‘Russia-Reversal’ Report Routs Oil & Gold, Bonds Signal Recession Inevitable

More FedSpeak to normalize an extremely hawkish expectation for the next 9 months today. Former NY Fed boss Bill Dudley said, in a Bloomberg op-ed, that The Fed’s actions will lead to an “inevitable recession.” Philly Fed’s Pat Harker is “open” to 50bps hikes at each meeting and favors starting QT “sooner not later.” And then St.Louis Fed’s Jim Bullard reiterated, in an essay on the Fed’s website, that he favors raising rates above 3% by year-end. Thay all reiterated the need to ‘keep inflation expectations anchored’… well, given the explosion in de-anchoring this morning from The Conference Board, The Fed is completely missing the mark.

And as Deutsche’s Jim Reid remarked, The Fed have never been as behind the curve as they are today.

For a sense of just how far behind, The Taylor Rule suggests given the current inflation rate and unemployment rate, The Fed needs to hike by an absurd-sounding 1155bps to get back to ‘normal’…

Source: Bloomberg

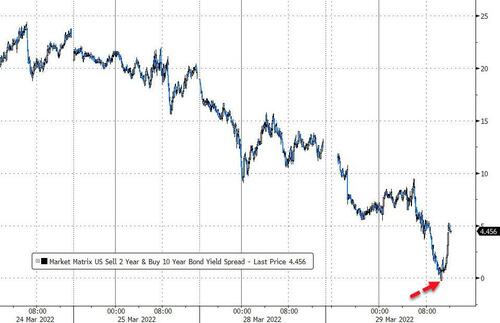

And amid all this, the most-watched part of the yield-curve – 2s10s – inverted briefly (and the rebounded)…

Source: Bloomberg

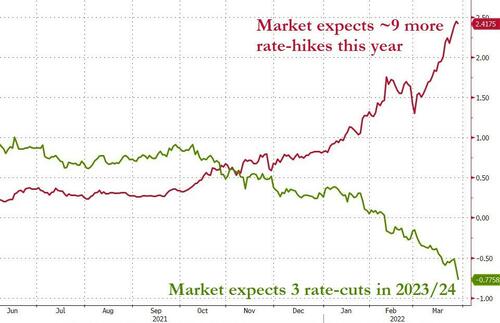

And the market is now pricing in 9 25bp rate-hikes this year… and more importantly 3 25bp rate-cuts in 2023/24…

Source: Bloomberg

And those positive sounding headlines on Russia-Ukraine talks lifted stocks, bonds, and the Ruble, while gold, oil, and other commodities (e.g. wheat and palladium) were monkeyhammered lower.

Stocks continued their surge higher with Small Caps leading (up almost 3%)…

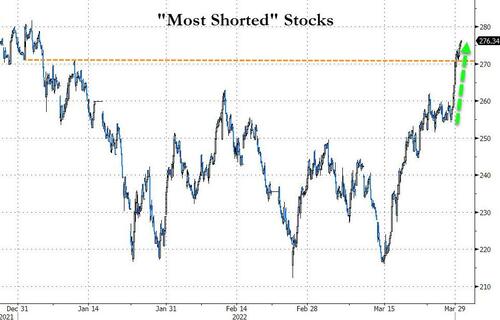

‘Most Shorted’ stocks were squeezed yet again and that actually lifted the ‘most shorted’ index into the green for the YEAR…

Source: Bloomberg

A chaotic day in the meme-stocks today which lost some of their momentum into month-end…

