Energy Traders Ask For Central Bank Bailouts To Save Them From “Margin Call Doom Loop”

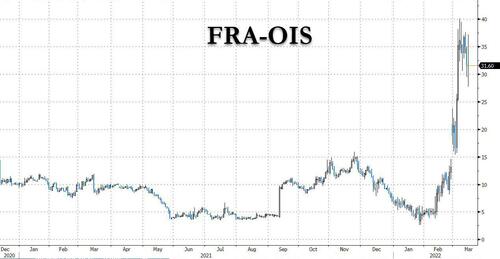

Yesterday, we reported that the Bloomberg news that one of the world’s largest independent energy merchants, the secretive Trafigura which trades hundreds of billion in commodities every year, was facing “margin calls in the billions of dollars” as commodity prices swung wildly in recent weeks, meant that the commodity “margin call doom loop” idea floated by repo guru Zoltan Pozsar was finally coming true, and despite Barclays’ earnest attempts to minimize its impact, could threaten broader financial stability and was manifesting itself in broad liquidity squeezes which could be observed in the surge in such unsecured funding markets as the FRA-OIS.

Well, Zoltan was spot on again, because one day later, on Wednesday morning, the FT reported that Europe’s largest energy traders have joined insolvent bank in calling on governments and central banks to provide “emergency” assistance to avert a cash crunch as sharp price moves triggered by the Ukraine crisis strain commodity markets.

Yes, that’s what happens when the “margin call doom loop” goes global.

The FT writes that in a letter it had seen, the European Federation of Energy Traders, a trade body that counts BP, Shell and commodity traders Vitol and the margin-call stricken Trafigura as members, said the industry needed “time-limited emergency liquidity support to ensure that wholesale gas and power markets continued to function”.

“Since the end of February 2022, an already challenging situation has worsened and more [European] energy participants are in [a] position where their ability to source additional liquidity is severely reduced or, in some cases, exhausted,” EFET said in its letter, dated March 8 and sent to market participants and regulators.

It was “not infeasible to foresee . . . generally sound and healthy energy companies . . . unable to access cash”, the letter warned, clearly ignoring that “generally sound” companies would have anticipated such a fat tailed scenario. The fact that they didn’t suggests that they were either not “generally sound”, or “healthy” and certainly did not plan accordingly. And yet somehow their stupidity and/or greed makes them eligible for Fed bailouts?

Rhetorical questions aside, just like that our theory that the recent spike in FRA-OIS was due to funding shortfalls at commodity companies has been proven true.

So what do these “generally sound” energy traders want?

According to the letter, the EFET wants state entities such as the European Investment Bank or central banks, such as the European Central Bank or the Bank of England, to provide support through lenders, to soften the impact of margin calls.

“The overriding objective is to keep an orderly market for futures and other derivative energy contracts open,” said Peter Styles, executive vice-chair of the EFET board, in an interview. “Gas producers, European gas importers and power suppliers must retain the opportunity to hedge their positions.”

Styles said it was possible to hedge risk without exchanges, but added that market participants needed the “liquidity, depth and visible price signals which futures exchanges with central clearing provide”.

Well, why not: central banks bailed out everyone during the covid crash, may as well continue the practice of bailing out everyone else in the process. Oh, and for anyone doubting if the Fed will step in and save stock markets – what China just did a few hours ago – this should answer your question.

It wasn’t immediately clear if central banks would come running to the commodity giants’ rescue. As the FT notes, “some may be reluctant to help trading firms that often make large profits from shifts in commodity prices.” However, senior ECB officials are keeping a close eye on global commodity markets, and as ECB vice-president Luis de Guindos said last week, derivatives, including commodity derivatives, were a “very specific market that we are looking at very carefully”.

That said, speaking at a conference on Wednesday, Rostin Behnam, chair of the Commodity Futures Trading Commission, the top US derivatives regulator, said appropriate margins must “unfailingly” be maintained.

“We must hold fast to our regulatory structures and resist the urge to make ad hoc decisions to avoid the natural outcomes of market forces,” he said.

Meanwhile, as attention slowly turns to CCPs (as we discussed yesterday), the clearing banks that provide services to trading platforms such as ICE Endex, based in the Netherlands, the UK-based ICE Futures and the European Energy Exchange, based in Germany, can access liquidity from their national central banks.

One senior trader said the initial margin for a wholesale European gas contract plus the extra cushion demanded by clearing banks was now getting close to the value of the contract, which is hardly a disaster: all it means is that one can’t trade extremely volatile futures with leverage and one has to have full equity. Alas, he didn’t like that view and said it was not a “functioning market”.

Meanwhile, after Trafigura, we have a sense of which commodity merchant will be next to be hit with a multi-billion margin call: in its annual report, published on Wednesday, Glencore, one of the world’s biggest commodity traders, highlighted the “ability to finance margin payments” as one of the risks facing the industry.

Meanwhile, as a result of the surge in volatility, hedging activity has shrunk according to traders in the oil market. The amount of outstanding futures linked to oil has dropped to multiyear lows in recent weeks. As a result, refiners are receiving fewer offers in their tenders for crude oil. Uruguay’s state oil company received just four offers in a recent crude tender. It typically receives 15, according to traders.

Tyler Durden

Wed, 03/16/2022 – 11:32

via ZeroHedge News https://ift.tt/U75wvTs Tyler Durden