Stocks Slammed As Bonds, Bitcoin, Bullion, & Black Gold Soar

While there was plenty of chaos in the world’s markets today, European sovereign bonds took the proverbial biscuit with some almost unprecedented plunges in yields.

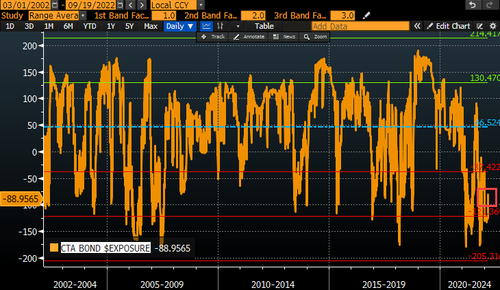

Heading into today, Nomura had warned that with CTAs pretty much positioned 100% short across the entire G-10 bond complex, the market was ripe for a short-squeeze…

And ECB Governing Council member Olli Rehn was the spark that lit the short-squeeze tinder when he said “…given the new situation, we need to take a moment of reflection as regards the speed and way of a gradual normalization of monetary policy.”

And we were off to the races

-

Italy 10Y crashed 30bps – its biggest drop since March 2020

-

German 10Y plunged 21bps – back below 0% – its biggest drop since 2011

-

UK 10Y collapsed 31bps – its biggest drop since 1992

Traders pushed back expectations for 25bps of ECB rate-hikes to March 2023 (from January) and at the same time US traders dovishly crushed Fed rate-trajectory expectations with a single hike in March now only an 80% prob (the market priced in 50bps just two weeks ago) and the number of hikes for the year plunged back closer to 4 (from 7)…

Source: Bloomberg

While Spot Ruble trading was largely suppressed, 1M forwards give a sense of the ongoing collapse in the currency…

Source: Bloomberg

And while Moscow closed its exchange – and a number of funds have gated redemptions – Russia ETFs continued their collapse today. VanEck’s Russia ETF fell almost 20%…

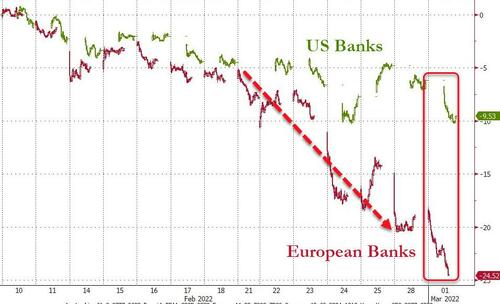

While US banks have been hit hard (worst performers today), it is European banks that are really suffering, down almost 25% in the last few days…

Source: Bloomberg

Yesterday’s late-day panic-bid in stocks was quickly eviscerated this morning with all the US majors ending notably lower to start March. Late-day new that AAPL was pulling products from Russia sent the tech giant lower and that pushed all the majors to the low of the day…

Credit spreads blew out to new cycle highs – HY widest since Nov 2020…

Source: Bloomberg

Treasury yields plunged across the curve with the short-end outperforming dramatically as rate-hike-trajectory bets were reduced. 5Y yields fell 16bps today while 30Y fell 6bps…

Source: Bloomberg

10Y yields tumbled back below 1.70%…

Source: Bloomberg

This is the biggest 2-day puke in TSY yields since the March 2020 flash crash in yields…

Source: Bloomberg

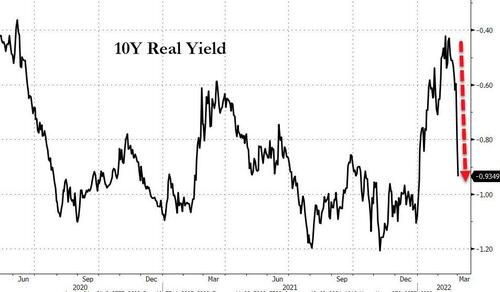

Real yields continued their collapse

Source: Bloomberg

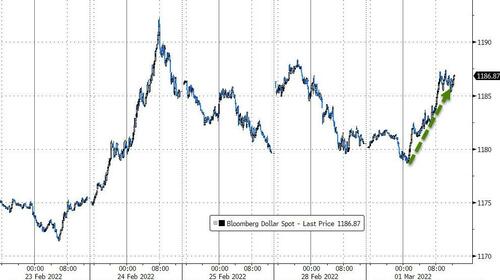

The dollar rebounded today…

Source: Bloomberg

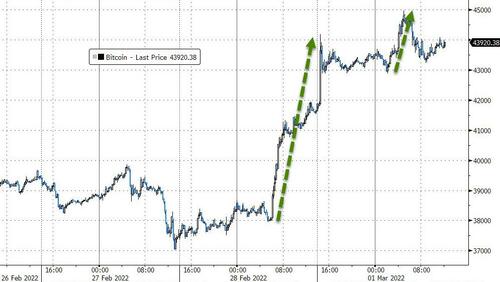

Crypto extended its gains with Ethereum topping $3000, and Bitcoin tagging $45k intraday…

Source: Bloomberg

Oil prices exploded higher today with WTI close to $107 at its highs…

Gold surged back above $1940 today…

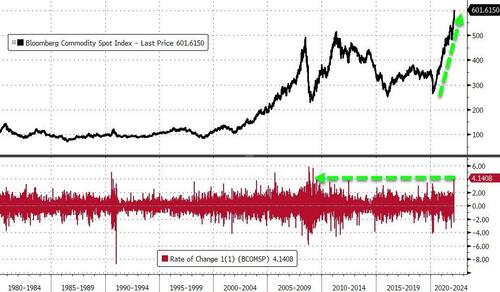

The Bloomberg Commodity Spot Index saw its biggest daily jump since 2009…

Source: Bloomberg

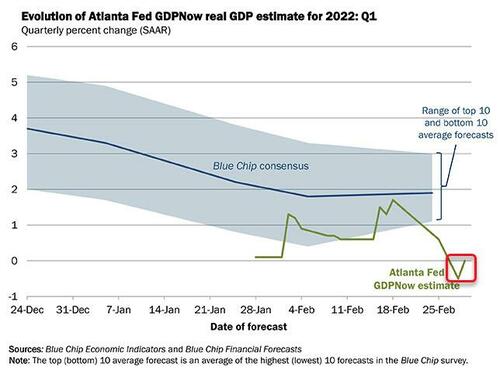

And finally, amid all this chaos, Q1 GDP is now expected to be ZERO!!

So hyper-staglation here we come… with a tightening Fed stuck in the corner.

And far more important than the state of the union, here is a detailed look at the state of the options market after today’s carnage…

Tyler Durden

Tue, 03/01/2022 – 16:01

via ZeroHedge News https://ift.tt/xvJiegE Tyler Durden