Stock Rally Can’t Forever Ignore Fundamentals

By Ven Ram, Bloomberg Markets Live commentator and analyst

Evidently interest rates don’t matter anymore. Not inflation either. And don’t even mention the war in Ukraine. Any one of these factors may, in more normal times, send stocks hurtling down. But not so for U.S. equities in recent days.

The S&P 500 and the Nasdaq 100 are in the midst of a flash rally that would have left Usain Bolt breathless. Apparently they have had a moment of epiphany: none of the factors that tend to weigh on equity valuations matter anymore.

Looking at the macroeconomic backdrop it’s hard to find a viable reason for stocks to be supported at current levels.

I can think of one: To some extent, stocks that have enduring cash flows and strong brand names may be able to pass on any increase in their input costs to their customers, making them an effective inflation hedge. When I say “supported” I definitely don’t have “rally” in mind as a synonym. Not one that means runaway gains of 8% in the S&P and 12% for the Nasdaq in the space of just one week in any case.

So much so that the S&P is now within striking distance of its record high.

The timing of the rally couldn’t have been more incongruent with Fed Chair Jerome Powell preparing the stage for an outsized rate hike in May and Loretta Mester chiming in for good measure to say that it would be appropriate to move the Fed funds rate to 2.50% by year-end.

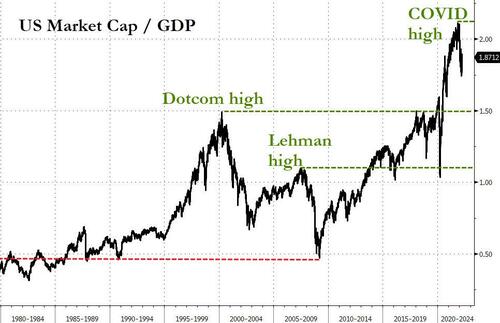

Yes, you could do a 100-meter sprint in well under 10 seconds if you have the magical legs of Bolt, but he wouldn’t attempt to do a marathon at anywhere near that pace. The simple point is that whatever stocks have done in the past week don’t represent particularly recurring gains. In the long run, gains in equities can’t outpace the productive capacity of the economy.

Since the end of 2018, stocks have distinctly behaved as though gravity is a force that isn’t applicable to the asset class, and the latest in-your-face, don’t-care-what-you-think rally epitomizes that attitude of hubris.

[ZH: The forward Treasury curve is screaming a recession is imminent…]

Yet, no matter what the spin, the invisible hand of the markets will always prevail, maybe not today, maybe not tomorrow. Stocks, as Benjamin Graham mentioned, are a voting machine in the short term but a weighing machine over the long term.

Tyler Durden

Thu, 03/24/2022 – 06:30

via ZeroHedge News https://ift.tt/EWrZl20 Tyler Durden