Goldman: How China’s COVID Lockdowns Could Disrupt Global Supply Chains

As China continues to struggle with its worst COVID outbreak since the virus first emerged in Wuhan more than two years ago, one of the biggest questions on the minds of American companies (not to mention investors) is how badly the lockdowns ordered by the CCP will disrupt production in the country’s factories, which form a critical link in the global supply chain.

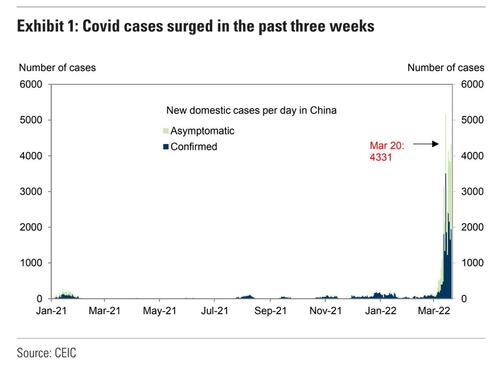

Unsurprisingly, investment banks have been peppered with questions about the economic backlash stemming from China’s ‘zero tolerance’ approach to combating COVID (and this latest omicron-driven outbreak in particular). As COVID cases continue to climb (with Shanghai recording a record case tally this week that’s inspired a wave of panic buying), Goldman estimates that lockdowns have impacted population centers responsible for roughly 30% of China’s GDP.

Overall, daily cases have declined slightly from their peak on March 20. But that doesn’t mean the outbreak is over.

In its latest sell-side research report on the issue, a team of Goldman analysts “assess potential disruptions to China’s supply chains from intermediate goods, exports, final output and logistics perspectives, mainly through analyzing provincial level input-output tables.”

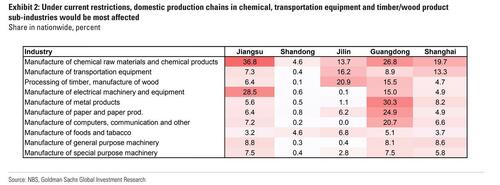

Here’s what they found: the greatest impact from the lockdowns will be on China’s chemicals, transportation equipment and timber/wood product”.

Furthermore, Goldman’s analysis suggests that “Jiangsu, Jilin, Guangdong, Shaanxi and Shanghai are more important among the virus-impacted provinces in terms of their roles in nationwide supply chains.”

The Goldman team breaks down the potential impact of lockdowns on various industries across several of the worst-hit Chinese provinces and/or cities.

The report also cites “anecdotal evidence” to suggest that regions with mid-to-high risk districts are indeed facing delivery delays or production suspensions to various degrees that could have a cascading impact.

While CCP policymakers have taken steps to mitigate the impact of lockdowns on China’s economy (the most recent example would be the reopening of factories in Shenzhen, as well as its port), they have continued to stress a “people first, lives first” approach.

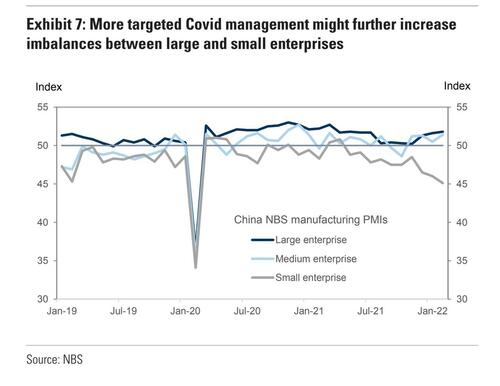

Taken together, all of this suggests a couple of potential outcomes: Possible implications: “1) overall supply chain might be more resilient than before given the same outbreak severity, as policymakers are moving more swiftly to resume production once local Covid situation appears to be under control; 2) structural imbalances between large and smaller companies might further increase, as major production/investment projects, which are usually handled by large companies, might be given the “green light” and resume production ahead of other projects when policymakers relax restrictive policies.”

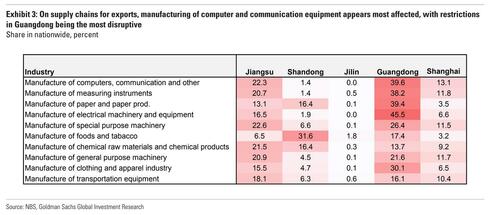

Moving beyond the most heavily impacted industries, the Goldman team also analyzed the impact of supply chains on other critical industries like computer components, paper and paper products (including the toilet paper that memorably disappeared from American supermarkets during the early days of the pandemic). The chart below reflects the current impact of lockdowns on these industries.

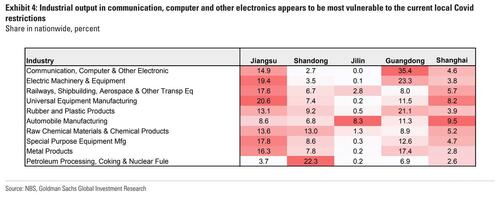

Finally, Goldman also published an analysis examining the most vulnerable industries to Chinese lockdowns.

Using the past as a guide, Goldman also charted the impact on deliveries via the ports.

As the CCP switches from broad-based lockdowns to more “targeted” measures, Goldman expects the impact will be worse for smaller firms as opposed to larger enterprises with more flexible and robust supply chains.

Goldman’s analysis concluded that should 30% of the Chinese economy experience a COVID shutdown lasting a month, it would reduce annual GDP growth by a whole percentage point.

But the bigger question is: as these issues cascade throughout the global economy, what might the impact be for the US?

Tyler Durden

Wed, 03/23/2022 – 22:00

via ZeroHedge News https://ift.tt/xdOfgSz Tyler Durden