WTI Dips After US Crude Production Rise, Product Inventory Builds

Oil prices are higher again this morning as optimism about Russia-Ukraine talks fade fast (and API reported significant inventory draws across the board last night).

“Markets remain skeptical of an immediate cease-fire,” said Keshav Lohiya, founder of consultant Oilytics.

Russian production outages “will quickly snowball if the current situation continues.”

The war is already taking its toll on Russian production, which fell below 11 million barrels a day in the second half of March, while deliveries to refineries slid about 11%. Supply is starting to show a “significant decline relative to the beginning of the month,” consultant OilX said in a note.

API

-

Crude -3.00mm (-1.588mm exp)

-

Cushing -1.061mm

-

Gasoline -1.357mm

-

Distillates -215k

DOE

-

Crude -3.449mm (-1.588mm exp)

-

Cushing -1.009mm

-

Gasoline +785k

-

Distillates +1.395mm

The official DOE data confirmed a sizable crude invenbtory draw last week and Cushing stocks also fell. However, the product side saw inventories build, perhaps suggesting demand fears are warranted…

Source: Bloomberg

Cushing stocks failed to maintain their very recent rebuiild and remain near operational lows…

Source: Bloomberg

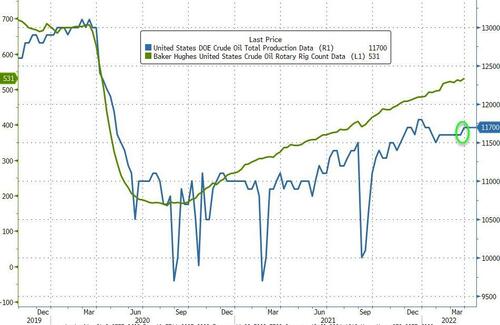

US Crude production picked up modestly last week…

Source: Bloomberg

WTI was hovering just above $108 ahead of the official data and slipped lower after the data

Finally, we note that retail; gas prices in the US (on average) are very slightly lower over the last week…

Source: Bloomberg

Sadly for Biden’s approval rating (and drivers across the country), the recent resurgence in crude prices suggest pump prices will soon be on the rise again.

Bloomberg Intelligence Senior Oil & Gas Analyst Fernando Valle notes that “short-term balancing for the crude-oil market may remain elusive as inventories continue to drain in the West and stay well below 10-year averages for refined products and crude. This may be compounded by attacks against Saudi Arabia’s oil infrastructure, while issues with equipment and service bottlenecks in North America will limit growth, and crude inventories may continue to drop. Consumer subsidies may limit demand destruction, with California, France, Brazil and Mexico being the latest to enact policies to cut prices at the pump.”

And don’t expect any help from OPEC+, which meets on Thursday to discuss its supply policy for May, with the group expected to stick with its strategy of modest output boosts even as the war in Ukraine disrupts flows. Major importers are urging OPEC+ nations with spare production capacity to open the taps faster, but the group’s key members have so far remained unmoved.

Tyler Durden

Wed, 03/30/2022 – 10:37

via ZeroHedge News https://ift.tt/uME1Gs5 Tyler Durden