subject to new measures, will disconnect these on receipt of legal instruction to do so.

- US Senator Graham called for sanctions on Russia’s energy sector.

- Russia Security Council Deputy Chair says: “Some French minister has said that they declared an economic war on Russia. Watch your tongue, gentlemen! And don’t forget that in human history, economic wars quite often turned into real ones”. In response to earlier commentary from French Finance Minister Le Maire

- Mastercard (MA) blocked multiple financial institutions from the Mastercard payment network following sanctions.

- EU Commission is to propose sanction restrictions on RT and Sputnik’s access to the European media market.

- Italian PMI Draghi has made a proposal to intensify pressure on the CBR and wants the BIS to take part in sanctions, via Reuters.

Markets have been whipsawed by the conflict and steps to isolate commodity-rich Russia. Disruptions to supplies of raw materials such as grain and energy threaten to stoke already-high inflation and hamper growth, just as the Federal Reserve prepares to raise interest rates. Lenders worldwide are already making it harder to finance transactions involving Russian resources.

“We could see a longer off-ramp for inflation here” amid the added pressures to energy prices from the Russian invasion, Tracie McMillion, head of global asset allocation strategy at Wells Fargo Investment Institute, said on Bloomberg Television. She said a half-point Fed hike in March “is probably off the table” while adding she expects four quarter-point increases in 2022.

Elsewhere, an Asia-Pacific equity gauge rose for a third session, aided by a climb in Japan, as diplomacy talks between Russia and Ukraine fueled hopes for a short-term solution. The MSCI Asia Pacific Index climbed as much as 0.8%, on track for its biggest three-day gain in a month. Technology and communication-services shares were the largest contributors to the gauge. Benchmarks in Japan outperformed the region amid hopes for a gentler pace of U.S. interest rate increases. “Some near-term relief can be seen for now as both parties are willing to carry out diplomacy talks to reach a peaceful conflict resolution,” said Jun Rong Yeap, a market strategist at IG Asia Pte. “Also, with the ongoing conflict, expectations for aggressive Federal Reserve tightening are being pared back.” Investors’ concerns over Russia’s invasion of Ukraine eased slightly after both sides agreed to continue another round of talks in the coming days. Still, a wait-and-see mood dominates as global funds seek to assess the economic impact of sanctions imposed on Russia. Asian equities have fared better than their European and U.S. counterparts amid the ongoing Russia-Ukraine war, with the benchmark falling about 2% the past two weeks. Some risk-averse investors view the region as a safe haven, according to Hajime Sakai, chief fund manager at Mito Securities Co. “Valuations for Japanese equities — although they always have been — are cheap,” Sakai said. “Plus, the recent situation makes it hard for investors to buy European stocks, which have been cheap compared to U.S. equities. In that sense, it feels like there could be a shift of funds to invest here.” Hong Kong stocks edged higher amid reports that the city is planning a lockdown for Covid-19 testing. Markets in South Korea and India were closed for holidays.

Japanese equities climbed for a third day, as investors hoped for limited local impact from Russia’s invasion of Ukraine while seeing cause for optimism that U.S. monetary policy may be more benign than previously feared. Electronics makers and telecoms were the biggest boosts to the Topix, which rose 0.5%. Tokyo Electron and Fast Retailing were the largest contributors to a 1.2% advance in the Nikkei 225. In Ukraine, a delegation led by Defense Minister Oleksiy Reznikov met with Russian counterparts on the northern border with Belarus on Monday, the first opportunity for negotiations since Russia invaded. Meanwhile, the MNI Chicago PMI fell to 56.3 in February compared with 65.2 in January. “The possibility of another round of talks is providing a sense of relief,” said Hideyuki Ishiguro, a senior strategist at Nomura Asset Management. “The U.S. Chicago Business Index showed growth momentum for the real economy is slowing, which is helping ease concern over any aggressive monetary tightening.”

