Goldman Now Sees Fed Hiking 50bps In May And June, A First Since 1994

In Jerome Powell’s Tuesday speech before the NABE, the Fed Chair said, “There is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level, and then to move to more restrictive levels if that is what is required to restore price stability.” He repeated the call “to move expeditiously” at the end of the speech, a change from his January phrasing of “steadily”, suggesting an even more hawkish conviction to the Fed’s future tightening path than he revealed during last week’s FOMC presser.

Indeed, on Tuesday morning, derivative traders priced in about 7.7 quarter-point rate hikes at the remaining six Fed meetings this year, effectively making provision for more than one half-point rise.

Breaking down the odds we get the following numbers, all conditional on each other:

- 72% odds of 50bps in May

- 65% odds of 50bps in June

- 35% odds of 50bps in July

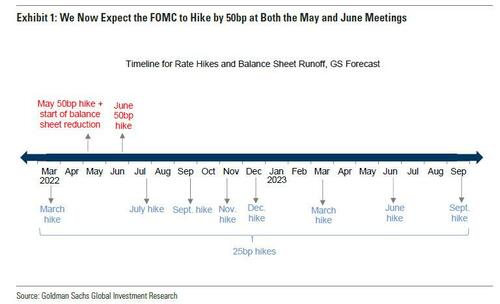

Overnight, Goldman Sachs economists agreed with this hawkish take and writing that the shift in wording from “steadily” in January to“expeditiously” today is a signal that a 50bp rate hike is coming. And not just one but two, because according to Goldman, the Fed will raise interest rates by 50 basis points at both its May and June policy meetings, and by 25 basis points in the four remaining meetings in the second half of the year, with three quarterly hikes in the first nine months of 2023.

We are now forecasting 50bp hikes at both the May and June meetings (vs. 25bp at each meeting previously). The level of the funds rate would still be low at 0.75-1% after a 50bp hike in May, and if the FOMC is open to moving in larger steps, then we think it would see a second 50bp hike in June as appropriate under our forecasted inflation path. After the two 50bp moves, we expect the FOMC to move back to 25bp rate hikes at the four remaining meetings in the back half of 2022, and to then further slow the pace next year by delivering three quarterly hikes in 2023Q1-Q3. We have left our forecast of the terminal rate unchanged at 3-3.25%, as shown in Exhibit 1.

Goldman leaves its forecast of the terminal rate unchanged at 3-3.25%; the bank continues to expect the FOMC to announce the start of balance sheet reduction at the May meeting, but after today’s comments they don’t think this is necessarily an obstacle to also delivering a 50bp hike in May.

Powell’s comment last week that the shrinkage of the balance sheet is “the equivalent of another rate increase” was consistent with our estimate of its impact, but below the consensus estimate. If the impact of runoff is smaller, then pairing the balance sheet announcement with a 50bp hike at the same meeting might count as moving “expeditiously” but not excessively.

Moreover, since the FOMC will reveal some parameters of the balance sheet reduction process in the upcoming March minutes, the official announcement in May might not be such a major event for markets.

That said, the bank concedes that “the Russian invasion of Ukraine and the possibility that financial conditions could tighten more aggressively in response to a faster pace of Fed tightening both present downside risks to our new forecast of two 50bp rate hikes, though neither looks like an obstacle at this point.” Additionally, Goldman notes that the invasion of Ukraine also presents upside risks to inflation, as Powell noted, “and our financial conditions index eased following last week’s hawkish March FOMC meeting and tightened only modestly today.”

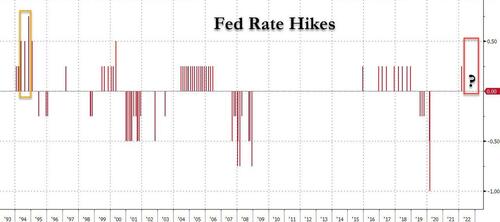

If Goldman is right and if the Fed proceeds with not one but two rate hikes in May and June, that would be the first time the Fed has hiked 50bps twice in one year since 1994.

Pouring gasoline on the hawkish fire, this morning St Louis Fed president James Bullard, who earlier this week said he favor raising rates above 3% this year, spoke to Bloomberg Television and urged the Fed to move “aggressively” to raise interest rates and shrink balance sheet.

“The Fed needs to move aggressively to keep inflation under control,” says Bullard, who dissented from last week’s quarter- point rate hike in favor of half-point increase. “Our policy as we sit here today is still a very large balance sheet and very low policy rates. We need to get to neutral at least so we’re not putting upward pressure on inflation during this period when we have much higher inflation than we’re used to in the U.S.”

Not everyone agrees, however, and Bank of America chief economist Ethan Harris writes today that “our view is that the bond market has it backwards: 50 bp hikes are more likely in the fall than at the next two meetings. The Fed had a great opportunity to endorse a 50 bp hike out of the gate when it was priced in a month ago and they passed on it.”

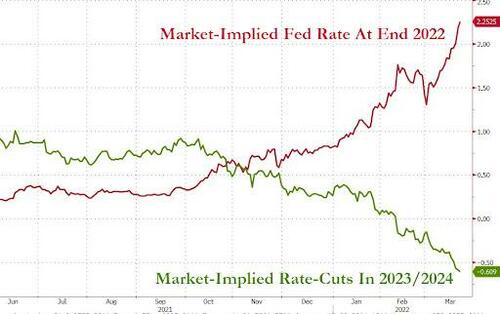

Meanwhile as we wait until May for the Fed’s next nailbiter, one day after fireworks rocked the front-end of the yield curve with the 2Y yield soaring 18bps the push higher continues and today the 2Y is higher by another 5.5pbs, rising to 2.17% with much of the yield curve beyond the 2Y point (including the 3s10s and 5s10s) now solidly inverted, as the flipside to the Fed’s hawkishness now is a market which sees the Fed turning uber dovish later, and now pricing in more than 2 rate hikes by 2024.

Nomura’s Charlie McElligott notes that while the equity market is currently “basking in the glow of a massive vol reset” as pre-Powell hedges are forcibly unwound but he warns, the REAL downside for Equities comes when the Fed STOPS hiking – because it confirms the slowdown / recession is imminent (coming to you in midyear / 2H ‘23!).

Will stocks ‘look forward’ to that recession once the negative delta overhang is erased?

Tyler Durden

Tue, 03/22/2022 – 09:21

via ZeroHedge News https://ift.tt/WypjBcq Tyler Durden