Stagflation On Deck: Atlanta Fed Cuts Q1 GDP To 0.0%

Just a few short weeks ago, when throwing out increasingly more ridiculous “forecasts” of Fed rate hikes in 2022 and 2023 was all the rage on Wall Street…

That’s why Jamie Dimon is richer than you pic.twitter.com/wFKuWycaqI

— zerohedge (@zerohedge) March 1, 2022

… we predicted just the opposite, namely that 6 months from now, “Wall Street will be tripping over each other to come up with a greater number of rate cuts in late 2023/early 2024.”

6 months from now: Wall Street trips over each other to come up with a greater number of rate cuts in late 2023/early 2024. One bank suggests NIRP https://t.co/g53v9QNbQD

— zerohedge (@zerohedge) February 18, 2022

Of course, the only thing that was missing for this outlier forecast to become “conventional wisdom” was a collapse in growth, which as recently as mid-February seemed impossible: after all the US just had its fastest year on record, and in Q4 GDP rose a whopping 7.0%. Surely it is impossible that growth would collapse from 7% to flat, or negative, in just a few weeks?

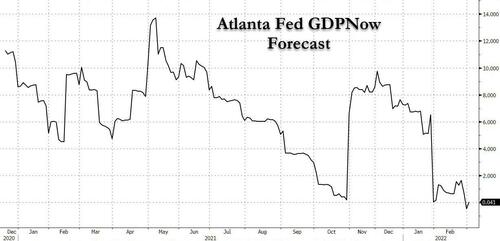

Well, prepare to be amazed because moments ago, the Atlanta Fed confirmed our worst case scenario when it slashed its Q1 GDP from 0.6% as of Feb 25, and 1.7% just a few days earlier to – drumroll – 0.0%.

Here is how the regional Fed explains what happened:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 0.0 percent on March 1, down from 0.6 percent on February 25. After recent data releases from the US Census Bureau and the Institute for Supply Management, an increase in the nowcast in first-quarter real personal consumption expenditures growth from 1.6 percent to 2.3 percent was more than offset by a decline in the nowcast of the contribution of net exports to first-quarter real GDP growth from -0.10 percentage points to -0.94 percentage points

What is remarkable is that the nowcast actually dipped negative yesterday, dropping as low as -0.5%, before “recovering”, but since the drop wasn’t on a scheduled update day, the focus will be on the 0.0% print.

Unfortunately, that’s just the start because now that the global economy is in freefall as a result of the war in Ukraine, and inflation is about to explode to never before seen levels, the Fed is completely trapped, and the result has been a collapse in rate hike odds, not just in the US…

Fed about to lose control pic.twitter.com/GzcQUBriY5

— zerohedge (@zerohedge) March 1, 2022

… but also around the world, as markets are now betting the to avoid a global depression, central banks will have to taper their normalization plans (if not reverse them outright), soaring inflation be damned.

And if the Fed confirms that the market’s expectations are correct, it is about to lose control because while it can explain away a dovish pivot with the coming recession, nobody has any idea how the central bank will offset the coming commodity (hyper)inflation which has already sent many commodity prices to record highs, and many more to come.

As for the Atlanta Fed’s GDP estimate, get read for much lower prints in the days ahead, as Wall Street goes full U-turn on its rate hike forecasts and starts predicting a much shallower lift off, followed by a collapse of rates into negative territory…

Tyler Durden

Tue, 03/01/2022 – 13:35

via ZeroHedge News https://ift.tt/e9c8Hq4 Tyler Durden