In rates, Treasuries sharply bull-steepen as front-end yields richen by more than 15bp, propelled by a wave of risk-aversion in financial markets during European morning. Treasury yields richer by 15bp to 8bp across the curve with 2s10s, 5s30s spreads steeper by ~5bp on the day; 10-year yields drop to around 1.72%, with bunds and gilts outperforming by 6bp-7bp in the sector. Yields on European benchmarks dropped, with Italian yields shedding around 20bps, as investors exit short positions and spread wideners after recent dovish comments from ECB policy makers; Bund yields fell below zero. Bunds and gilts outperform longer-dated Treasuries, with futures markets pricing in fewer rate hikes by both Fed and ECB. S&P 500 futures are under pressure as Russia’s war on Ukraine intensified, drawing mounting financial penalties. Swaps referencing Fed policy meetings no longer price in any chance of a March rate hike exceeding 25bp, with 118bp of hikes priced into December FOMC. Traders Abandon Bets on a Half-Point Fed Rate Hike in March.

In FX, the Bloomberg Dollar Spot Index inched up as the greenback traded mixed versus its Group-of-10 peers; the yen and commodity currencies were steady to higher while the euro and Scandinavian currencies weakened. The euro gave up gains after earlier trading above $1.12. The pound held steady the against the euro and the dollar, while gilts advanced. Markets will look to speeches from the Bank of England’s Michael Saunders and Catherine Mann, policy makers who voted for a 50bps hike back in February, for clues on how the central bank’s reaction function could be affected by Russia’s invasion of Ukraine. The Australian dollar rose a third day to touch a six- week high versus the greenback in early European session, before paring gains. Australia’s yield curve steepened, with 10-year yield 5bps firmer, after the RBA kept interest rates at a record low and said it would be some time before wage gains are consistent with its inflation target; it also said it will remain “patient” as it assesses risks stemming from Russia’s invasion of Ukraine and the resulting jolt to energy prices.

In commodities, Ccude futures advance. Brent soared above $103 a barrel, as WTI spiked 5% above $100 level. Spot gold rises roughly $12 to trade above $1,920/oz. Most base metals trade in the green; LME aluminum outperforms peers Wheat futures rose by the 50 cent limit. Bitcoin remains bid and has extended above yesterday’s best levels thus far, rising above 44,000.

Looking ahead, we get US Final PMIs, German Prelim. CPI, US ISM Manufacturing PMI & Construction Spending, New Zealand Export

/Import Prices, Speeches from Fed’s Bostic & Mester, ECB’s Lagarde, BoE’s Saunders & US President Biden’s State of the Union Address.

Market Snapshot

- S&P 500 futures down 0.3% to 4,354.75

- STOXX Europe 600 down 1.0% to 448.39

- MXAP up 0.7% to 183.52

- MXAPJ up 0.5% to 599.67

- Nikkei up 1.2% to 26,844.72

- Topix up 0.5% to 1,897.17

- Hang Seng Index up 0.2% to 22,761.71

- Shanghai Composite up 0.8% to 3,488.84

- Sensex up 0.7% to 56,247.28

- Australia S&P/ASX 200 up 0.7% to 7,096.55

- Kospi up 0.8% to 2,699.18

- German 10Y yield little changed at 0.07%

- Euro little changed at $1.1218

- Brent Futures up 3.6% to $101.47/bbl

- Brent Futures up 3.6% to $101.47/bbl

- Gold spot up 0.3% to $1,915.33

- U.S. Dollar Index little changed at 96.71

Top Overnight News from Bloomberg

- Russia intensified shelling overnight of key cities in Ukraine as its troops on the ground move slowly in a large convoy toward the capital, Kyiv. The mayor of Kharkiv, Ukraine’s second- largest city, said residential areas were being bombed in what he called “a war to destroy the Ukrainian people”

- The invasion of Ukraine is causing a mass exodus of companies from Russia, reversing three decades of investment by Western and other foreign businesses there following the collapse of the Soviet Union in 1991

- It’s possible that Russia’s invasion of Ukraine will lead to stagflation, ECB Governing Council member Olli Rehn told Kauppalehti in an interview, adding that it’s still too early to assess the impact on the European economy

- “Inflation will most likely remain higher than initially thought and of course these restrictions and higher prices will decrease economic growth,” ECB Governing Council member Martins Kazaks tells Latvian TV

- Italian inflation surged to a record for a third straight month, heaping more pressure on the European Central Bank after higher-than-expected readings from Spain and France

- Billions of dollars in cash is at risk of being trapped, stock funds have plunged, and capital controls are choking off money flows. Russia has all the hallmarks of an uninvestable market for global investors

