WTI Extends Losses After Cushing Crude Stocks Rose For 2nd Straight Week

Oil prices ended lower after a choppy session (with WTI back below $110) as EU foreign policy chief Josep Borrell said he expects leaders to discuss – but probably not yet approve – further sanctions against Russia when they meet in Brussels later this week.

Low liquidity is a “logical response to the increased volatility and margins and most importantly the uncertainty around political outcomes,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Management. “Market participants have realized they have very little edge in calling political end games and don’t want to keep getting chopped up trying.”

Russian crude is still being treated with extreme caution by buyers worried about damage to their reputation or falling foul of sanctions.

API

-

Crude -4.28mm (+25k exp)

-

Cushing +646k

-

Gasoline -626k

-

Distillates -826k

After last week’s surprise build in Crude stocks (and at Cushing), API reports a sizable crude inventory draw (-4.28mm vs expectations of a small 25k build). Cushing stocks rose for the second week in a row

Source: Bloomberg

WTI was hovering just below $109 ahead of the API print and slipped lower after the data…

Finally, amid all the chaos and uncertainty (legal, geopolitical, and economic), it appears traders are stepping back from the market with Open Interest in WTI and Brent futures plunging to its lowest since 2015…

“Some of the weakness we saw in oil in the last week and a half or so was related to the liquidation of long positions linked to increased margin calls,” Francisco Blanch, head of commodities research at Bank of America said in a Bloomberg Television interview.

“Open interest has actually fallen in oil despite the incredible risk that we are running here with the war in Ukraine still unfolding.”

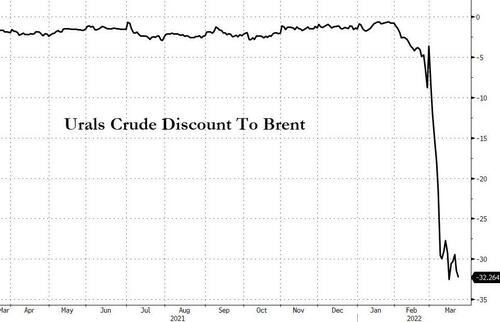

Russian Urals crude differentials fell 93 cents/b day on day to a new record wide discount to Dated Brent amid growing international condemnation of Asian crude purchases and renewed calls for further Russian oil sanctions.

Russian Urals cargoes basis CIF Rotterdam were assessed at a new record low of Dated Brent minus $30.99/b and for CIF Augusta at Dated Brent minus $30.69/b March 23.

Oh and in case you were pissed off at the record gas prices you are paying, TheStreet.com says “it’s not all bad news”, and claims that “It’s a Small Price for Freedom”… we have no words.

Tyler Durden

Tue, 03/22/2022 – 16:39

via ZeroHedge News https://ift.tt/31QzgaW Tyler Durden