GM Sold Their 7.5 Million Share Stake In Lordstown Motors In Q4

General Motors has sold out of its stake in Lordstown Motors – an investment the company received as part Lordstowns’ SPAC deal.

The sale took place in the 4th quarter and after an “undisclosed” lockup period, according to CNBC.

General Motors owned 7.5 million shares of the company, which had an initial equity value of $75 million. GM’s stake in the company was less than 5% and it received the shares for in-kind contributions and $25 million in cash.

General Motors didn’t comment on the timing of its sale, though it wasn’t totally unexpected. GM’s main involvement in Lordstown, per CNBC, was “a goodwill gesture to assist in getting the Lordstown Assembly plant back up and running following the automaker ending production there in 2019.”

GM spokesperson Jim Cain told CNBC: “Our objective in investing was to allow them to complete the purchase of the plant and restart production.”

Since its SPAC deal, Lordstown stock has plunged.

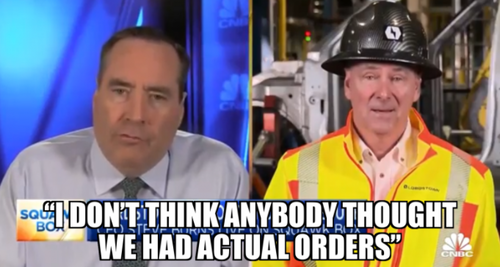

The steep loss in market value is due to Hindenburg Research which accused the electric car startup of faking preorders. Hindenburg is best known for calling Nikola an “intricate fraud,” which led to the departure of the company’s founder and eventual probes by several regulatory bodies. This is eventually what happened to Lordstown by early summer when CEO Steve Burns and CFO Julio Rodriguez resigned. The Department of Justice has since been probing the company for false and misleading statements to investors.

Hindenburg also released a video called “The Lordstown Motors Mirage” with their report:

The company’s 2021 10-K, released on Feb. 28, confirms SEC and DOJ inquiries into the company are ongoing.

Tyler Durden

Tue, 03/01/2022 – 18:05

via ZeroHedge News https://ift.tt/cul9LXA Tyler Durden