Soft-Landing Chances Slipping Away According To Bonds

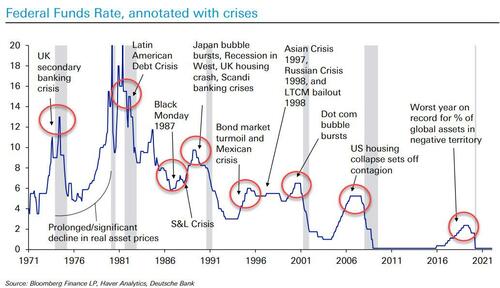

Speaking to Bloomberg TV earlier today, Fed’s uberhawkish St Louis Fed President James Bullard said, among many other hawkish things, something notable: he believes the Fed can achieve a soft landing. Unfortunately, we have some bad news for Jim: as Deutsche Bank recently showed, “every Fed hiking cycle in the fiat high debt era has led to some kind of financial crisis somewhere across the world“…

… and this time will be no different; in fact one can argue that tightening at a time of record liquidity sloshing around and a CPI print which will hit double digits in a few months, the coming collapse will be one for the history books.

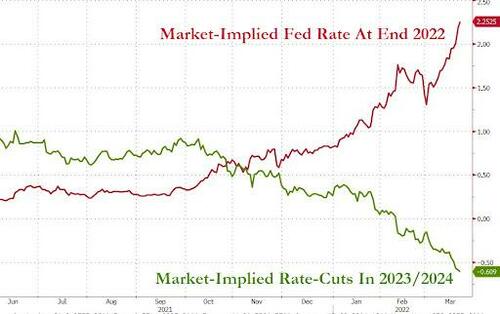

It’s not just our view, however: as Bloomberg’s Cormac Mullen writes, the bond market suggests that “the chance the Federal Reserve can engineer a soft landing is fading by the week, with the war in Ukraine exacerbating the inflationary pressures.”

As Mullen notes, Jerome Powell’s aggressive tone Monday sent Treasuries into a tailspin and refocused attention on the various recession signals they are throwing up. The spread between five-year and 30-year Treasuries slumped to its flattest since 2007 as the yield curve hurtles towards an inversion. Meanwhile, as we showed yesterday, bets are rising on interest rate cuts as soon as next year.

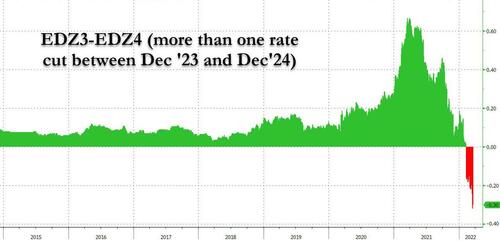

Meanwhile, the eurodollar futures curve – a proxy for the direction of the Fed’s policy rate – now shows a peak in June of next year, followed by the equivalent of more than two 25bp rate cuts by December 2024. In the Fed’s dot plot, officials’ median projection was for the benchmark rate to hit about 2.8% in 2023 and remain steady in 2024.

As Mullen concludes, “even Powell himself acknowledged the severity of the test the Fed now faces, withdrawing stimulus as inflation accelerates at the fastest pace in four decades.”

Tyler Durden

Tue, 03/22/2022 – 11:05

via ZeroHedge News https://ift.tt/BjEbtcL Tyler Durden