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks began the month mostly on the front foot after Monday’s intraday rebound on Wall St where the major indices finished mixed but off worse levels and following talks between Russia and Ukraine with another round of discussions to take place in the coming days, while the region also digested encouraging Chinese PMI data. ASX 200 gained amid a cyclical bias with outperformance in tech, financials and industrials leading the index. Nikkei 225 traded higher and briefly climbed above 27k where it then met some resistance. Hang Seng and Shanghai Comp. were mixed with the mainland kept afloat after the better than expected Chinese Official Manufacturing and Caixin Manufacturing PMI data, while Hong Kong lagged with the city set for a 9-day lockdown later this month alongside mass COVID-19 testing.

Top Asian News

- Kishida’s First BOJ Board Picks Hint at More Neutral Stance

- Asian Stocks Rally for Third Day as Risk Sentiment Improves

- Hong Kong’s Ballooning Covid Cases Shatter Investor Confidence

- Baidu’s Sales Beat After Cloud Arm Offsets China Slowdown

In Europe, sentiment in equities has moved to risk-off as the mornings Russia-Ukraine updates are generally downbeat, albeit at a limited frequency vs recent sessions. Currently, Euro Stoxx 50 -2.5% after an indecisive open given a largely update APAC handover post-data. Stateside, US futures are lower across the board, ES -0.5%, though magnitudes are more contained than their European peers as participants look to a heavy data-docket ahead and Fed speak incl. Powell later in the week.

Top European News

- ECB Rate-Hike Bets for 2022 Put on Ice Amid Russia Fallout

- Man Group Assets Hit a New High as Clients Add $13.7 Billion

- U.K. Mortgage Approvals Rise to 74k in Jan. Vs. Est. 72k

- TotalEnergies Says It Won’t Invest in Any New Russia Projects

In FX, it has been a very choppy start to March in FX circles as safe havens climb amidst a further deterioration in Russia-Ukraine sentiment. However, petro and commodity currencies derive protection from strength in underlying prices as WTI and Brent top Usd 99/bbl and Usd 102/bbl respectively. Franc mixed following retreat vs Dollar and test of key Fib retracement level against underperforming Euro – Usd /Chf back up near 0.9200, DXY close to 97.000, but Eur/Chf sub 1.0300 after dip through 1.0250. Rouble hands back some recovery gains as Russian officials maintain that Ukraine mission will continue until objectives met – Usd/Rub around 96.8000 vs sub-89.5000 low.

In commodities, WTI and Brent are bolstered as geopolitics continue to dominate newsflow, Brent May’22 above USD 102/bbl at best, ahead of Wednesday’s OPEC+ meeting. IEA extraordinary ministerial meeting on the impact of Russia’s invasion of Ukraine on oil supply will take place at 13:00-15:00GMT/08:00-10:00EST, according to the Japanese Industry Ministry. Russian President Putin discussed the OPEC+ deal with the Abu Dhabi crown prince, according to Reuters citing Tass; reminder, the JTC commences today from 12:00GMT/07:00EST. IOG committed to sell its share of output from Elgood Gasfield to Gazprom unit for two years, according to FT. Yamal-Europe pipeline has stopped after shipping gas westwards to Germany overnight, preliminary bids have emerged to ship gas eastwards from Germany to Poland through the pipeline, according to Reuters citing Gascade data; subsequently, the pipeline has resumed eastbound flows. Spot gold and silver are supported in-line with haven assets as risk-sentiment sours while base-metals, such as Nickel, are bid on potential Russian supply risks.

US Event Calendar

- Feb. Wards Total Vehicle Sales, est. 14.4m, prior 15m

- 9:45am: Feb. Markit US Manufacturing PMI, est. 57.5, prior 57.5

- 10am: Jan. Construction Spending MoM, est. 0.1%, prior 0.2%

- 10am: Feb. ISM Manufacturing, est. 58.0, prior 57.6

- Employment, est. 54.2, prior 54.5

- New Orders, est. 56.3, prior 57.9

- Prices Paid, est. 77.5, prior 76.1

Tyler Durden

Tue, 03/01/2022 – 07:51

via ZeroHedge News https://ift.tt/2NI3bg7 Tyler Durden