And ARKK soared…

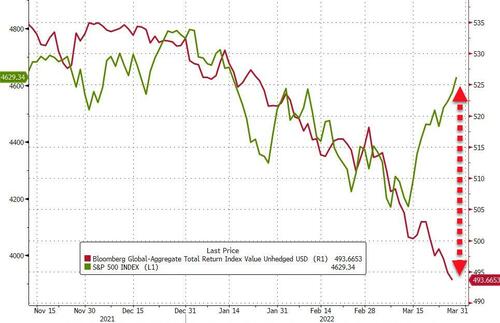

Bonds and stocks have dramatically diverged over the last 10 days…

Source: Bloomberg

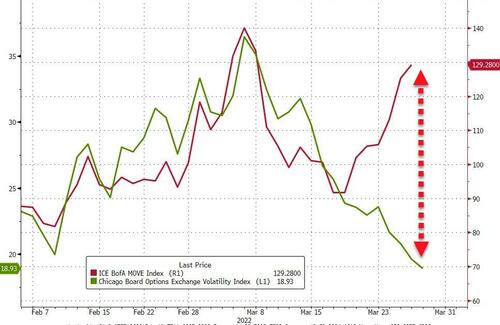

The spread between the S&P rally and Treasury selloff over the last 10 days is the 5th biggest since the GFC. Even more absurd, the increase in rates vol (MOVE Index) relative to falling equity vol (VIX) has been the largest since 2009 and one of the largest ever.

The Dollar tumbled today to two-week lows (having tagged the stops at pre-FOMC yesterday)…

Source: Bloomberg

The Ruble soared higher once again today, managing to fully erase all losses since the invasion crashed the Russian currency…

Source: Bloomberg

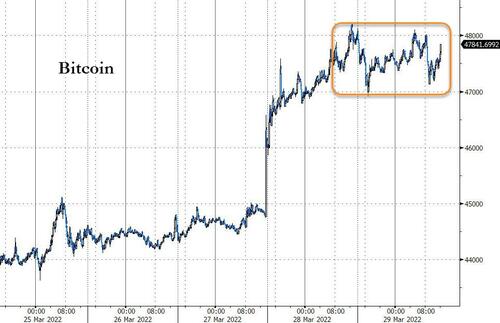

Bitcoin held on to its gains yesterday, hovering just below $48,000…

Source: Bloomberg

When the Russia-Ukraine headlines hit, gold was immediately puked lower, breaking below $1900. But once again, buyers stepped back in at that level…

Crude prices were also clobbered on the optimistic peace talks reports, sending WTI back below $100 briefly before rational dip-buyers stepped back in…

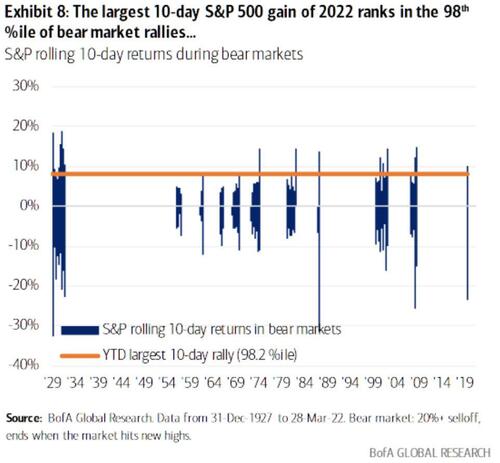

Finally, over the last two weeks, the S&P has produced one of its sharpest rallies in history, larger than the biggest 10-day rallies in 7 of the S&P’s 11 bear markets since 1927.

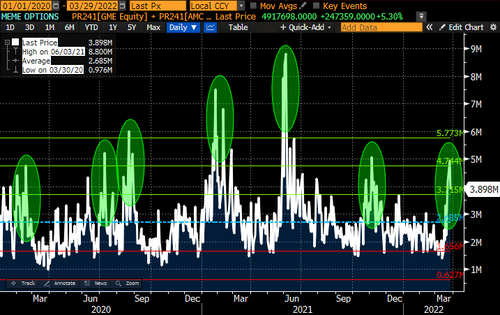

And it’s all been because the ‘gamma-squeezers’ are back.

As Nomura’s Charlie McElligott noted earlier, Emboldened by passive Systematic bid to spot markets and feedback loop into Vol compression: The WSB-crowd is back in a major way on this Equities bounce, where for the past 2 weeks, we see the collective “upside grabbing” activity at levels only previously witnessed during prior speculative frenzy periods in the COVID / WSB / “stimmy” era (our basket of 10 of the most prominent “meme stocks” has seen their aggregated daily Call option volumes jump to over +2 z-scores as of last Friday vs the 2 year lookback).

Tyler Durden

Tue, 03/29/2022 – 16:02

via ZeroHedge News https://ift.tt/xY80MPS Tyler Durden