New Home Sales Unexpectedly Tumble In February As Mortgage Apps Crash

Despite the unexpected plunge in existing home sales, analysts expected new home sales in February to rebound modestly from January’s drop but they were wrong (again) as new home sales fell 2.0% (+1.1% exp) and worse still January’s 4.5% drop was revised drastically worse to a 8.4% plunge.

Source: Bloomberg

New Home Sales are still down 6.2% YoY (down YoY for the ninth straight month)

And the average new home sales price topped $500k for the first time ever.

A recent report showed a measure of homebuilders’ sales expectations for the next six months slumped in March to the lowest since June 2020 amid growing concerns over the combination of rising construction costs and higher interest rates.

And we suspect this is far from over as mortgage applications in the last week tumbled once again, now at its lowest since pre-COVID seasonal lows…

Source: Bloomberg

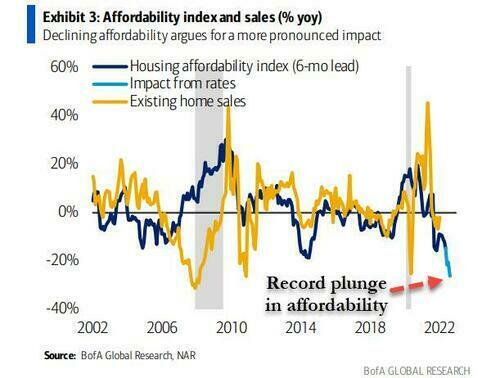

All of which has occurred before The Fed actually hiked rates even once and as housing affordability is about to crash by the most on record…

The costs and financial hurdles to buying a home are not the only thing that have been on a tear recently. Rents have been on fire over the past year, with the Zillow Observed Rent index soaring 14.9% yoy to $1,904 in January.

Tyler Durden

Wed, 03/23/2022 – 10:09

via ZeroHedge News https://ift.tt/KXbx4EQ Tyler Durden